Detailed Trade Review, and Data-Driven and Historical Studies

Part 2: Different types of deep dive from 3 readers

To celebrate my second TTRH anniversary, I’ve asked readers to share their stories of their trading breakthroughs.

The fact that 11 people responded they’d be “honoured” to, and supplied often-lengthy stories within days of my request, is truly humbling. Particularly when many aren’t used to writing long form in English.

But my readers have faith in the famous ‘editorial magic’ — and I must be confident I’ll deliver on those expectations, no matter what.

(This is similar to the confidence traders need in their own processes to be able to stick to them even when they inevitably lead to suboptimal outcomes!)

However, uncertainty is unavoidable.

I’ve ghostwritten for enough ‘ordinary’ people to firmly believe that everyone has a story to tell.

But finding the right buttons to press can take time — which I lacked in the run-up to this stack. I’d have to roll with what I’d be given.

So, it was a relief to find most stories captivating, and offering you value, even as a first draft. In fact, many were so engaging, I didn’t at all mind their length. That said, it meant I had to split this stack into three parts, each covering a different theme.

Part 1 focused on personal growth and finding a style that works for your personality.

This part focuses on traders who found their way through deep study and/or rigorous routine.

We’re shining the spotlight on three more readers:

A Vietnamese stock broker who struggled with consistency, then methodically addressed his problems and developed a detailed trade review process.

A part-time trader constantly reviewing and incrementally improving his metrics, bringing a strong numerical focus to his trading after a value-based and news-driven start.

A trader who went from patient and risk averse, to overtrading and volatility chasing, to studying the true market leaders of the past 75 years to regain perspective.

Though their journeys are unique, they have a recurring theme:

Going from a lack of direction, to hard work and disciplined routines in line with their personalities.

How all three found what they were looking for through deep study, but each took a totally different direction with that study, is fascinating to me.

I believe this reflects their personalities — and shows how knowing yourself isn’t just vital to determine how to trade, but also how to study trading.

6. From struggling with consistency, to a detailed trade review process.

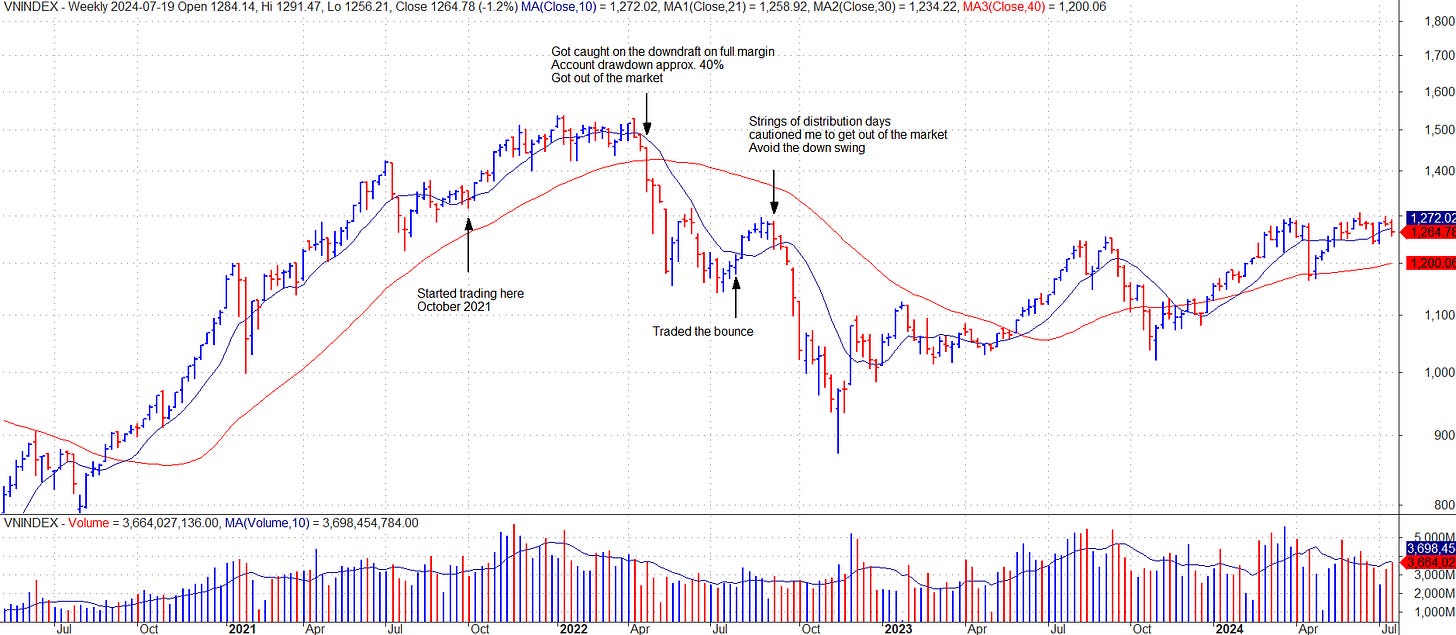

I started my career as a stockbroker in Vietnam in July 2021.

Before moving to Vietnam (from Alberta, Canada), I’d dabbled in trading penny stocks on the Canadian stock market around 2016.

As a stockbroker, I was exposed to the market all day long, but we were nearing the end of a roaring bull market. Being spoiled by the market environment, some of my trades ran >30% in a matter of three days — trading seemed rather easy!

Since it was so easy, I was indiscriminate with my trades.

When starting at my first brokerage house, I was trained in the CAN SLIM methodology at a basic level, so trading breakouts was my go-to strategy.

I bought anything that looked like a breakout — which worked, until late November 2021. At the time, I hadn’t a clue why the strategy stopped working, because I wasn’t tracking the leaders.

The market traded sideways from December 2021 until April 2022, then broke down.

When the market broke on 25 April 2022, I was on full margin…

…and I couldn’t get out of my positions, because the Vietnam market had a T+3 settlement rule then.

In other words, I could only sell my positions three days (or later) after I’d purchased them. Suffering a 40% drawdown in just three days was traumatising! So, I closed all my losing trades — cut the losses, as the O’Neil and Minervini books taught me.

