Discover more from The Trading Resource Hub

Situational Awareness and EPs

Insights from Anthony Shi on market cycles, EP nuances and building a profitable system

Audio available at the end of this post.

I first came across Anthony Shi — a competitor in the 2024 US Investing Championship ($1 million+ division) — when he had only around 160 followers on 𝕏, and was just known as ‘Dolan V. Kent’.

Anthony immediately impressed me with his depth of writing and clarity of thinking.

He published many more quality threads after that, which helped deepen my understanding on various topics, including episodic pivots (EPs) and situational awareness.

In this stack

P.S. Anthony, thank you for reading the first draft of this stack and suggesting improvements!

Qullamaggie stream recap: simple market filters

To determine whether you should be trading — and if so, how aggressively — among other factors, you need to establish the market environment.

In various streams, Qullamaggie suggested using a simple ‘market filter’ for this, such as $QQQ:

You could define a traffic light system, looking at things like:

Is the 10-day moving average (MA) above the 20-day MA?

Is the 10-day MA trending upwards?

Is the 20-day MA trending upwards?

In a different stream, Qullamaggie showed us a simple market filter applied on $IWM:

This basic filter uses the 10-day and 20-day MA crossover to determine whether you’re in a green (trade) or black (don’t trade) zone.

The above is simple — and an excellent place to start if you’re a novice trader.

And as Anthony points out:

“No process works if you can’t stick to it. An oversimplified process that is carried out religiously is 100x better than the perfect process rarely completed.”

This is true for various areas within trading — I outlined four examples in this base.report blog. It’s also true for diet, exercise, and many other areas in life requiring discipline.

But what if you’re ready to move to the next level?

Understanding different market cycles

The trouble with indices is that they’re increasingly weighted towards a handful of stocks, rather than the universe of stocks you may want to trade.

Even if an index did reflect your universe of stocks, it doesn’t answer critical questions like:

Can you see your edge?

Is that edge currently working? And if yes:

What specific tactics should you deploy?

How aggressively should you be trading?

Understanding the market cycle you’re in, as well as the stage of that cycle, will help you answer such questions.

Remember this tweet, condensing a key Dan Zanger lesson?

Those “big moves” are what Anthony calls ‘swing cycles’. They’re the good, infrequent swing periods we get 2–3 times a year.

Put differently, those are the periods you want to go long.

Furthermore, outside those periods, you don’t want to give too much back. As Ivanhoff points out, the ‘market timer’ will far outperform the ‘boom and bust’ trader, particularly over time.

That requires an ability to identify the start and end of those periods.

To develop that ability, so you can build a profitable system around those periods, you must understand their context.

