What I Learnt From a 22% Win Rate

Building in failure, getting aggressive and learning to anticipate

Happy New Year!

Like many, I’m still spending time with family, but I’ve also been reflecting.

Many lessons I’ve already shared. Some will have to wait (client confidentiality).

But three big lessons from 2025 are worth repeating.

…especially since you’ve never heard them through my own trading specifics.

I rarely share them because I like the privacy. I also favour timeless over timely content, and to share lessons in a way more helpful to others, without risk of readers copying me (no matter how often I say to adapt the ideas to suit your personality).

Plus, I have to deal with enough attacks and pressure over my writing (yes, even with free content), and don’t fancy a double dose of them. So, I’m not going to break habit to the extent of giving a full trade-by-trade or statistical breakdown.

However, I’ll share more than I usually do, through three big lessons from 2025.

1. Build in failure.

I’ve always had a low win rate. (Or rather, I did since 2021. 2020 was my first year of trading.)

But 2025 started rather extreme.

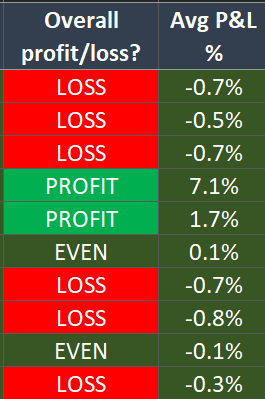

Here’s a message I sent to a friend on 26 February 2025:

I’d never been more happy about a flat period!

To be clear, I shouldn’t have had a win rate as low as 22% over a two-month period. I read the environment wrong (situational awareness is something I continue to improve) and didn’t get as much out of my winners as I should have.

But I previously always lost money on a <30% win rate.

So, what changed?

Quite simply, I focused on losing as little as possible:

Studying Jeff Sun, CFTe’s work in depth in December 2024 (which became the basis for a previous stack) was my lightbulb moment. And not just because he shares practical tips like the 3-stop strategy.

I finally understood — deeply, properly — that it wasn’t just about maths or managing the inherent uncertainty of the markets (although those are part of it).

The value is psychological. As Matt Petrallia puts it: rules are really tools to manage you.

You’re looking for asymmetric opportunity.

I already used tight stops, which give better risk–reward (even with the same % gains), but reduce your win rate.

I further improved my average win relative to my average loss by, as mentioned earlier, focusing on losing even less:

Staggered stops (just two, not three like Jeff, and based on a logical technical level intraday rather than fixed percentages).

Being quick to move up my stop — again, to a logical level intraday, and using the knowledge that my biggest winners rarely revisit my entry to my advantage — but generally not higher than my breakeven point, unless I have decent gains to protect, giving the position space to work.

The more failure you bake into your strategy (Mark Minervini’s term), the more resilient you become. You can make many mistakes (as I did) and not get into trouble.

The logic, I already knew.

But experiencing it the way I did in January and February last year truly internalised the concept. It also made me realise that with just one more winner, I’d be making some very healthy profits, which boosted my confidence.

2. Get aggressive when necessary.

I didn’t place any trades in March or the first half of April.

My first buy after the market correction was triggered reluctantly (which I’ve often experienced with my best trades). I didn’t want to put on risk, but $PLTR met my rules so perfectly, I couldn’t ignore the setup on 23 April 2025.

I never tweet about my trades, but I sometimes reply to a tweet about them. (Losers too — e.g. $NBIS on 8 December 2025.)

My thesis:

Other aspects that added conviction were:

AI theme.

Sentiment generally felt bearish (or at least cautious).

Other names had started working (e.g. $NFLX on 21 April, didn’t trade it) and other stocks were showing strength on this day.

On the day of the entry, the stock was gapping — and this name has a history of EPs working. For clarity, this wasn’t an EP setup, but the fact that gap-ups had previously worked for this stock made me more comfortable to buy this one.

Going full size after sitting in cash for nearly two months was uncomfortable.

…but I knew the circumstances warranted it.

Thanks to the situation my former employer had put me in a few months prior, I’d finally internalised the mindset needed to take aggressive action when you’re coming from a position of strength. Since that event, this was my first opportunity in the markets to apply it.