I went back to the drawing board to diagnose the issue:

During the ‘easy dollar environment’, I was indiscriminate with my trades, which led to overtrading.

Since catching a winner was so easy, I wasn’t motivated to track my trades. I just thought I’d make it back on my next trade!

But had I paid attention to my trading records from late November to mid-December 2021, I’d have noticed my extending losing streak.

Because I hadn’t, I didn’t cut back on position sizing — never mind stop trading. In effect, without realising it, I was suffering ‘death by a thousand cuts’.

Crucially, I didn’t notice that the market leaders had topped.

This experience taught me to follow the leaders in tandem with the general index.

After the 2022 bear market, I was on a quest to improve my technical knowledge, but again struggled with consistency. Although my technical knowledge improved, my process was rudimentary: I only looked at the index, stocks, entries and exits.

I struggled to narrow my focus, because I tended to look at too many stocks. So, in late October 2023, I started to record my trades more meticulously.

This helped me produce a model book of my own trades.

At this time, I noticed a few clients who are also knowledgeable in trading or investing methodologies, yet had sporadic results.

They had two striking commonalities:

They didn’t keep a record of their trades.

They didn’t have a way to conduct a frequent performance review.

From these observations, I knew I had to address how I review my own performance.

This is like an athlete watching their own tape — I needed to narrow down what to address:

Is it my execution, stock selection, position sizing,…?

Did I trade when market conditions weren’t favourable?

Did the leading stocks behave normally or abnormally while I was trading?

Did I not account for something that could move the market at the time?

These were all components I considered, but I lacked a way of tying them together to make sense of it all.

Then, at the start of 2024, I came across an SMB Capital video. Looking into Mike Bellafiore, I read The Playbook and One Good Trade.

The Playbook nailed my problem:

I have sufficient technical knowledge and track my trades, but lacked a detailed review process.

This meant I didn’t reflect on my performance — my preparation wasn’t as thorough as I thought.

But if I implemented a frequent review process, I could shorten my feedback loop, and evaluate my performance as recently as possible.

This SMB Capital video with Lance Breitstein made the difference for me, and I modified the ‘Report Card’ to suit my process:

For me, annotating my analysis on a chart is insufficient.

I must write out my thoughts in OneNote, where I can access my analysis and reflection as I write my daily review, so that I feel a sense of accountability.

My current playbook covers:

Index review

Is the general market favourable to my trading strategy?

My strategy works best in trending environments. I also look at some concepts from Oliver Kell’s price cycle, as well as a few technical indicators like MACD — this helps me determine whether momentum is intact or weakening.

Understanding the market conditions helps me adjust my expectations and exposure.

The big picture

Focus on the macro level:

Are there global events that could impact other indices or the prices of futures, like a US Fed announcement or certain geopolitical events?

Are there any domestic economic policies, like the State Bank of Vietnam raising rates, that could impact the market?

How are leading stocks behaving? If these are weakening, so may the overall market.

From these observations, I explicitly state how I expect the market to behave in best-case, base-case and worst-case scenarios.

Portfolio review

I review every single position in my portfolio on a technical basis at the end of each day, and explicitly write down my current level of market exposure.

I tend to average up as my positions progress in my favour, so look for developing technical buy areas or pocket pivots. I also look for warning signs, such as moving average violations or MACD crossovers, that may indicate a reason to sell.

Performance (execution) review:

If the night before I’d planned to execute, I assess my performance.

Here, I get candidly critical with myself.

What did, and didn’t, I do well? Did I follow my rules? And if I didn’t, but made an on-the-spot decision to actively manage my positions, what opportunity costs did I incur?

(I track this on another spreadsheet, similar to the one in Minervini’s second book. I pay particular attention to my 10 most recent trades, as they may indicate the state of current market conditions more accurately.)

Trading plan

From the “Portfolio review” section, I write down what to do with any current position.

I also run scans for buy signals at the end of the trading day, and note down any buy candidates — like a name that’s been basing and is flashing a pocket pivot signal.

I’ll write down a reason to buy, as well as my initial position size, in line with the capital risk I’m willing to take on that trade.

The logic within each part of my playbook ensures a feedback loop.

My trading is a mosaic of knowledge from CAN SLIM-inspired traders, though I veer more towards the technical side.

However, Bellafiore’s The Playbook opened my eyes to the impact of having a process and consistently sticking to it.

This is key to treating your trading like a business.

- Khoa Nguyen (@alphatrading403)

Note from Kyna: I love this trajectory from long-time reader Khoa, and I think it illustrates how certain core principles appear no matter which market you trade.

I also enjoy how methodical Khoa was about addressing his problems. From the realisation that market environment makes all the difference (particularly for breakout trading), to the discipline around journaling and process so that he lets the market come to him, there’s much to take away here.

Thank you so much for sharing your story, Khoa!7. From following the news, to a tailored market spreadsheet and a data-driven deep dive.

I placed my first trade in Q3 of 2021 — the market top at the time!

I traded names like $TSLA and $AMZN while learning technical analysis from a YouTube channel that focuses on value trades in beaten-down names, and having Bloomberg TV on constantly.

My first breakthrough was finding the TraderLion YouTube channel and watching interviews with market greats. These made me realise that value stocks aren’t suitable for my personality and that financial news channels are garbage, so I stopped focusing on both.

From the greats, I learnt lots of lessons:

1. Narratives and stories are secondary.

Price and volume (supply and demand) are all that matter.

Sound bases show that buyers are stepping up while sellers are dwindling. And as volume dries up while a tight range forms, the stock is primed for a big move, either up or down.

2. Review your trades.

After learning to read charts, for the first time ever, I reviewed my trades.

My first thoughts were a mixture of disbelief and embarrassment. What was I thinking?! (Anyone who has done this can probably relate…)

I swore to never again place such bad trades or be so ill-disciplined.

3. Build a system tailored to your needs.

Following other people and hoping for the best is a sure-fire recipe for disaster.

Even if you’re learning from a legitimate source, they may have a different situational or mental profile to you. For example, I couldn’t buy O’Neil-style breakouts with 7% stop losses.