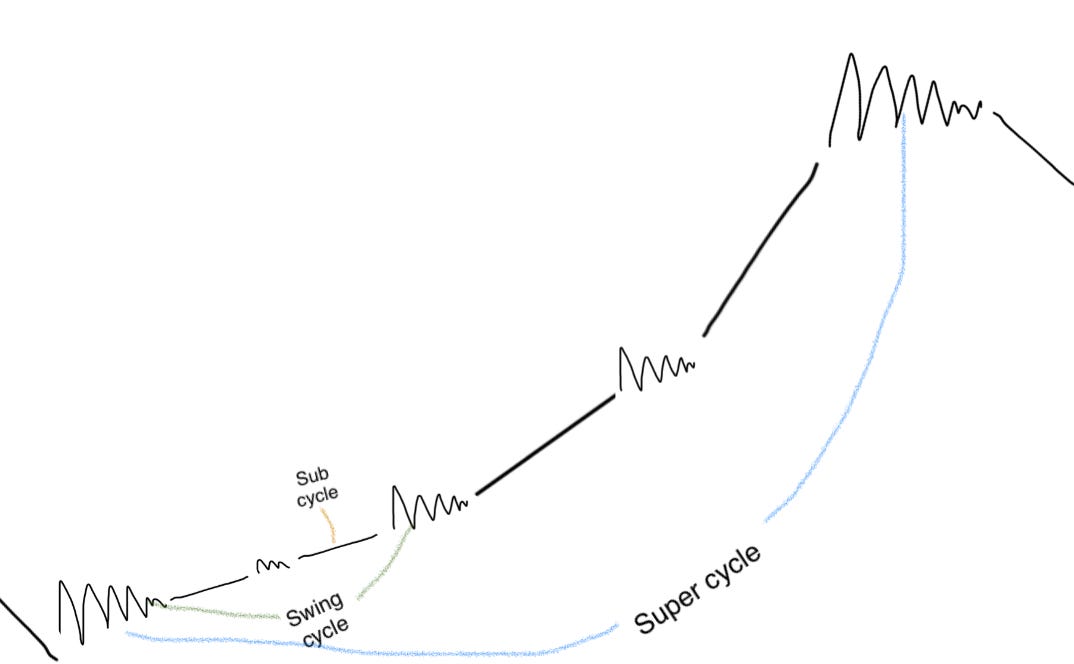

In this thread, Anthony laid out three different market cycles:

Super cycles

Swing cycles

Sub-cycles

Anthony kindly created this abstract image for me to help illustrate them:

Let’s dive into the details of each market cycle.

