The Maths of Trading and Crunching Your Numbers

Your journal: the place to look for your ‘trading truths’

Audio available at the end of this post.

One of the first trading videos I ever watched was Mark Minervini’s and David Ryan’s “8 Keys to Superperformance” webinar:

At the time, many of its valuable lessons were new to me.

Now, over four years later, many of the lessons seem obvious to me — a sign of growth! (Noticing such differences is part of the reason I encourage people to revisit old content.)

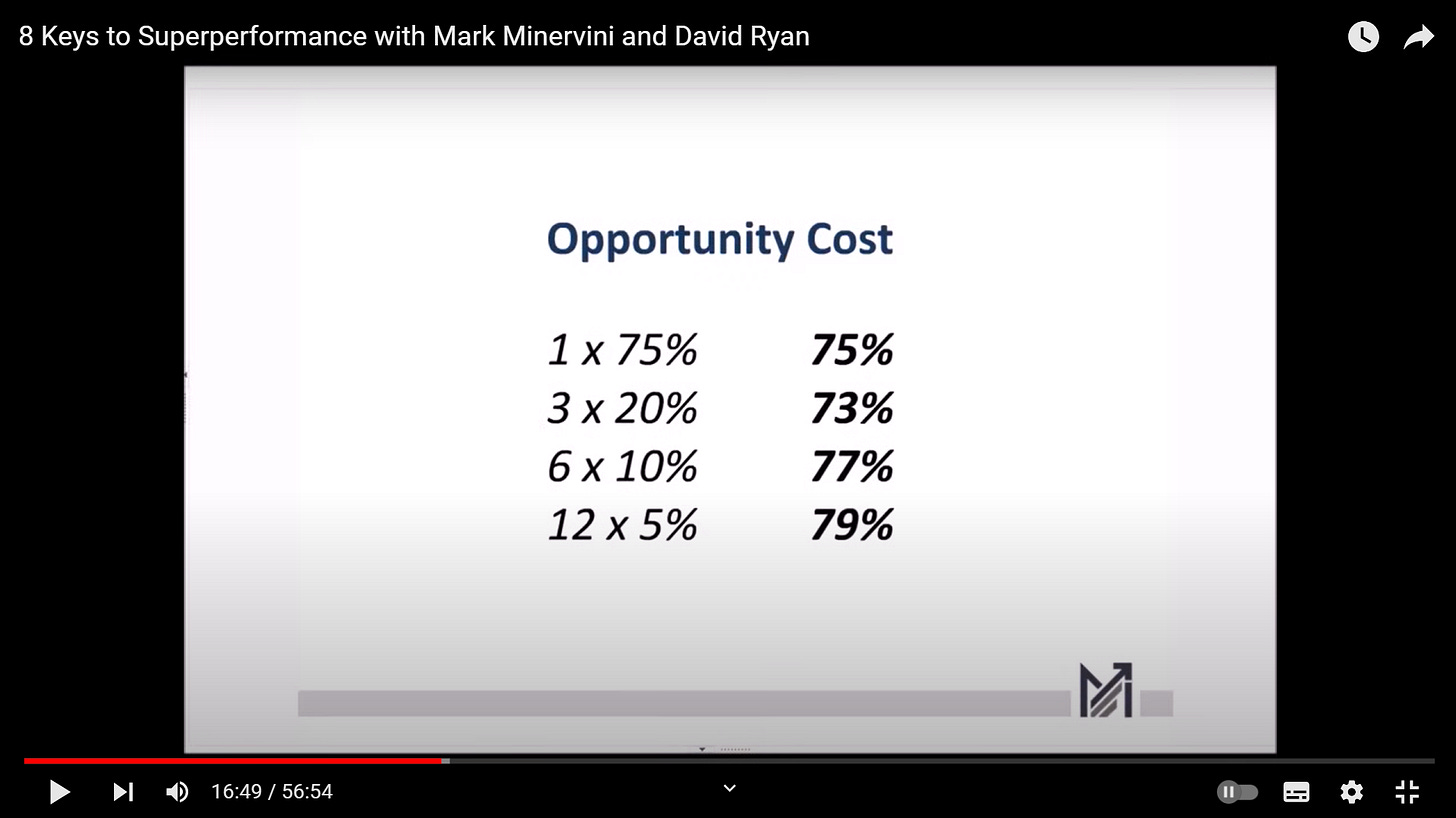

That said, one slide — illustrating the power of compounding — still has impact:

It’s a powerful way to show how there’s no one right way to trade.

For example, do you find it hard to hold stocks through pullbacks? Then don’t! Go for shorter-term moves. And turn over your edge faster. So long as you have a statistical edge, turnover is positive.

But know the reality of your strategy.

If you’re going for 5% profits, your stop losses must be tight. In turn, your entries must be superb. You’ll also need to place more trades (or you won’t move the needle on your account), which requires more effort.