As an Asia-based trader who works full time, I need a system that:

Allows me to trade using the previous close as my main reference; and

Executes during the first two hours of trading (9–11 pm local time).

4. Work hard and keep improving.

After building my trend-following system, things were going well, but I still had much to improve.

I did this by:

Constantly reviewing my metrics; and

Incrementally improving them.

Many little increases compound, stacking the odds in my favour.

After all, if 95% of aspiring traders fail, you must look in the mirror and ask yourself what you’re doing to be in the 5% of people who succeed. The market (and life) doesn’t owe you anything. Success isn’t going to be handed to you on a plate.

So, you must outwork everyone. You must always be working to improve:

Review past trades, looking for new edges and system refinements.

Focus on the mental side of trading.

You must love stocks and the markets. This takes many, many hours — but it’s been so much fun for me!

5. Learn from the best.

After constantly building and refining my system, I was still largely flat at the end of 2023.

That’s because I was constantly scanning (new scans every day), finding great setups, then would often attempt a trade, get stopped out, and see the stock set up a few weeks later.

So, I had to decrease my trades and focus on leading stocks.

I now have a mentor in Oliver Kell from “The Swing Report”. I can’t recommend it highly enough — he focuses on clear commentary on leading stocks, which has massively impacted my performance.

Learning from the best, aligned to your style, will massively speed up your learning curve.

(Note: Before reviewing Oliver’s report, I perform my own analysis of the indices and my positions. Then, I compare my analysis against Oliver’s, noting down points I missed to further my development. Learning from someone else doesn’t mean following them blindly.)

6. Follow only those who add value, and ignore the rest.

These days, I rarely use the ‘following’ tab in 𝕏.

Instead, I get (silent) notifications for the people that add value to my trading: Oliver Kell, Jeff Sun, Brian Shannon, Clement Ang, Connor Bates, Jay (PBA), and a few others.

(Of course, you too, Kyna!)

