Update: I added more nuance in this more recent post.

First stream since 26 January 2023! Kristjan spent a lot of time explaining the EP strategy, which I cover in detail below, making this a long post.

Kristjan’s positions

AI

APLD

IMGN

LI

MNDY

PLTR

SHOP

These were all EPs, mostly from earnings. Kristjan said he pretty much only trades EPs nowadays, not even really bothering with breakouts anymore. Kristjan’s girlfriend (whom Kristjan taught to trade) also just trades EPs now, and has much more opportunity than him due to a smaller account.

Kristjan’s watchlist

CVNA

Market outlook

In the weeks before the stream, there were a lot of EPs around, especially among small and micro caps.

Speculation money is starting to come back into the market. This is the first time we’re seeing this since late 2021. Stocks are making big moves on big volume — they are actually breaking out of bases on volume — which is a significant character change in the market. This is very different to the January 2023 rally, which mostly involved stocks coming off their lows and short covering. (Determining the market environment is discussed in more detail below.)

With this character change, traders with a small account were given an incredible amount of opportunity. To quote Kristjan:

“If you think we’re in a bear market — ‘oh the debt ceiling’, ‘oh inflation’ — well, shut the f**k up. This is what’s happening, guys. Forget about all of that stuff. This is what’s happening in the market, in the real world.”

I put the quote here due to its relevance on the market outlook, but within the stream Kristjan actually said this in conclusion to teaching viewers how to find the stocks they need to study. I’ve detailed those lessons later.

Kristjan did clarify that stocks acting well now, as if in a bull market, doesn’t mean that we can’t top and then go down for another year. But we should ignore things like sentiment readings, and focus on what’s in front of us. Trade the price action. If we get another leg down, we get another leg down. But take advantage of the bullish environments when we get them.

Having said all that, on the day of the stream itself, Kristjan wasn’t really seeing anything exciting — it was a slow day. That’s mostly because it was nearing the end of the earnings season, and most of the excitement had already passed.

Market environment

To establish the market environment to determine how aggressive you should be, you can use a “market filter” (that’s what Kristjan calls it) like the $QQQ:

You could define a traffic light system, looking at things like:

Is the 10-day MA above the 20-day MA?

Is the 10-day MA trending upwards?

Is the 20-day MA trending upwards?

The exact parameters are, as always, up to you. We all implement Kristjan’s lessons slightly differently, and it’s up to you to figure out exactly what works best for you.

It’s also up to you to define how you put the traffic light system into practice. For example, one question you need to answer for yourself is what you do in a yellow or red light environment: do you trade with smaller size or place fewer trades? Or maybe both?

These are all questions you need to figure out the answers to for yourself. Crucially, however, you must recognise that you need the wind (i.e. the market) in your back for your trades to work. A big part of the game is figuring out what way the wind is blowing at any given time.

AI stocks

AI stocks have started to wake up, e.g. $AI (7.6% ADR, mid cap) had an EP — after the company announced preliminary results, narrowly exceeding guidance — on 15 May 2023. Kristjan bought it:

Notice how the volume isn’t going away (you can see this better on the chart below). Normally, the volume dries up with these types of stocks, but not on $AI. Kristjan called it “a piece of s**t”, but the volume is what’s driving the price up, and the lack of fundamentals doesn’t stop the stock from making him money! In fact, as he pointed out:

“Piece of s**t stocks go up the most.”

At the time of writing (after the 26 May close), the stock still looks strong in terms of both price and volume.

However, note that it’s due to report earnings after next Wednesday’s close (31 May 2023).

The EP setup, with examples

“Really, there’s been an incredible amount of opportunity. If you’ve been struggling, I’m just going to show you a really simple strategy. Well, it’s simple but it isn’t easy, like everything else. But I know how the average struggling trader trades: he has 8 screens, 59 indicators, he’s in 8 chatrooms, following 500 people on Twitter — no, you’re never going to make it.”