1. Super cycles

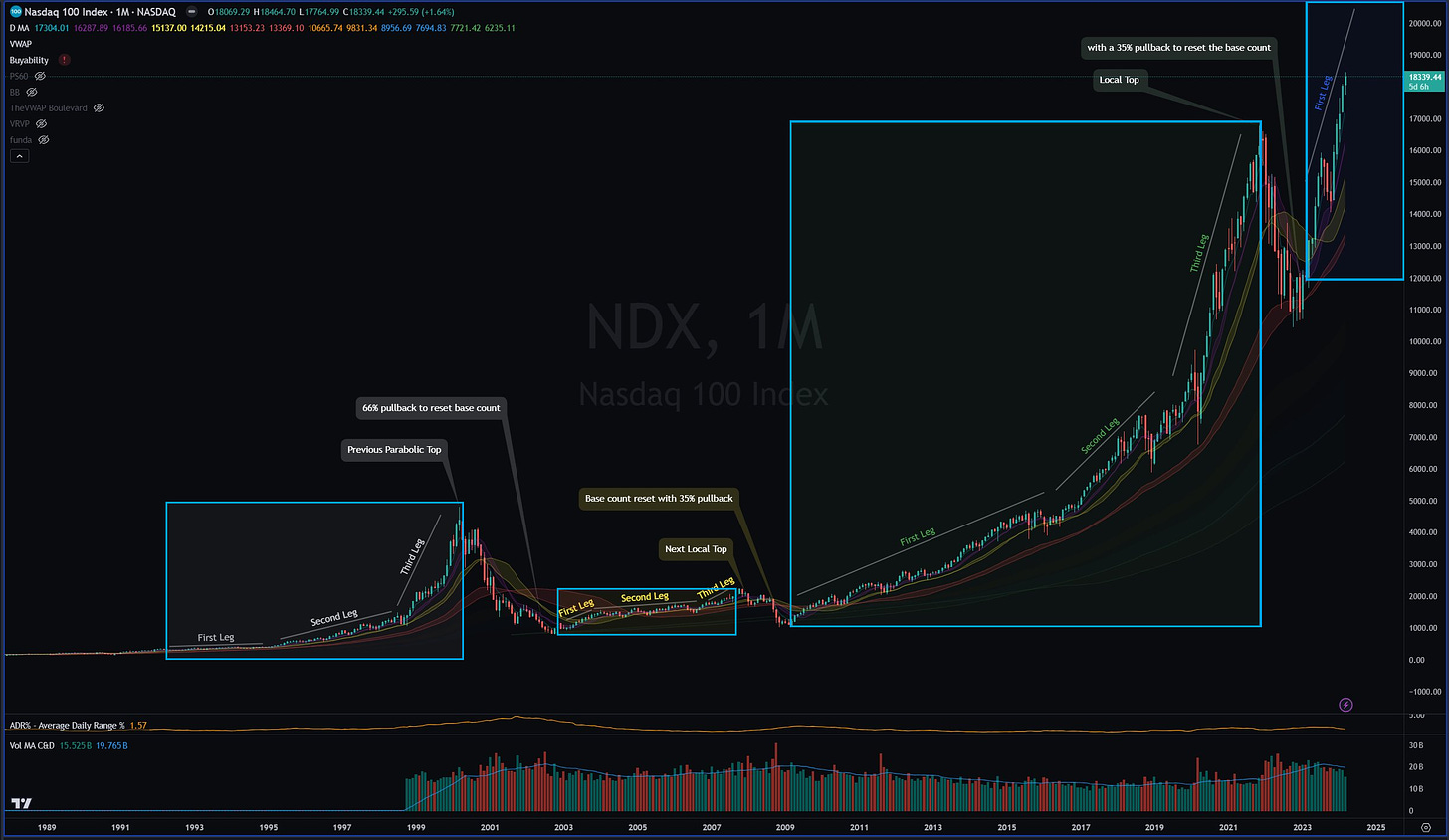

In short, ‘super cycles’ are the major bull and bear market cycles. These typically last around seven and two years respectively:

Bull cycles tend to happen in three legs, each steeper than the last, with the third ending in a parabolic move.

Bear cycles are corrections — an opportunity to reset the base as the market works off excesses. Major bear markets also tend to have three major phases.

Anthony provided this image to highlight bullish super cycles (in the four coloured boxes; I’ve added blue outlines for visibility):

2. Swing cycles

Within each super cycle, you get ‘swing cycles’.

Those are 2–3 periods a year, each typically lasting 2–3 months, when you can get aggressive as a swing trader.

Why 2–3 months? Because earnings season lasts for 3 months!

A swing cycle typically lines up with earnings season, as fundamental data gets priced into general economic data, which subsequently drives the direction of the market.

If you’ve studied enough Qullamaggie streams, you should be aware that a momentum stock starts its move with an EP, followed by post-earnings-announcement drift (PEAD).

Further reading: This stack discusses in more detail how different setups interplay.

The following image (I’ve added coloured outlines for visibility) illustrates two swing cycles within a super cycle:

The next image zooms in on March 2023–March 2024 (the blue box on the previous image):

Swing cycles are typically separated by corrections of around ten weeks.

But, as Anthony explained, the swing cycle depicted above was special for a couple of reasons:

We came out of a bear super cycle and started a new, very bullish super cycle.

The first run started mid-earnings season in November 2023. It paused over the new year, only to continue higher into 2024’s first earnings season.

3. Sub-cycles

Point 2 above meant we formed two sub-cycles within one larger swing cycle:

2 November–28 December 2023 (eight weeks)

8 January–8 March 2024 (nine weeks)

Here’s an updated image, showing the cycles on $QQQ:

Zooming into each sub-cycle, going into the stock level, you get three ‘archetypes’ or ‘waves’:

Fundamental leaders (e.g. $NVDA)

Growth stocks (e.g. $SMCI)

Speculative stocks (e.g. $SOUN)

Look at Anthony’s examples above, all from the sub-cycle from 8 January–8 March 2024. Notice how each archetype ‘class’ started its move at a later date?

I go into more depth on individual stocks below.

Caveats

No two cycles start or end exactly the same — my repeated use of the words ‘typically’ and ‘tend to’ was deliberate.

As such, treat the above numbers as estimates or guidance only. Don’t obsess over ‘exact’ data.

Final thoughts on the market cycles

Anthony used a few simple ideas — like the different cycles, legs and archetypes — that add a lot of nuance to simple indicators. It truly does, as Anthony put it, form “a vivid picture of different periods with distinct [and] different characteristics”.

But, again, the main point is to understand the context of the good swing periods. As Qullamaggie says, you must understand “these different structures that occur over and over again in the markets”.

If you know what to expect, you know what you’re looking for. Then, you can build a system around that knowledge.

Plus, to borrow Mark Minervini’s phrase, you’ll know when ‘the proverbial train isn’t on schedule’.