Also, the higher your risk-to-reward ratio, the lower your win rate. Low win rates make losing streaks a mathematical certainty. But trading profitably with a low win rate also builds in failure into your strategy.

Choose what works for you, and accept the trade-offs.

Losses work geometrically against you

This is another mathematical reality:

If you’re down 10%, you need 11.1% to get back to breakeven.

If you’re down 20%, you need 25% to get back to breakeven.

If you’re down 50%, you need 100% to get back to breakeven. You need to double your account, just to break even!

That’s why you don’t set wide stops — not even on >10% ADR (average daily range) stocks. In Trade Like a Stock Market Wizard, Mark says to set “an absolute maximum line in the sand” of 10%, tops. But your average loss should be much less.

Mark proceeds to point out that if, even with a 10% stop loss, you regularly get shaken out of stocks, you either need to improve your entries or the market environment is poor.

Calculate your MAE

This reminds me of one of the benefits to calculating your MAE (maximum adverse excursion). If your winners regularly move 10% against you before they turn into winners, that suggests you need to work on your entries.

On the other hand, if you take that to mean you should always set a 10% stop loss, to still manage your risk, your position sizes will need to be small. So, when you do catch a winner, it’ll likely not move your account.

In short, know your numbers — and consider different ways of how they might inform your improvement efforts. What seems the most obvious answer isn’t necessarily the best one.

As Marios Stamatoudis points out: the ‘vehicle’ you select matters.

In other words, generating new ideas is great. But can you also find the best way of putting them into action, and then execute them well?

Loss adjustment exercise

Mark’s first book also outlines his ‘loss adjustment exercise’.

Mark used to be undisciplined about cutting losses. Although the concept sounded logical to him, he would occasionally break the rule. Therefore, as an experiment, he decided to take his journal, and adjust his losses to an arbitrary 10%.

(He accounted for some winners turning into losers, and some smaller losses becoming bigger.)

The result? Over 20 trades, his compounded return changed from -12.05% to 79.89%.

In Mark’s words:

“The hypothetical improvement in the overall portfolio performance seemed too dramatic to be believed.

“I rechecked the math two or three times, and the numbers were correct. Instead of having a double-digit percentage loss in my portfolio, I would have had a gain of more than 70 percent.

“Is it possible that such a small alteration could have such a dramatic impact on performance? Absolutely!

“This revelation was a pivotal moment in my trading. I was convinced that risk management was the key to success. From that point on, I grew very risk adverse, and my results improved dramatically.”

Once again, this shows the power of a well-placed stop loss.

It also illustrates how trying different hypothetical techniques on your past trades — or indeed checking metrics like the MAE and MFE (maximum favourable excursion) — can lead to lightbulb moments that permanently alter your results.

You already have the help you’ve been seeking

A couple of months ago, Jeff Sun shared similar insights into this:

“The statistics in your journal aren’t just about your strategy’s edge—they reflect your behavioral approach to each trading day.

“You can’t replicate another great trader’s strategy and expect the same results, but with small tweaks and adjustments, you might even outperform them.

“You already possess the tools needed to find the ‘holy grail’ you've been seeking—it’s just a matter of doing the work you’ve been hesitant to undertake.”

I strongly recommend you read the original tweet to get Jeff’s full list of suggestions.

The importance of number crunching

I haven’t written about journal analysis in a while. In fact, the last time journaling was a core focus on The Trading Resource Hub was when Dave (@DMacTrades) guest posted on here!

But I strongly believe that taking a quantified approach to your journal — even if you’re a discretionary trader — is a vital step in moving forward as a trader.

When traders repeatedly make mistakes like getting out of trades early, the first thing to ask yourself is what your journal tells you. Over time, is selling early costing you money?

If you can categorically respond with either ‘yes’ or ‘no’, you know what you should be doing, based on your own hard data.

In other words, you know what your rules — based on your own performance and personality — should be. You’re not going off someone else’s say-so, no matter their track record. You can’t copy conviction.

Don’t forget: trading inevitably involves suboptimal decision-making. You’re constantly going to get out of trades either early or late, but you can’t let that undermine your determination to follow your rules.

The best way to have confidence in your system and exercise discipline is to know, not think, that it’s right for you.

To finish on Jeff’s powerful question:

You already have it, but why do you not want to do it?

As I’ve said before, profitable strategies and systems are no secret. Heck, the path towards successful trading is no secret — deep dives are hardly a ‘little-known hack’!

But people won’t do them because they take a lot of time and hard work.

So, ask yourself: how much do you really want this?

Support my work

Found this stack valuable? If you’d like to contribute financially to say thank you, please buy me a coffee.

You can also help out by liking, commenting on and/or sharing this stack. They all help spread the word!

Listen to this stack

More content like this

To explore my full archive, click here.

Awesome article. Comes right on time with some things I am thinking about. Thank you for the work you put in!

I don't know why people preach forpaid material if we have this available free👏🏻