This $PLTR trade (and several others in this period) got me over that hump, finally becoming comfortable to trade aggressively — including in how I managed the trade.

Given the stage of the market cycle, I didn’t take a partial. I’d been wanting to lengthen my timeframe (something I’ll continue to work on in 2026), and I’d been handed the perfect opportunity to do just that.

I didn’t sell half until the day before earnings (5 May 2025) to de-risk the position. And sure enough, it gapped down on earnings.

3. Anticipate, don’t react.

Selling half into earnings helped me keep a cool head.

Previously, I’d have sold the rest of the position on the gap lower. But because I’d locked in half my profits, and had cushion on the remaining half, I wanted to give the stock a chance.

My thinking was that the stock was getting a bit extended going into earnings. A gap down didn’t come as a surprise. (Had it gapped up instead, I’d have sold another quarter.)

Furthermore, the trend wasn’t broken — the moving averages were still rising, and the stock didn’t breach the 20 SMA. When it looked like the stock was finding intraday support, I bought back the shares I’d sold, with a hard stop for the full position at the new LOD.

This isn’t something I’d have done in the past, because my mindset was more reactive then — characteristic of a less experienced trader.

It’s much more likely I’d have sold everything, then bought it back as the stock recovered on 8 May. Maybe even on 13 May.

Instead, I realised that buying this pullback would likely be my only near-term opportunity to get in when the stock wasn’t extended based on its ATRx.

I’ve gained a far deeper understanding of market structure in 2025 (a topic for another stack), and I’m much more conscious about how stocks move through a constant cycle of contraction and expansion, on every timeframe.

That understanding now forms the foundation of all my decisions when executing and managing trades.

It helps with anticipating price action rather than reacting to it.

This is a huge thing I’ve learnt from watching Brian Shannon in action — specifically, from the way he always maps out scenarios on his charts. Discussing technical analysis and trading concepts, and producing content like this article with Brian further reinforced this mindset.

Coming back to my $PLTR trade, when I ultimately sold my position on 19 and 21 May, this was via a hard stop order while on holiday, so I wasn’t actively watching the markets. I had to monitor my positions from my phone — the first time I’d charted on a tiny screen. (It was my first smartphone since 2018, and my second smartphone ever.)

In hindsight, the first sell was premature — based on a technical level on too short a timeframe — which was likely caused by not sufficiently looking at the bigger picture. Something I’ll be mindful of next time when trading with only a phone.

Remember to appreciate the little things.

Of course, I’ve learnt many more lessons in 2025 — for the markets and for life — most of which I’ve shared along the way.

It was my first year of self-employment. I internalised many core trading lessons. I met incredible people. And I got to help many with their trading and writing.

…the perfect cocktail to make huge progress.

But perfect cocktail or not, I habitually put myself in a pressure cooker.

And I know I’m not alone.

That’s why I’m ending on this note, to remind myself as much as anyone else:

Give yourself breaks. Remember to appreciate the little things.

Face-to-face time with family. Playing boardgames in the evenings. Walks in the local area. And a particularly personal one: the ability to take pictures like the below.

Only a few years ago, I couldn’t tolerate light. At the peak of the photophobia, I couldn’t even tolerate the whiteness of paper.

Now, I can take pictures like this. It still feels slightly surreal.

After years of literal darkness, I’d already given up hope of recovery in January 2023. By the end of 2023, I hadn’t just recovered from the light sensitivity and rediscovered nature — I’d launched TTRH, started a new job, won a book award, and found faith.

A lot can happen in a year.

- Kyna

P.S. A lot can happen in a year. What changed for you in 2025? Let me know in the comments or reply to this email!

P.P.S. If this resonated and you’d like to help keep TTRH going at this frequency, you can buy me a coffee.

24% win rate here, so you are not alone! Interested to know how you set your two stops. I do something similar setting one around -0.6R where I will sell half my position and then sell the other half at my stop loss (-1R).

One of my deep lessons of 2025 with A-Ha effect was this: everyone suffers one of two pain points: the pain of discipline (trading your system, selling acording rules, sometimes prematurely) or the pain of regret (not following your system, your rules, your intuitions/experiences). I understand the pain of discipline much better now and prefer it over the pain of regret 😁