You can add to your situational awareness by also using breadth-based tools — such as the Market Monitor from Stockbee — to see underlying buying and selling pressure.

A slight tangent: the prominence of the number three in trading

Earlier, I wrote:

“Bull cycles tend to happen in three legs, each steeper than the last, with the third ending in a parabolic move.”

This reminds me of a big lesson Sean Ryan learnt from his dad (David Ryan):

“The market seems to move in waves of threes, either up or down.

“Whether it’s three large moves over the span of a month, or three smaller moves within a day, the pattern repeats itself relative to the timeframe.”

In fact, the number three regularly crops up in trading and technical analysis:

Three trend directions: up, down or sideways.

Three market cycles: super cycles, swing cycles and sub-cycles.

Three archetypes/waves: fundamental leaders, growth stocks and speculative stocks.

In certain chart patterns, like head and shoulders (and inverse), and triple tops and bottoms.

Three types of triangles: ascending, descending or symmetrical.

Make of that what you will!

Nuances my stream notes on EPs missed

While I’m glad my EP stream notes — most notably from 18 May 2023 — helped a lot of traders (myself included), they only focused on a few characteristics:

Price and volume

Catalyst type

Theme

Anthony’s EP thread took far more nuance into account. His examples also focused on more recent EPs (from 2024).

His idea to lay them out sequentially was also great. As Anthony said, this gives you a feel for sentiment over time. My old stream notes were chronologically less organised.

I suggest you go to Anthony’s thread to get the full details — I don’t intend to copy him verbatim — but will condense the highlights. For this to truly click, however, you must study the charts yourself. In depth.

Each of Anthony’s examples — of good and bad EPs — discussed four characteristics:

Theme

Chart history

Neglect

Swing cycle

1. Theme

Very simply: is the name linked to a strong theme, such as AI or GLP-1?

As Anthony points out:

“Every bubble starts from a grain of truth.”

Overpriced stocks repeatedly pop up in the market. And they can stay overpriced for a long time.

In fact, just because something is already overpriced doesn’t mean it can’t still go up. A stock only tops after the last holdout becomes a buyer.

Further reading: Clement Ang, another 2024 USIC competitor, discussed the usefulness of curating thematic watchlists in this guest post. I’ve also discussed the usefulness of manually building watchlists in this stack.

2. Chart history

What’s the character of the stock? What’s the chart like?

Does it have a history of making big, clean moves after an EP? If yes — great (e.g. $SMCI and $PLTR). If no — bad sign (e.g. $CFLT, $LYFT, $HOOD, $TTD and $NET).

Does the stock have a history of making strong intra-earnings breakouts only? That’s a red flag (e.g. $COHR).

Is the stock leading the sub-cycle? If yes — that’s a good sign (e.g. $AFRM).

Forming a nice base near the highs? Another good sign. Bonus points if it’s a recent IPO, like $ARM.

Hopefully, you get the idea. You’re looking for clean traders, good charts, and a history of making the type of move you’re seeking.

3. Neglect

EPs work best after a period of neglect. I particularly like the $SMCI example Anthony gave:

Many CAN SLIM traders, such as David Ryan and William O’Neil, like big bases for a reason. As Anthony put it:

“High octane investors get sick of waiting, or think it’s overvalued and sell.”

But the reality is that even big growth names need time to digest a previous big move:

The better digested, the more reliable the move will be once the stock is ready to go.

Plus, the longer the base, the more traders get tired of waiting and take their eye off the ball.

Multiple (four!) failed breakouts from the range the stock was building frustrates traders. Again, that leads to traders selling and/or no longer watching the name.

The stock rejected a new all-time high. Again, that leads to selling and blacklisting.

Hopefully, you get the idea. Traders and investors can be extremely impatient, and seeing action they don’t like leads to selling and blacklisting — which creates opportunity when the company surprises with, say, phenomenal earnings.

When that happens, everyone who got shaken out earlier will rush back in, creating huge demand. In less liquid names like $SMCI, that amplifies the price surge.

Further reading: This stack explains six criteria (including a low float) that make EPs more explosive.

