What Was Qullamaggie’s Real Message?

7 top lessons from Kristjan Kullamägi

Audio available at the end of this post.

People obsess over Qullamaggie’s setups and buy tactics.

But those weren’t his real message.

Admittedly, it took me ages to realise this. When I first stumbled across Kristjan’s streams, I just studied his setups and categorised charts as ‘yay’ or ‘nay’. I wrote down criteria like ‘surfing the moving averages’, ‘making higher lows’, etc…

…thereby failing to develop any real understanding of how or why Kristjan’s system worked for him.

More importantly, I failed to see Kristjan’s deeper lessons.

These lessons look at the bigger picture, and what it takes to achieve excellence — whether in trading or elsewhere.

Since I turned 29 this week, and Kristjan’s birthday is tomorrow, I’m reflecting on 7 of my top lessons from the other KK:

Verify information

Find people ahead of you

Adaptability is a superpower

Get into the momentum leaders

You’ll be wrong most of the time

Do more of what works and less of what doesn’t

Exceptional results require exceptional dedication

1. Verify information

Kristjan emphasised to verify things for yourself, and not take his word as gospel.

For example, when he gave his episodic pivot (EP) masterclass on 18 May 2023, he said:

“Don’t take my word for [it that] EPs are good trade[s].

“No, what you need to do is to study it for yourself. Is this guy bulls**tting, or is he actually telling the truth? Is this really […] something you can trade?”

Why is conducting your own studies so important?

Because you need to understand the ‘why’.

You can’t borrow conviction.

Trading inevitably involves suboptimal decision-making. So, when you repeatedly get out early (or whatever), how long do you think you’ll stick with someone else’s advice — even if what they say is correct?

Kristjan and other successful traders can only point you in the right direction. They can’t ‘make’ you trust the moving averages.

Conviction comes from doing your own work.

I could fill this post with rants from Kristjan on the topic, but to take 8 June 2023 as an example:

“You need to do the work yourselves, guys.

“Look at […] what kind of entry method would’ve been the best, what kind of exit method would’ve been the best. Is it best to sell into strength after 3–5 days? Or is it best to sell some into strength, and then trail the rest with the 10 or the 20 moving average?

“You need to do it yourself. You’ll never have conviction if you just take someone’s word for it. It’s not about being perfect, it’s about building conviction in your […] own skills, right?

“Because people are always saying: ‘Oh, […] can you help [prevent me from] selling too early?’ […]

“Well, actually, I can’t. You can — by studying stocks! By studying these setups! And if you’ve gone through, say, 500 setups, and you’ve convinced yourself [about] the best method, then you won’t have a problem anymore [with] selling too early.

“You need to build the skills yourself. I’m just here to give you some ideas with […] what type of things work in the market, but you need to put your own personal flavour on it.”

This is why Kristjan (and his mentor Stockbee) are always telling you to do a deep dive.

Much of trading comes down to pattern recognition. At some level, most skills do — writing included. And the more reps you put in, the better you can recognise the patterns.

In other words, a deep dive isn’t just essential to build conviction — it’s how you develop a high level of skill.

Learning the ‘why’ is also essential to become a mechanical engineer.

Reverse engineer the minds of top traders to try to figure out things like:

Why do they do things a certain way?

How come they reach a different conclusion than you?

What details are they identifying and processing that you miss?

By becoming, as Marios Stamatoudis puts it, a ‘mechanical engineer’ rather than merely an ‘operator’, you won’t just know how to operate someone else’s system.

Rather, you’ll understand exactly what purpose each ‘lever’ within that system serves, so you understand what impact any changes to individual elements might have. Then, you can refine and optimise the system to suit your personality and circumstances.

Imitation achieves proficiency — and is the place to start.

But for mastery, you must innovate.

2. Find people ahead of you

Kristjan scaled his account at a remarkable rate, going from $5,000 to $100,000,000 in a decade.

While this can’t be attributed to any single factor, a probable key to that success was Kristjan’s ability to iterate. To quote him from 3 June 2021:

“You always want to reach the next level. You always want to learn from people that are better than you, that are on a higher level than you in mastery.

“That’s how you get better.”

Hard to argue with that!

Kristjan also regularly spoke about how he learnt from lots of people, taking one or two key lessons from each person, then moving on.