The above quote is Kristjan leading into an explanation on what episodic pivots (EPs) are. Essentially, you’re looking for these characteristics in a stock:

A gap up. Usually at least 8–10%, sometimes a lot more.*

Huge volume.

A catalyst — news that surprises the market. It doesn’t really matter what the news is; sometimes, it can even be a fluff PR, like $CXAI had (the first example below). Kristjan himself mostly trades earnings EPs, as they’re the most common, and the easiest/safest to find and trade.

*Kristjan did add a caveat that EPs don’t have to gap up, but most of the ones that he trades do.

This simple strategy is great if you have a day job or kids. You simply don’t need very much time — just one hour a day is enough to find and enter these stocks: 30 minutes before and 30 minutes after the market open. Furthermore, you won’t get too many signals, which adds to the simplicity of this strategy, and its suitability to part-time traders.

This stack presents all the information that Kristjan went over during this stream as clearly as I could, with additional clarifications or charts where I felt they added something. However, if you want to learn more about this setup, it’s definitely a good idea to check out Kristjan’s own blog post on the topic.

$CXAI

The fluff PR example alluded to earlier: $CXAI (25.9% ADR, micro cap). This stock made over a 600% move on enormous volume in just two sessions on essentially nothing (the news on 13 April 2023 was that $KINZ (a SPAC) shareholders approved a merger with $INPX’s enterprise apps group $CXAI).

$PLTR

$PLTR (4.8% ADR, large cap, specialises in big data analytics), on the other hand, reported surprisingly good earnings, which resulted in a good EP, with big volume, on 9 May 2023 (Kristjan bought this one himself):

At the time of writing, the stock is still continuing its move:

$SHOP

E-commerce platform $SHOP (3.9% ADR, large cap) had a similar situation like $PLTR: an EP on surprisingly good earnings, which Kristjan also bought. This one was on 4 May 2023, and happened on the same day as news (which Kristjan didn’t mention during the stream, but did record on his chart notes): $SHOP announced a 20% workforce reduction, and sold most of its logistics business to Flexport ($SHOP was trying to compete with $AMZN in logistics). As you can see, this gap up occurred on big volume:

While the move since the stream hasn’t been as powerful as $PLTR’s, the chart still looks good:

$LI

Another EP Kristjan recently bought: Chinese EV manufacturer $LI (3.7% ADR, large cap), which reported surprisingly good earnings. The 10 May 2023 gap up was, again, on big volume:

Considering that China names of late haven’t been doing all that well, $LI is showing a lot of relative strength in its group. This is $LI’s chart at the time of writing:

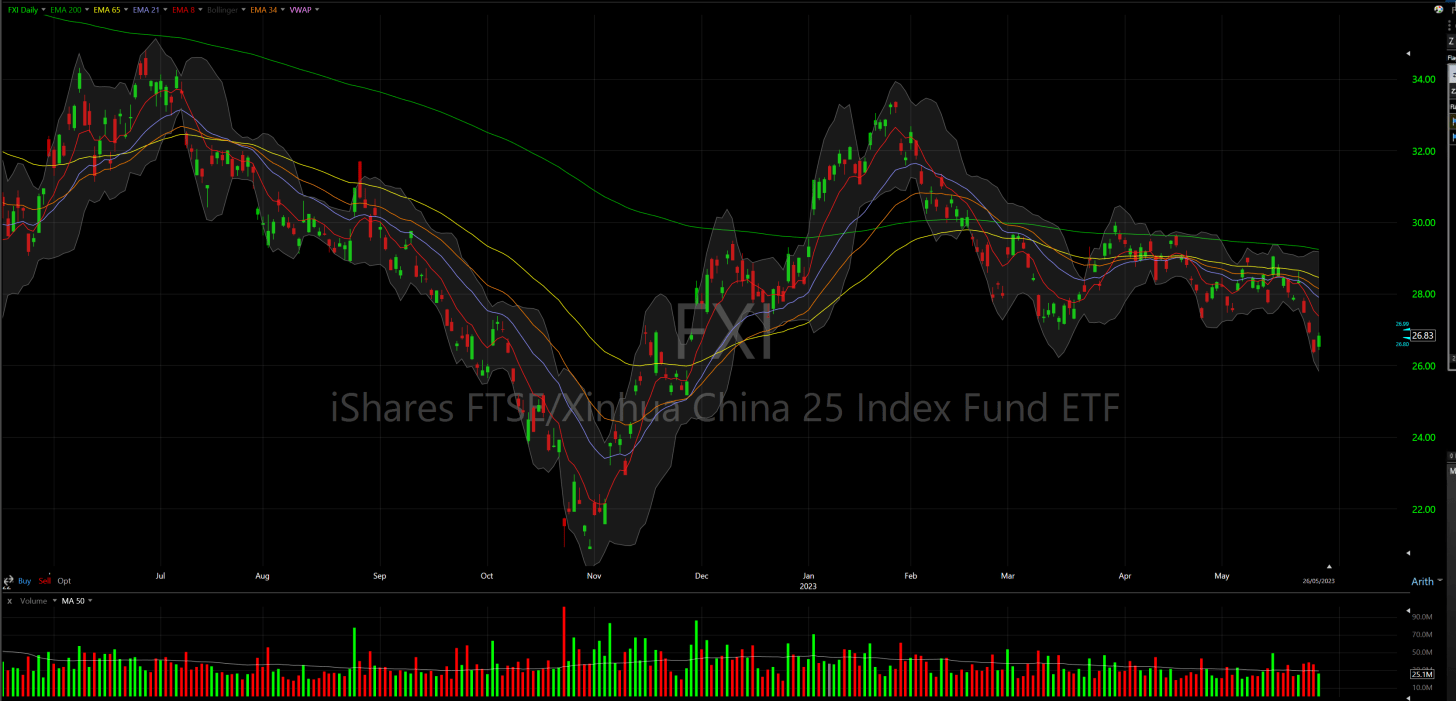

And this is the $FXI chart (a China index fund) at the time of writing:

The importance of relative strength is discussed further in the 19 May 2023 stream notes.

$MNDY

Another EP in Kristjan’s portfolio is $MNDY (5.0% ADR, mid cap), which reported surprise earnings on 15 May 2023, resulting in a big gap up on huge volume:

Kristjan did get shaken out of this one, but re-entered, which he detailed further during 19 May’s stream.

$SMCI

This had a “perfect EP” on 3 May 2023 that Kristjan passed on — $SMCI (5.8% ADR, mid cap) gapped up on earnings with huge volume, but Kristjan thought the numbers not that great, and the guidance “pretty boring” too. However, this name is linked to AI, which may well be the reason this EP worked perfectly:

In fact, more recently still, $SMCI had another big gap up on big volume, on news about $APLD teaming up with $SMCI to deliver an AI cloud service — notice the AI theme again. This was on 25 May 2023:

$CELH

$CELH (4.4% ADR, large cap), in the beverages space, had an EP on great numbers and guidance on 10 May 2023. Notice the big volume again, and the fact that it broke out of a 1.5-year base — Kristjan rated this a “five-star” setup.