7. Do a deep dive into your metrics.

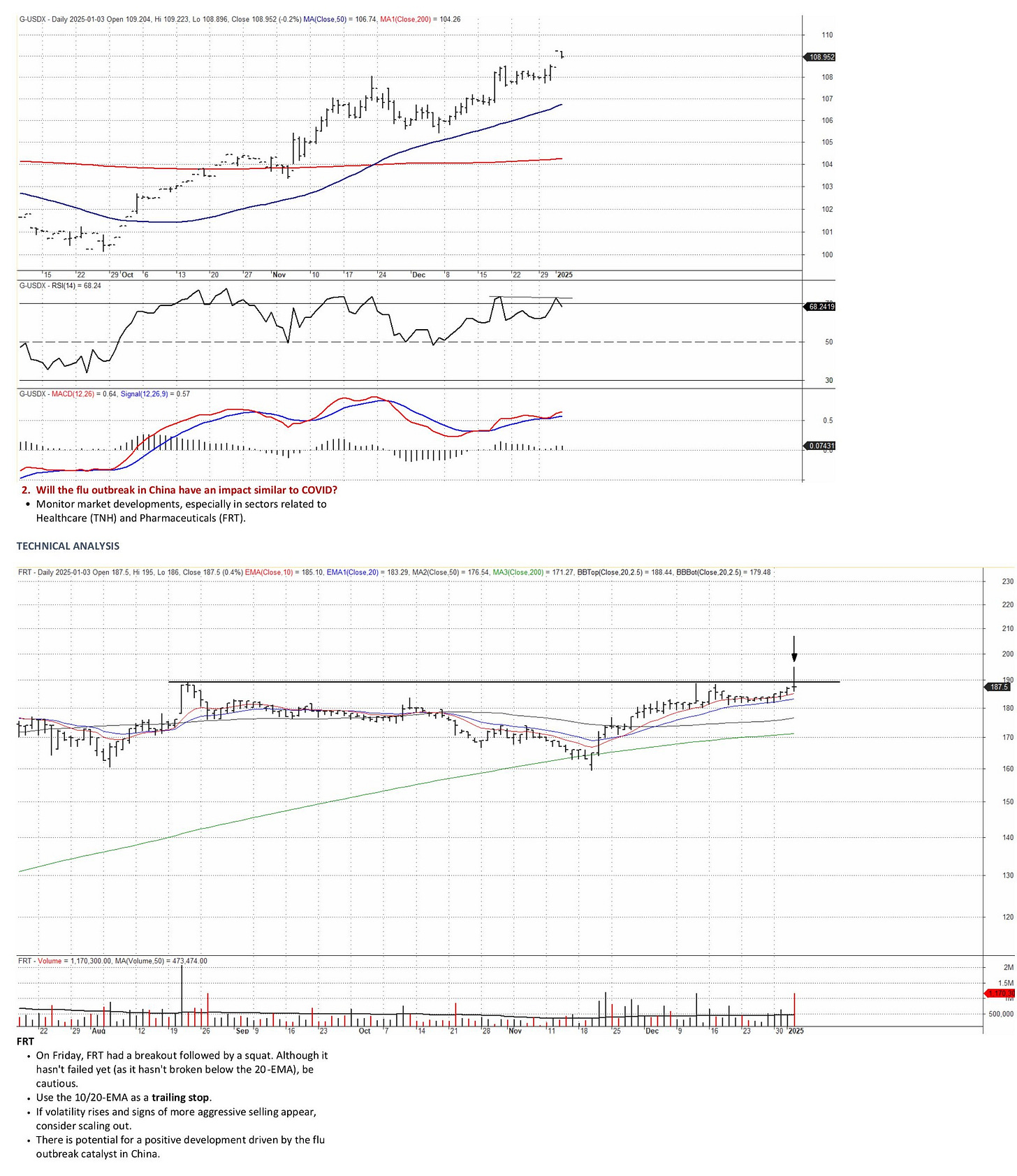

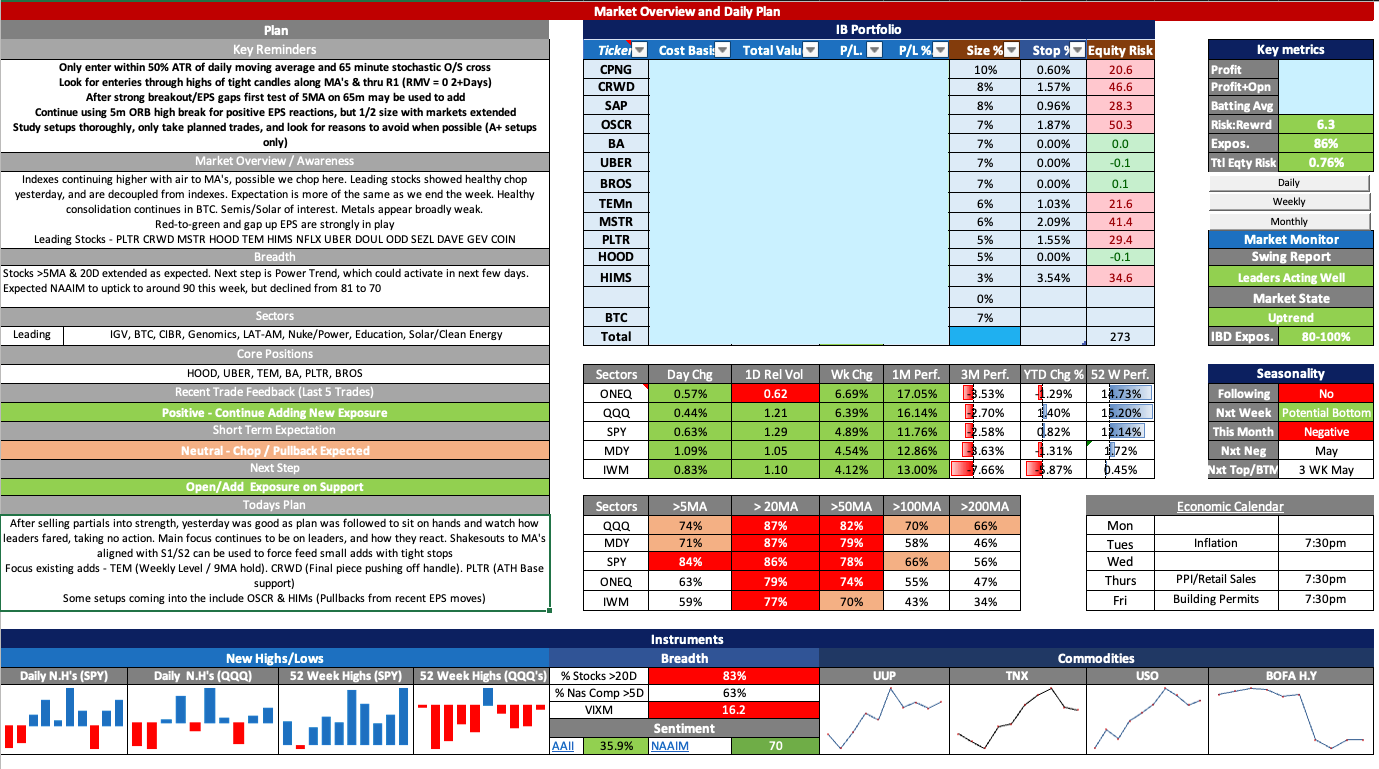

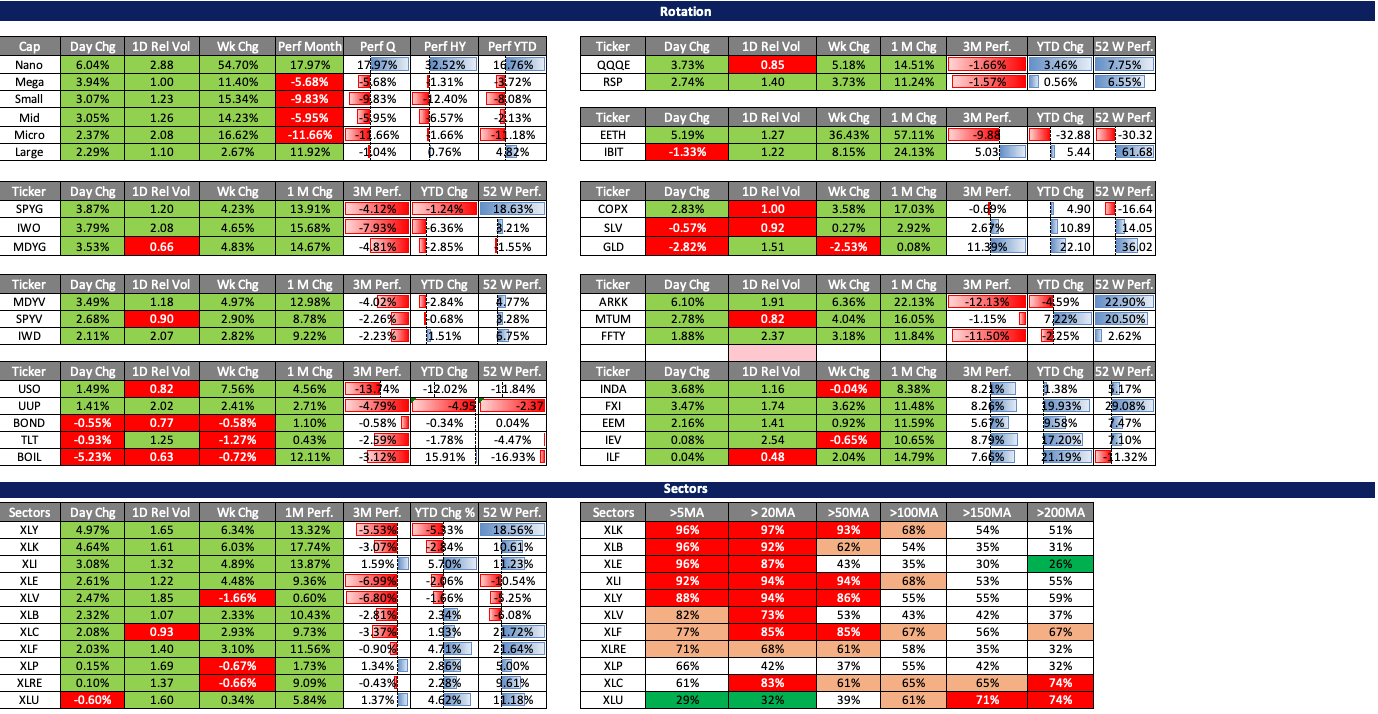

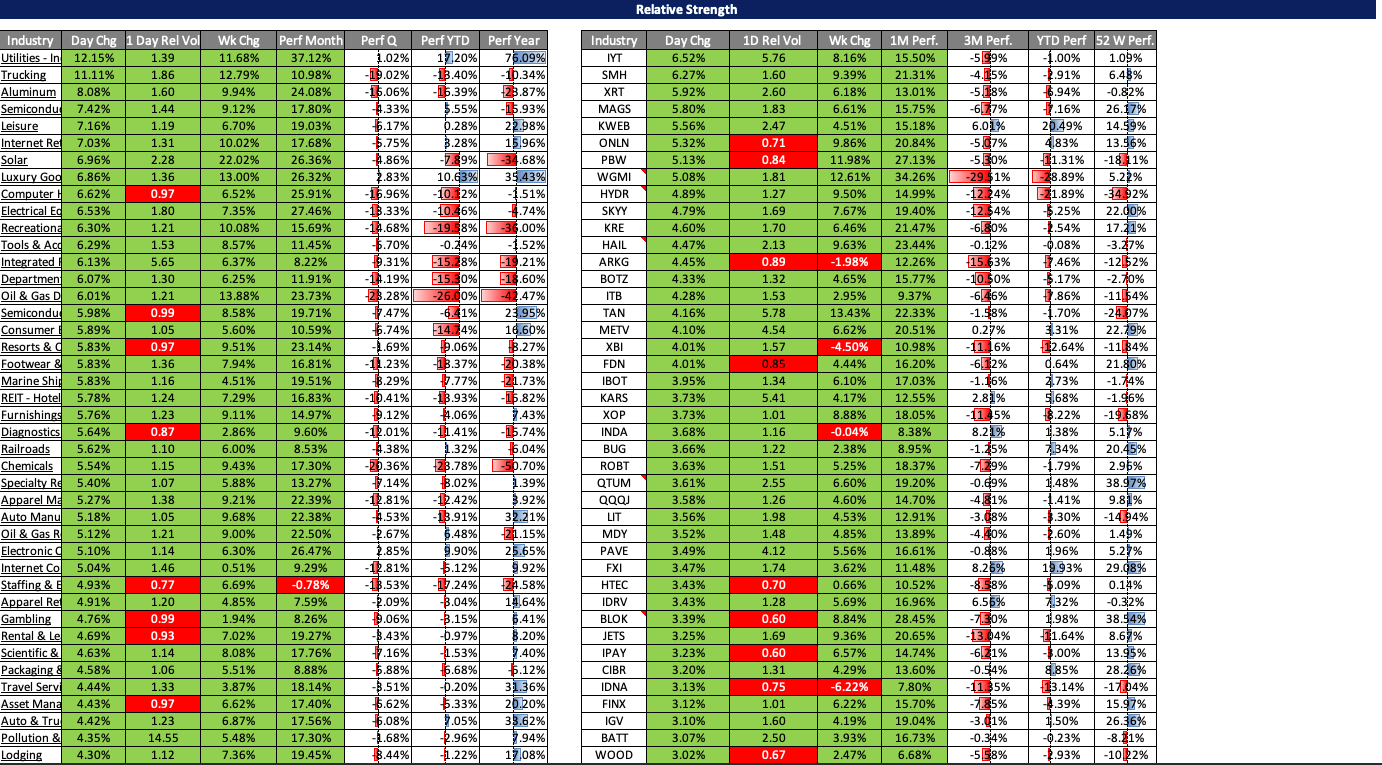

Over the past year, Jeff has been my biggest trading influence, inspiring me to build my own market spreadsheet:

The spreadsheet is tailored to my trading system, containing the main data points I need to make decisions. The included market commentary and daily plan (i.e. journaling and written analysis) help set the tone, and mentally prepare me, for the day ahead.