For example, from the 11 June 2020 stream:

“I’ve had many mentors [—] probably a dozen mentors [over] the years. I’ve taken one or two key concepts from everyone, and then I moved on. I implemented something that made sense to me […] in my trading, and then I moved on. And I’m always looking for new people.

“Like, opening range highs. […] I read [about] a guy that made a personal net worth of, like, a billion dollars. All he traded was the opening range highs and opening range lows, and now he’s a fund manager.

“But he did it on futures and commodities and stuff like that. But that’s the concept I got from him. […] It’s great for risk management purposes.”

On different streams, Kristjan has shared similar stories about where he learnt other elements of his trading system — the use of the average daily range (ADR), for example.

But you can only make something your own if you understand the ‘why’.

3. Adaptability is a superpower

“The biggest, biggest advantage you can have in financial markets, no matter if you’re a trader or investor, [is to] keep an open mind.”

While this quote comes from Kristjan’s 3 June 2021 stream, we hear similar things from the greatest traders and investors — most notably Stanley Druckenmiller, who constantly stresses the importance of being able to change your mind.

Chart patterns simply reflect supply and demand. No matter the century of your chart, the patterns won’t change.

But nuances are a different matter.

During that June 2021 stream, Kristjan got into extended stocks $AMC and $BB.

Why?

Because in that market environment, stocks that had already gone up several hundred percent in under a week were also the stocks continuing to make the biggest moves.

In other words, Kristjan adapted!

“I don’t want to be […] another trader who was once successful and then lost his edge.”

Edge erosion is a real phenomenon. Markets have changed over the years, becoming far more accessible to retail traders and seeing the algorithmic trading boom. Again, this doesn’t change chart patterns, but it creates more noise and affects the success rate of breakouts.

You can hedge against this by being adaptable.

The learning never stops.

Observe what has been working lately as part of your situational awareness framework, and adapt accordingly. Keep figuring out ways you can refine your system.

Don’t obsess over setups — obsess over finding low-risk entry points in strong names, and improving your risk-to-reward ratio.

Speaking of strong names…

4. Get into the momentum leaders

While many trading legends trade in slightly different ways, they all aim to identify relative strength:

Who are the momentum leaders?

Tracking relative strength doesn’t just provide valuable information about which names to trade — it also informs you about overall market health:

Going through a correction but the leaders are holding up? You’re just going through a normal pullback, and can expect the uptrend to resume after the market has had sufficient rest.

Speculative trash is taking off while leaders are showing signs of weakness? You’re nearing the end of a sub-cycle — this isn’t the time to be aggressively buying.

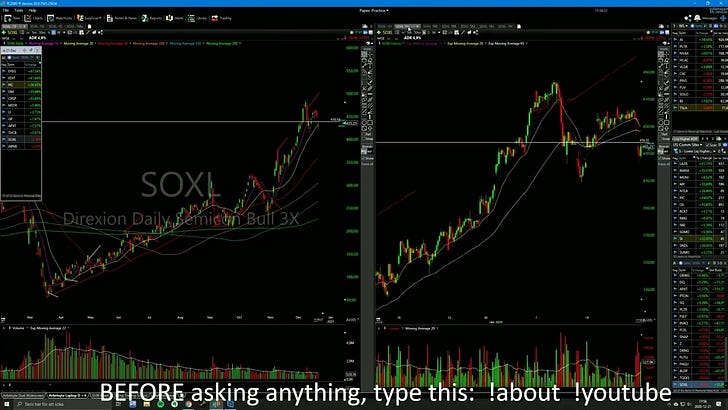

One of the big things that always struck me during streams was how quickly Kristjan flipped through charts.

This showcased the speed at which he could absorb large amounts of data, as well as the strength of his ‘brain-based database’ in terms of themes. If he saw an interesting chart, he could — and would — instantly check what correlated stocks were doing.

How did Kristjan develop this ability?

Lots of chart-flipping.

You can incorporate this as part of your routine, as well as practise this by reviewing your own database following a deep dive.

Stockbee’s daily 20% study will also help, where he runs four scans to find the week’s biggest movers. This exercise — a ‘mini deep dive’ — will exponentially improve your clarity, training your eye and building up your mental database.