$POWL

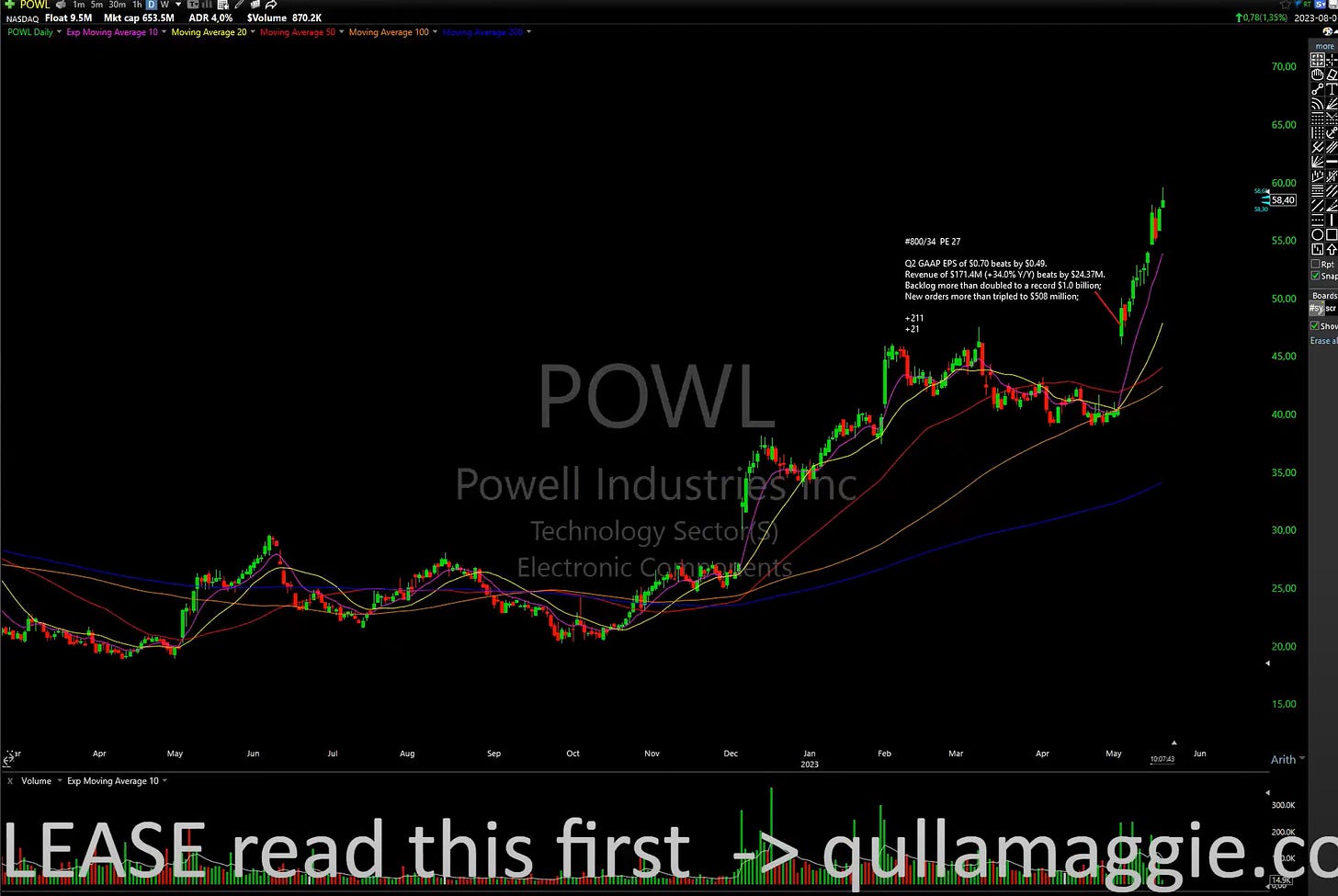

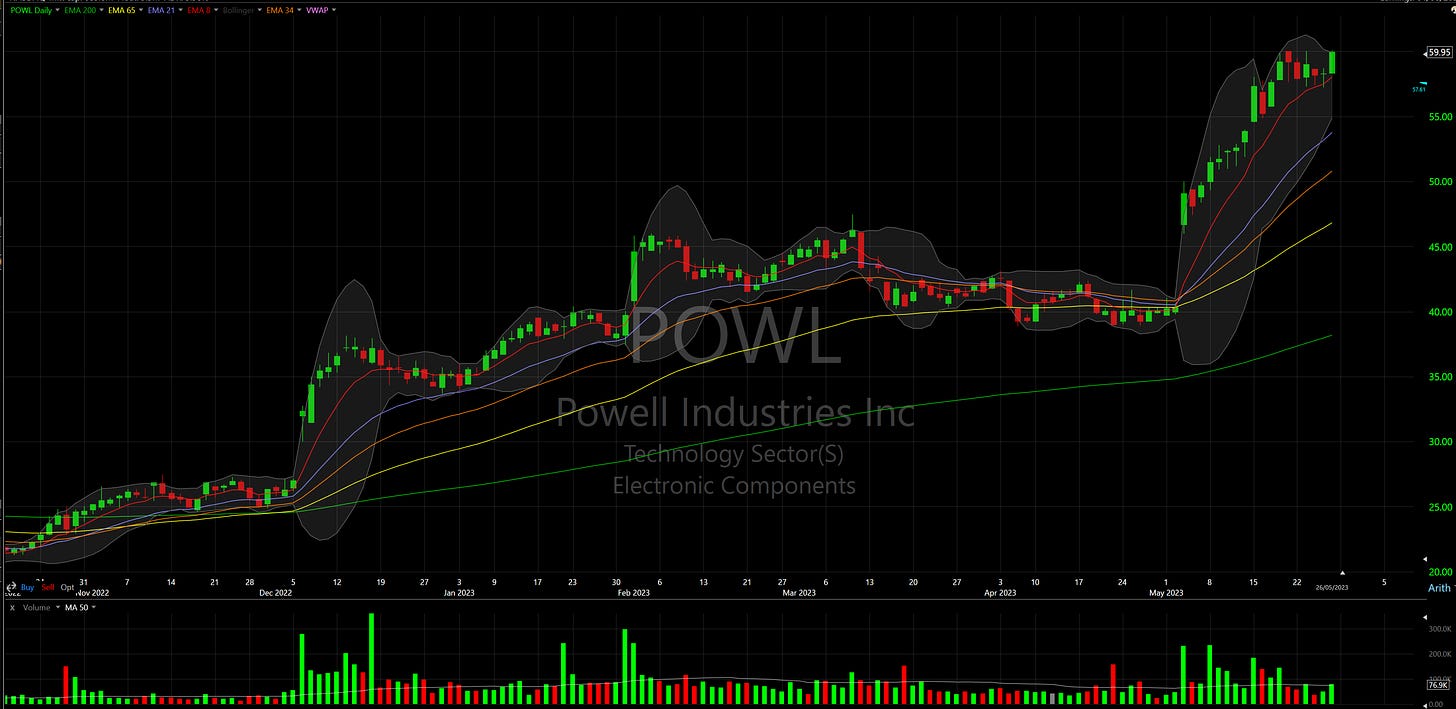

The volume on $POWL (4.0% ADR, small cap) was only around four times the average (still high, but ideally you want to see bigger volume than that on EPs). Nevertheless, the EP on 3 May 2023 — on great earnings — worked really well:

The chart looks even better now:

Also notice how this name has had an earnings EP before, on 6 December 2022, on more good numbers.