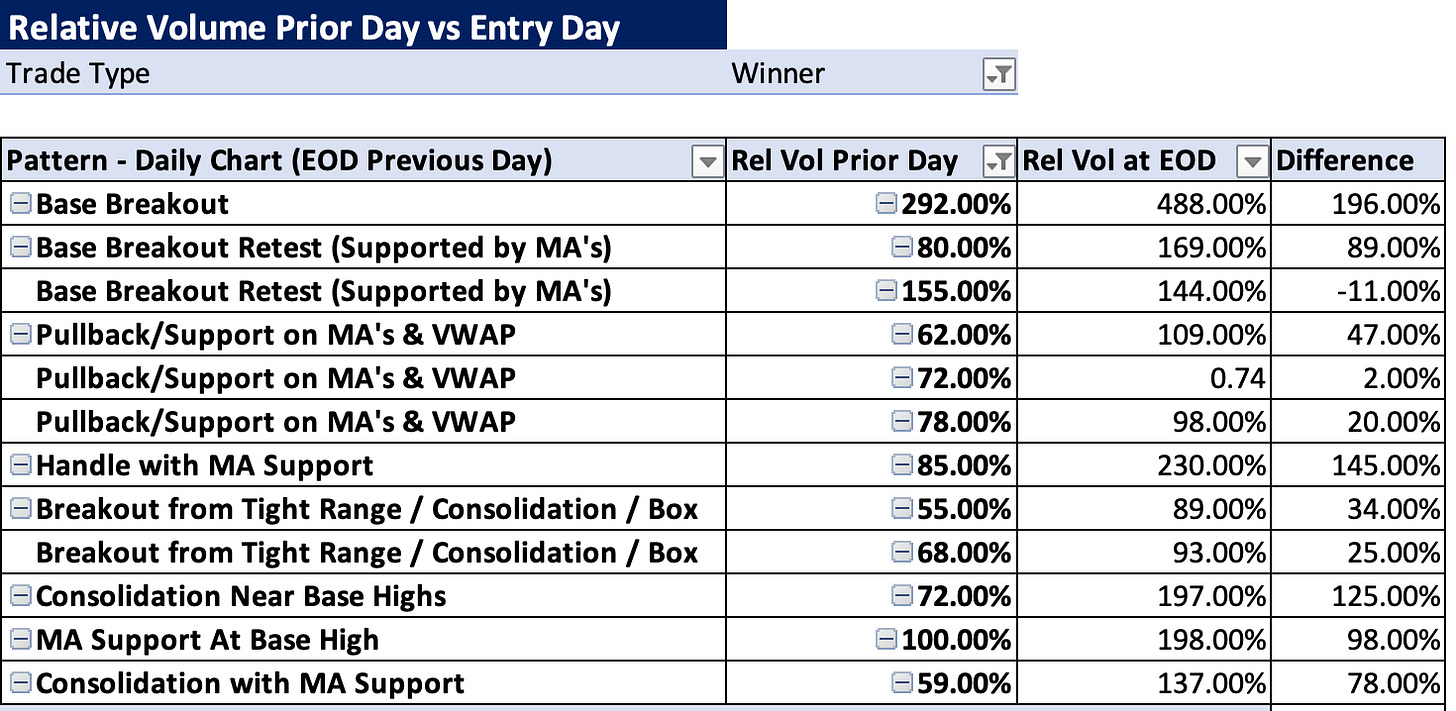

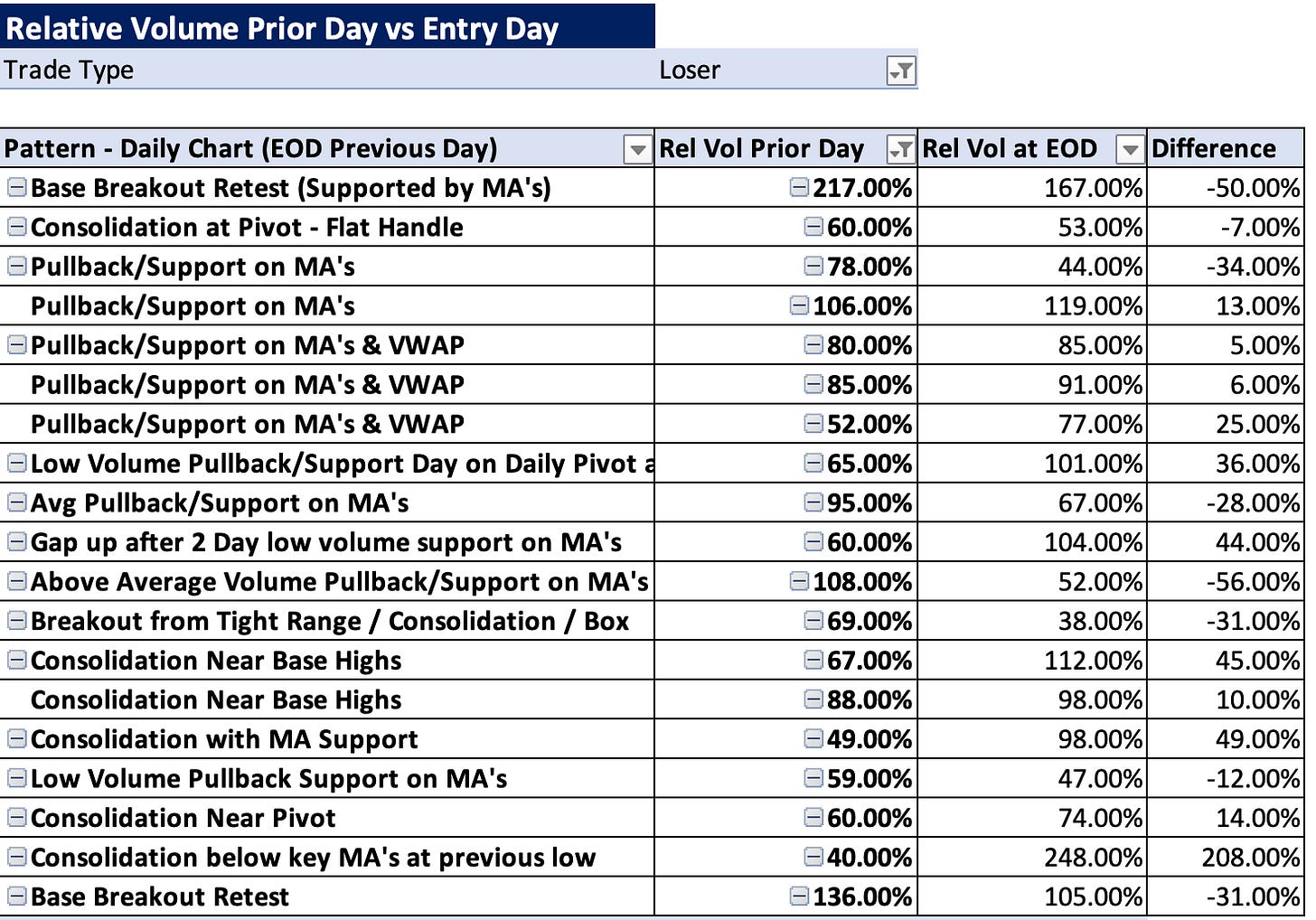

Jeff has also inspired a real focus on the numerical aspects of trading:

This type of data-driven deep dive provides deep insight into your own trading and helps enforce necessary changes based on hard numbers.

For example, most traders know that breakouts ideally occur on above-average volume. But when I reviewed my trades, I discovered that RVOL on my winners was on average 72% higher than the previous day, but only 10% higher on my losers.

Knowing the hard numbers, based on my own trading, made it far easier to apply and stick to strict requirements.

I finished 2024 with a 39% batting average and 7:1 reward-to-risk ratio, with my average winner at 17% and average loser at 2.4%.

After reviewing my trades, my action points for 2025 are:

Sell a partial when stock becomes 1 ATR (or more) extended from the 5 DMA (especially on gap-up opens).

Look to start positions on pullbacks rather than on strength, primarily looking for shakeouts to the DMAs that align with the S1/S2 pivot point, and an oversold stochastic on the 65-minute chart.