It also builds your situational awareness, telling you:

What types of setups are working (if any!); and

What themes are in play.

This doesn’t mean you have to copy Kristjan’s entry tactics or setups.

Maybe pullbacks work better for you than breakouts, for example.

Or perhaps you can find an alternative entry to the opening range high (ORH), as JUNO explained to me in our second interview.

Some of this comes down to circumstance. If you trade from an APAC time zone, for example, you’ll probably want to enter positions near the opening bell or rely on limit orders. Or if you can’t watch the markets until after the first hour, figure out a way of getting into the strongest names later in the day.

Does this mean you’re going to miss trades? Of course. Every method has its trade-offs. But it’s about finding a system that works for you.

Again, this comes down to doing your own homework so that you:

Understand what levers to pull; and

Can build conviction.

5. You’ll be wrong most of the time

Even if you become a good stock picker, getting into the leaders, be prepared to spend most of your time in a drawdown and have low win rates.

To repeat the Qullamaggie quote Christian Flanders referenced last week:

“You’re going to spend most of your time in a drawdown, even in a really good year.”

And to quote Mr Flanders himself:

“A bull market can deceive you into thinking the good times will roll on forever. But they won’t.”

Qullamaggie shared his 2020 win rate in his Chat With Traders interview: about 35%. In 2019, it was 25%. Yet he had phenomenal returns, particularly in 2020.

Plus, while Kristjan may feel that he could be trading less, there’s no doubt he knows how to spot a leader. With that in mind:

If the very best (Kristjan) is wrong most of the time, you will be too.

6. Do more of what works and less of what doesn’t

Kristjan proffered this advice more than once when asked in the stream chat how someone can improve as a trader.

And though this response can seem almost flippant, it’s also hard to argue with. Frankly, it’s how you improve at anything.

With that in mind, don’t wait for a ‘perfect’ start.

Just start somewhere. Anywhere. The faster you start, the faster you can collect — and implement — feedback. And the faster you’ll get your reps in.

I wouldn’t be where I am today if I hadn’t started writing online in May 2023, long before I felt ready. And to this day, I’m evolving and growing in my primary field (writing).

The Trading Resource Hub started as ‘pure’ note-taking. From there, I added my own insights, made links between different traders/resources, and ultimately produced original content.

Now, I feel privileged to be able to bring more regular guest contributions to this Substack.

I’ve enjoyed these past couple of weeks, getting insights from Clement Ang and Christian Flanders, with several more guest posts on their way.

For clarity: guests write their own posts, but I do put my ghostwriting skills to good use by applying my editorial magic and offering guidance where required.

As far as I’m concerned, you don’t need to be a confident writer to guest post here — you just need to be confident in your knowledge and be the right person to share it, by virtue of your personal experiences (and not your follower count).

If that’s you, please message me, and we’ll have a chat :)

7. Exceptional results require exceptional dedication

To get exceptional results, you need exceptional dedication and strategic risk-taking.

Manage your downside, but also know when to ‘go for the jugular’ — like when Kristjan went all-in on trading.

But he didn’t just forego a plan B — he put in an insane amount of hard work into his plan A. He went to lengths few people would be prepared to copy, even if it guaranteed their success.

I find that dedication inspiring.

Every now and then, someone trolls me over my lack of superperformance as a trader — failing to see that my priority remains writing. It’s what I love most.

And studying top performers like Kristjan inspired me to push harder as a writer — with the results to show for it. I’m still not the best I can be, but I’m a darn sight better than 20 months ago, when I first started writing online.

Your results reflect your priorities.

Support my work

If you find my writing valuable, and would like to support future work, please buy me a coffee:

Or if you’re new here, you can explore my archive first.

I just wanted to take a moment to sincerely thank you for the incredible work you’re doing. Your posts have been absolutely terrific—so well-researched, insightful, and professionally put together. It’s clear that you put a great deal of effort into every piece, and your dedication to the trading community is truly commendable.

Beyond the depth of analysis, I also appreciate the extra steps you take, like your audio notes, which make the content even more engaging and accessible. It’s rare to find someone so committed to both quality and clarity, and it doesn’t go unnoticed.

Your work has been invaluable, and I just wanted to express my gratitude for all that you do. Looking forward to more of your insights!

I love your Substack. Please keep writing it!