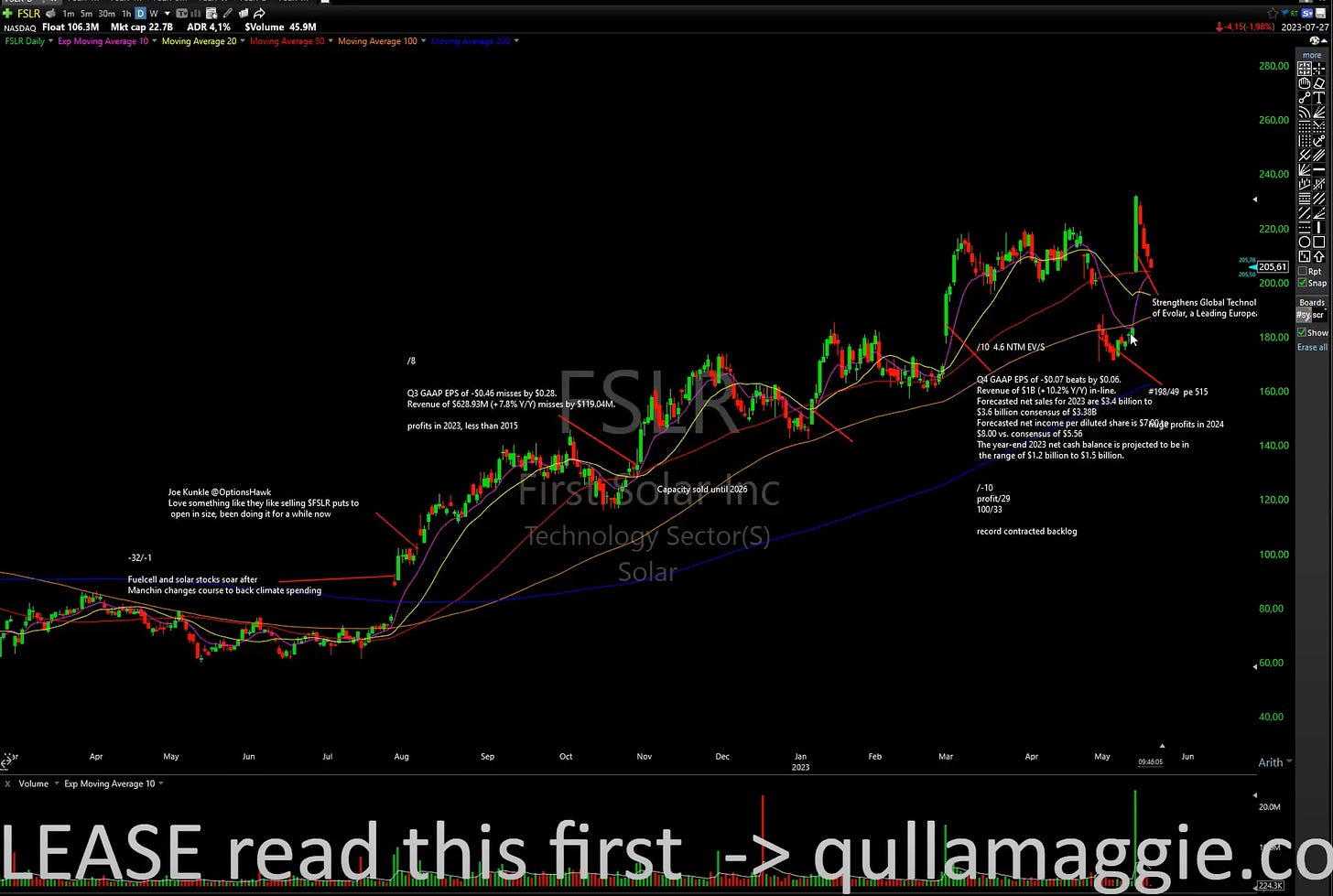

$FSLR

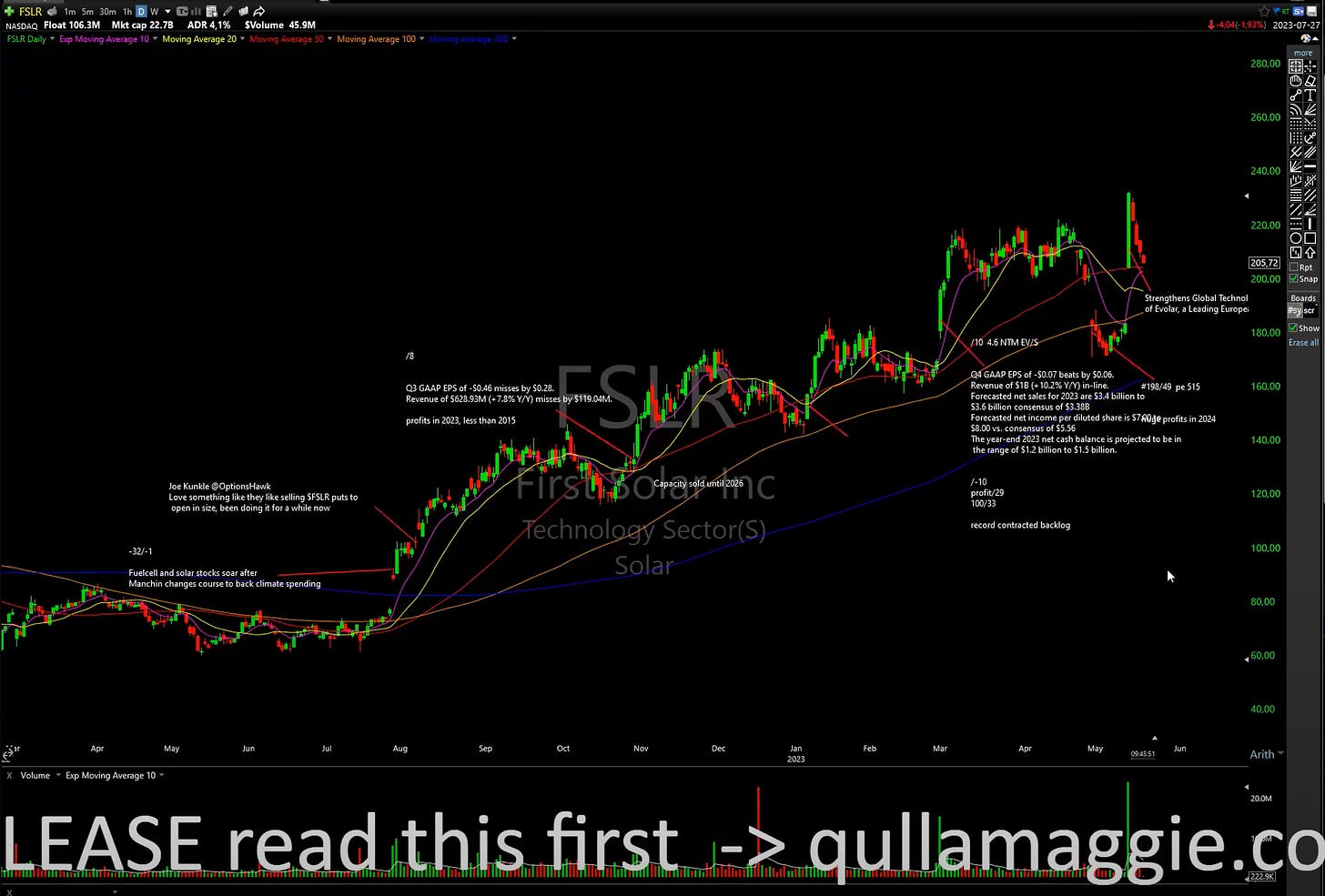

Kristjan entered solar stock $FLSR (4.1% ADR, large cap) on 12 May 2023, following the news of its acquisition of Evolar, strengthening its global technology position in thin film photovoltaics (PV):

However, he’s already sold it, because the price action on solar names has been horrible (and themes massively influence price action). To illustrate the point about the bad price action in solar recently, check $MAXN:

And $FSLR:

Clearly, EPs don’t always work. In fact, as Kristjan says, EPs “often fail”. But when they do work, they make you big money, covering your losses and then some.

$IMGN

You want to find these stocks that gap up at least 8–10% on big volume. Sometimes they even gap up much more than that — for example, biotech $IMGN (8.2% ADR, mid cap) gapped up >100% following news on good trial results:

Kristjan remarked that biotech EPs are some of the best, if not outright the best.