Improve entries on EPs and high-ADR stocks (such as quantum/space stocks).

Continue model book studies and finish one book on trading per month.

As Jesse Livermore said:

“The human side of every person is the greatest enemy of the average investor or speculator.”

Mastering that side — one trade, one lesson at a time — is the real game.

- (@JANSEYFARTH2)

Note from Kyna: As I enjoyed Simon’s insightful comments (e.g. here and here) on previous stacks, I asked if he’d be willing to share his story.

While the format he chose may be less personal than some other contributors, his lessons resonate. They reflect my own experiences, and those of many other traders: keep it simple, find what works for you, study your journal, and surround yourself with the right people.

Within and outside of trading, hard to go wrong with that!8. Regaining perspective through extensive study of historical market leaders.

My 10-year trading journey hasn’t been filled with prodigal progress and excellence, but grit and resistance.

In other words, mule-like stubbornness and a refusal to quit.

The initial years were undramatic. I’m naturally risk-averse and don’t have the gambling urge. My performance reflected this: I pretty much broke even for my first four years (apart from a slight up year in 2018).

I was patient and knew how I wanted to trade.

Breakouts were my thing, and I liked trading any asset, any market. Japanese stocks treated me especially well.

Things were slow. I bought at the end of the day, and I patiently sat in my trades for weeks or months until they hit target. I had no concept of stock selection, leaders, ADR, and so on.

It was as bare-bones as looking for good patterns and buying the breakout. Crude, but it worked, and I gradually refined it.

In hindsight, this is where I should have put my efforts: simply refine and improve what works.

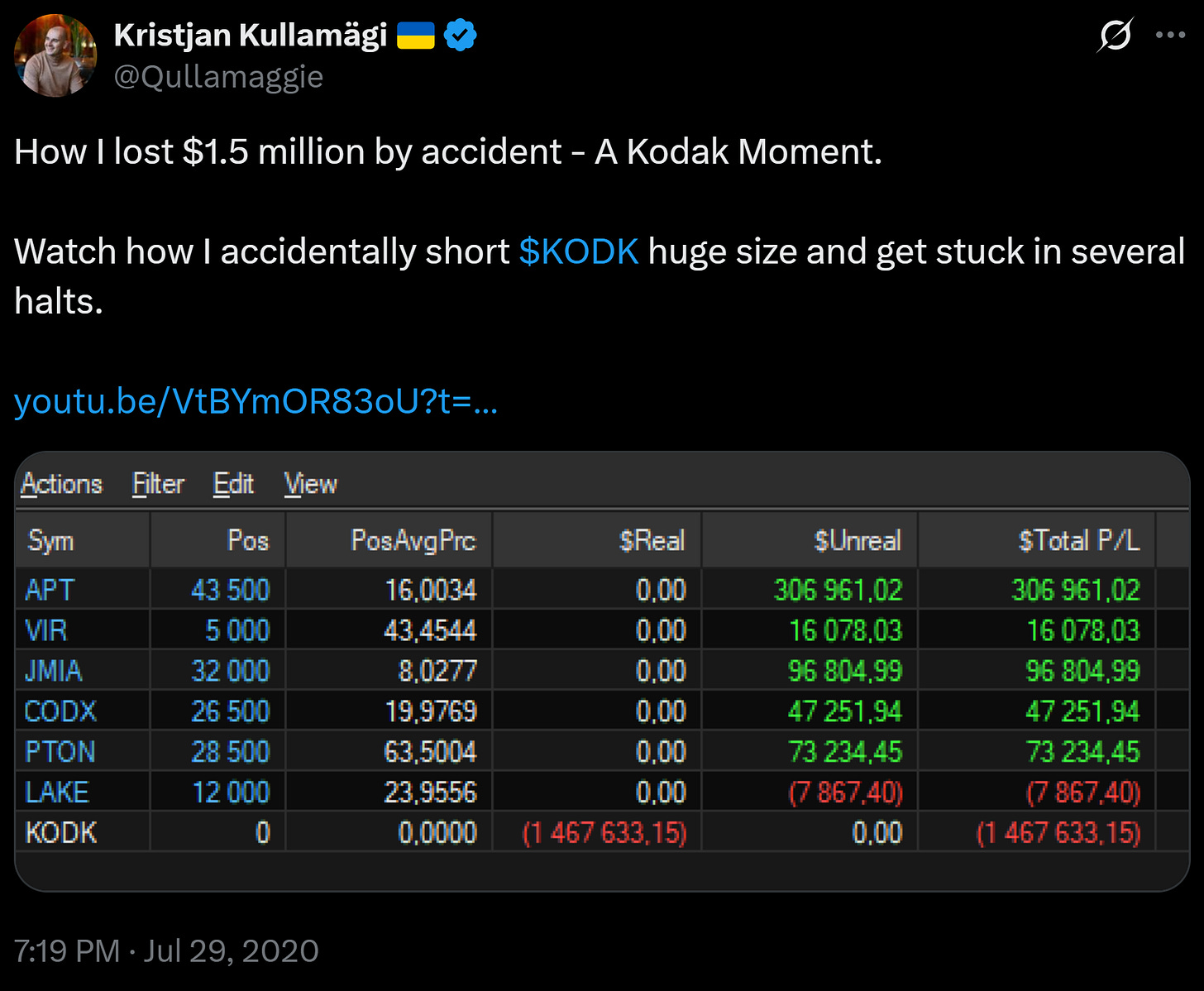

Instead, in 2020, I stumbled on a tweet:

Intrigued, I watched the clip.

It turns out this ‘Qullamaggie’ had turned a few thousand into millions. I’d never seen anything like it. I didn’t even know people could trade like this. But here he was — a regular dude making millions by trading insanity stocks.

I was awestruck, and consumed any content I could get my hands on.

At first, I was reluctant to delve into more volatile stocks — I felt like I should stick to the leaders…

…but that didn’t last long.

How could it, when I saw guys trading $GME, $AMC and other meme stocks?

My patience waned, and I became an overtrading fiend, fuelled by energy drinks and staring at the screens from open to close.

But I was making money.

Of course I was! A monkey could have made money in that environment.