4. Swing cycle

In Anthony’s words:

“Have you ever wondered why Qullamaggie says: ‘We just need a quick flush or correction’?

“It’s because, as you get long in the tooth in a swing cycle, breakouts become more prone to failure.

“We take good setups when we see them. So, when we see a stock break out by gapping up and out of a range — which is a sign of big strength at the start of a cycle — we can get sucked into a late-stage breakout.

“Those have a high failure rate — if not immediately, then after one or two days. With weak hands having sold, it builds potential for people to rush back in and push up the price when they get back on board.”

This illustrates the need to not just understand what the different market cycles are, but also know where you are within each cycle. For breakouts and EPs, the earlier they occur within a cycle, the better your odds of them working.

On top of that, you need to learn other nuances of your strategy — like how some patterns work better in some market conditions than others, as I explained in more detail in this Zanger stack.

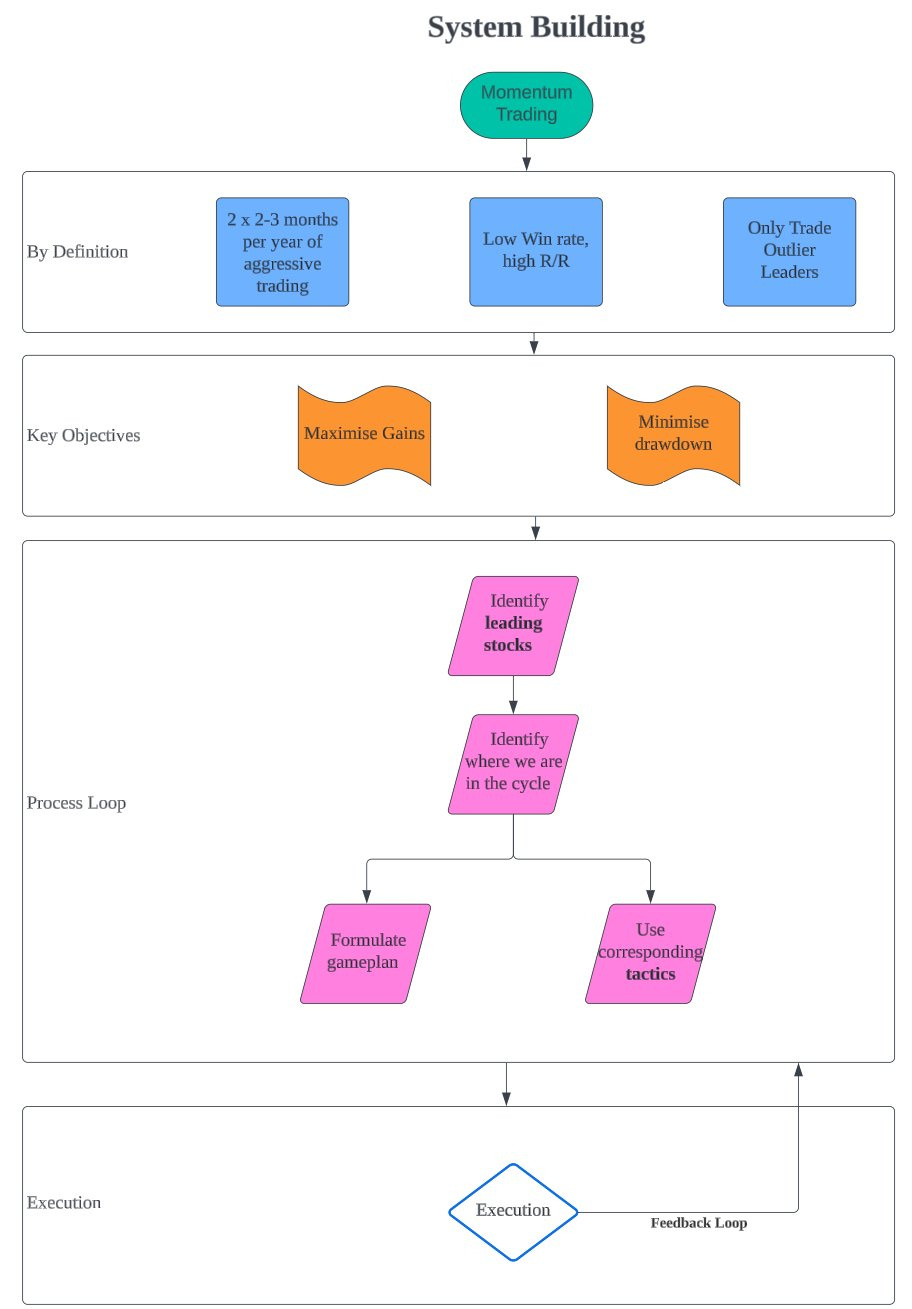

Bringing the elements together: building a system

In yet another thread, Anthony shared his thoughts on building a profitable system:

I think this contains lots of great elements — but I want to stay on topic. So, I’ll just draw your attention to a couple of points:

By definition, momentum trading means you’ll only get the really good opportunities 2–3 times a year. Keep that in mind.

Simply identifying the leaders isn’t enough. You must also identify where we are within the cycle. From there, you can make an informed plan that stacks the odds in your favour — including about pyramiding and sizing up.

Again, I highly recommend studying Anthony’s threads in detail for yourself, and following @DolanVKent on 𝕏.

Stockbee (@PradeepBonde) is another great follow on 𝕏 to learn how to improve your trading processes. (I’ll likely go deep on this topic in a future stack.)

And, as I wrote last week, remember that situational awareness — how you perceive your environment — is about more than your read on the overall market, and how its recent action shapes your expectations for the next few sessions.

It’s also about how well-prepared you are, your overall state of mind, and even the state of your tools.

Learning through writing

When I first wrote this stack, I was amazed at how much I learnt in just one week — about a topic I thought I knew fairly well! — by studying Anthony’s threads and putting together my first draft.

And that was before knowing that Anthony was going to actively contribute to the stack the way he did.