With an even crazier start to 2021, I was on Cloud Nine.

I’d managed my risk impeccably for years, and now I also knew how to make money. Surely I’m the next Paul Tudor Jones!

I quit my job and went full time.

Every waking minute was spent in front of the screens. And it worked — until mid-November 2021. Then the tide went out, and I realised I was swimming naked and making an enormous mistake. A mistake born out of arrogance...

…because I’d deluded myself into believing I could somehow repeat Qullamaggie’s performance.

But me trying to trade like him was a recipe for disaster.

Qullamaggie taught me many invaluable lessons. His work ethic is legendary — and that was something I had to adopt.

However, I’m not built like him.

Qullamaggie thrives on volatility — which I hate. How could I model myself after someone whose core strength is my polar opposite?!

I’d been arrogant. I’d been blind, failing to realise I was on the wrong path.

The incoming bear market showed me the ugly truth.

I’m a terrible day trader, and while my swing trading acumen fairs better, going long in a bear market isn’t a good idea.

I spiralled into despair. I’d gone from being the most patient of traders — disciplined and steady — to acting like a gambler, desperate to make a quick buck while constantly fighting the market and forcing trades.

For the next two years, I traded in a state of confusion and overwhelm, lacking direction. I tried everything from penny stocks, to breakdowns, episodic pivots (EPs), and more, but simply couldn’t form a comprehensive approach.

Finally, in late 2023, I’d had enough. I’d gone through so much pain, and came to my senses. Rational ideas started to take shape.

What if studying my biggest winners has been a falsehood, since they were concentrated in the 2020–2021 mania?

What if that wasn’t me, but just the market? What if I’d been lying to myself all that time? What if I’m a slow, ‘boring’ trader, like I’d naturally gravitated towards at the start of my journey?

For the first time in years, I looked at weekly charts again…

…and saw many stocks — which I’d not even looked at before — that made big moves over a few months.

I realised I had to go back and look at all US stocks that made big, durable moves.

But with many pre-2020 moves (and stocks) gone, to do this properly (an O’Neil-style study), I needed decent data. So, I got the US platinum package from Norgate Data.

Loading up the charts was terrifying. What if the 1950s turned up nothing? Or the sideways chop of the 1970s — was it then even possible to successfully trade stocks?

Not only did my fears prove wrong…

…I’d found a treasure — a literal roadmap for how to trade.

Stocks made amazing moves in every decade:

Reynolds Metals and Douglas Aircraft in the mid-1950s.

Lorillard Tobacco, Texas Instruments and Polaroid in the late 1950s.

Xerox, Syntex and National Video in the 1960s.

Houston Oil & Minerals and Caesars World in the 1970s.

LA Gear, Computervision and Home Shopping Network in the 1980s.

Newbridge Networks in the early 1990s.

These were all true market leaders that followed similar patterns:

Basing during corrections, breaking into stage 2 uptrends, then running for months or years with support on key moving averages.

Same story for 75 years.

Around this time, I found my now-friend Barry Bivingston, who tweets amazing stock charts from the early 1900s.

The pattern was clear: stocks make big moves! Whether there’s prosperity and peace (e.g. General Motors and Montgomery Ward during the Roaring Twenties), or war and turmoil (e.g. Crucible Industries and Bethlehem Steel in the midst of WWI)…

…this is how stocks actually move.

When you see the patterns over and over again with your own eyes, you really start to understand the market cycles and stock behaviour.

The idea of paying attention to macro chatter becomes preposterous.

The fear and greed grasping at the masses become an amusing spectacle.

Not because you’re armed with any particularly special faculties, but simply because you’ve already seen it all through your studies.

Lefèvre said it best in Reminiscences of a Stock Operator:

“There is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market to-day has happened before and will happen again.”

In conclusion: know thyself. Be as honest as possible when you assess your personality and trading results.

When you see someone you can somewhat identify with enjoy huge success, if you’re not careful, you can get taken off track.

I don’t mean this as criticism of Qullamaggie.

He taught me the importance of hard work, studying and how to think. I’ll forever be grateful to him.

But the lesson I learnt for life?

Before anything else, study yourself.

If you get that wrong, it doesn’t matter how much effort you put into areas you have no business of entering. Success will elude you, and the harder you try, the more pain you inflict — until you’ve finally had enough and surrender.

Acknowledge that faint whisper in the back of your head. That’s the truth. Ignore it at your own peril.

- Cobez (@IntlSpeculator)

Note from Kyna: Cobez’s story hit hard. I too have taken deep inspiration from Qullamaggie, particularly in terms of work ethic, but the one unhelpful lesson I learnt from him (now unlearnt) was his ‘the higher the ADR, the better’ mindset.

High-ADR stocks have, on balance, cost me money. I’m naturally risk averse, and much prefer trading size in liquid leaders, with a tight stop. This works for my timeframe and desired screentime, this works for my temperament, and now that I’ve finally learnt to get (more) comfortable with trading aggressively — in the right names, at the right time — I’ve achieved my best performance as a trader to date in this recent rally, in terms of both execution and P&L.

Cobez has been on fire on 𝕏 lately, sharing historical charts and stories from his studies. One tweet at a time, his timeline is turning into a banger archive — well worth checking out!Another huge thanks to all contributors!

I truly appreciate you taking the time to share your experiences so that others may benefit from your lessons.

Next week is the final part of this series, which covers deeply personal stories from three more readers — each of whom has achieved a lot, but at great cost.

They’ve all learnt risk management the hard way, and have experienced the dark side of trading none of us want to think about, but that very much exists.

Yet another awesome article, Kyna!

Thanks to all the 3 contributors and to you as well! Lots of learning here for aspiring traders like myself.

Risk management is absolutely essential for longevity in the market. We want to be able to trade another day and risk management makes sure of that.

I don’t have a sophisticated journal like these guys but I have a basic one and I see my journal as the reflection of my trading. It’s who I am as a trader. My actions, my comments to myself are all in there.

Example: do I feel ashamed looking my body in the mirror? If yes, we got work to do.

Journal is the same for me. It shows my true face as a trader. Good trades, bad trades, random trades etc. Everything goes there.

Thanks