The experience rewired my brain. And from the incredible feedback that first version received, I obviously wasn’t alone.

In fact, it quickly became the most popular stack on The Trading Resource Hub, and continues to hold the top spot today, as I crossed 4,000 subscribers earlier this week — incredible. As ever, thank you all for your support!

Writing on Substack for 15 months, and working with Anthony in particular, reinforced my belief that you can supercharge your learning by following my favourite triad:

Study

Write

Publish

Maybe I ought to do an entire article on this triad at some point. But to keep it short here:

Writing makes you a more sophisticated thinker. Writing means you’re structuring and connecting ideas. It also identifies knowledge gaps or flaws in your thinking.

Writing forces you to pay more attention to detail — a key principle behind an edge. It’s part of why I see writing as a form of deliberate practice.

Both points offer incredible ‘return on investment’ on your study time. A ‘return’ you can further amplify by also publishing what you write:

You’ll be forced to explain things more clearly — a great test for your own understanding.

It ups the pressure to both avoid mistakes and be consistent.

You open the door to feedback (partly direct, partly through the questions you’ll get) and, by extension, opportunities for improvement.

Best of all, you get to connect with like-minded people, which is incredibly satisfying on a personal level and compounds your growth.

An early subscriber once wrote to me:

Give, and the world gives back.

That line hit me hard, because I’ve found it to be so true — particularly through this Substack. I’ve since shared that message many times.

And on that note, I hope you found this stack as helpful as I did. Anthony, thank you again for everything you’ve taught not just me, but many others too.

Support my work

Found this stack valuable? If you’d like to contribute financially to say thank you, please buy me a coffee.

You can also help out by liking, commenting on and/or sharing this stack. They all help spread the word!

Listen to this stack

Yes, that’s a recording of me personally reading out my own writing. No AI involved.

And yes, I’m playing my own intro and outro.

More content like this

All stacks with Anthony Shi are here. My Qullamaggie stream notes are here.

To explore my full archive, click here.

I first published a version of this stack on 6 April 2024.

Great report! I've really been enjoying your posts...keep up the great work!

Kay you are the best! This is by far the best substack read i have read. DolanVKent post is amazing, than you for sharing this with us.