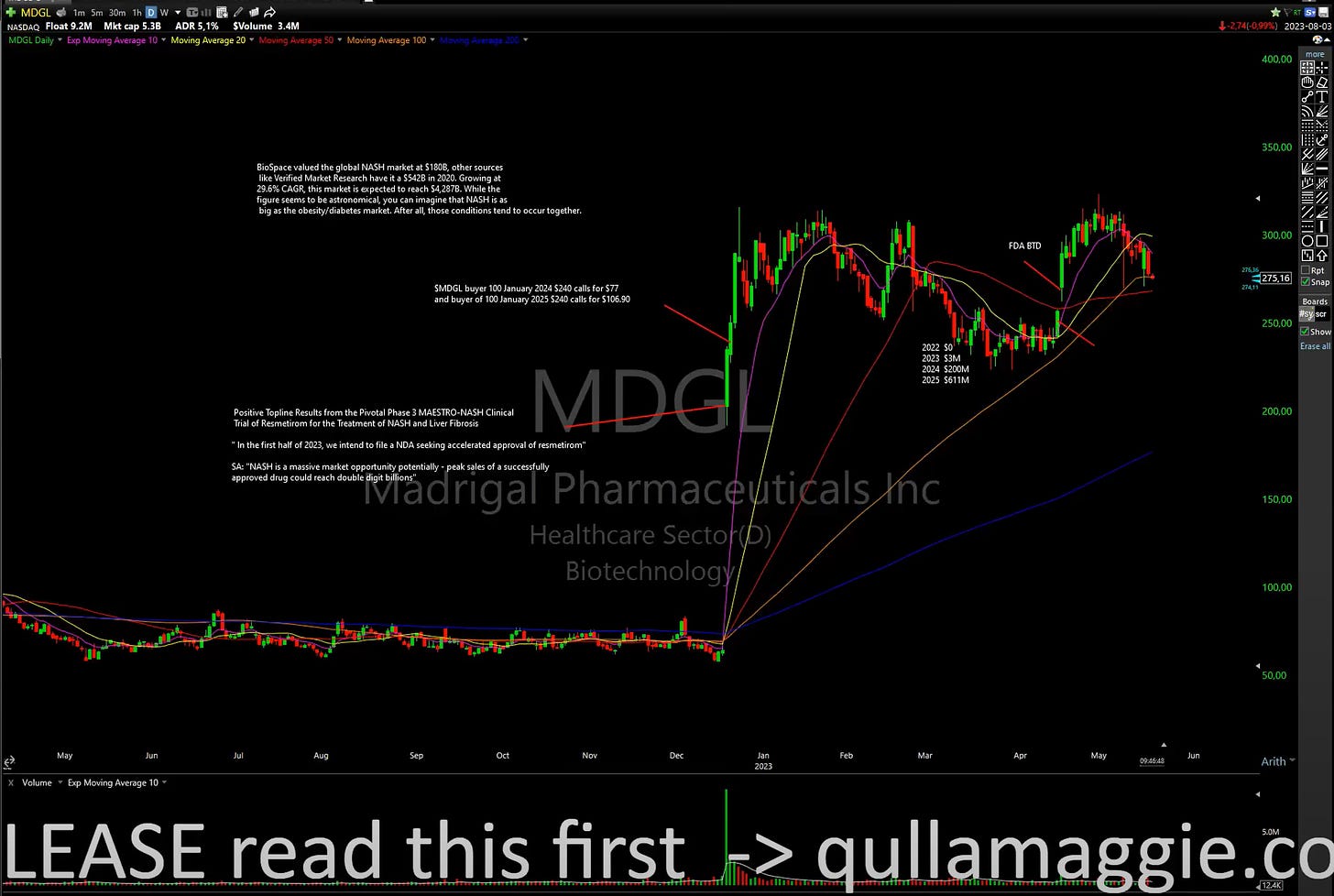

$MDGL

This biotech actually gapped up 200% on huge volume on 19 December 2022, after which it went up another 50% in just a few sessions. $MDGL (5.1% ADR, mid cap) also reported positive clinical trial results.

How to enter EPs

The entry tactic for EPs is, in Kristjan’s words, “pretty simple”. You just wait for the 5-minute highs — we call this the ‘opening range high’ (ORH) — to be taken out, then enter at the highs.

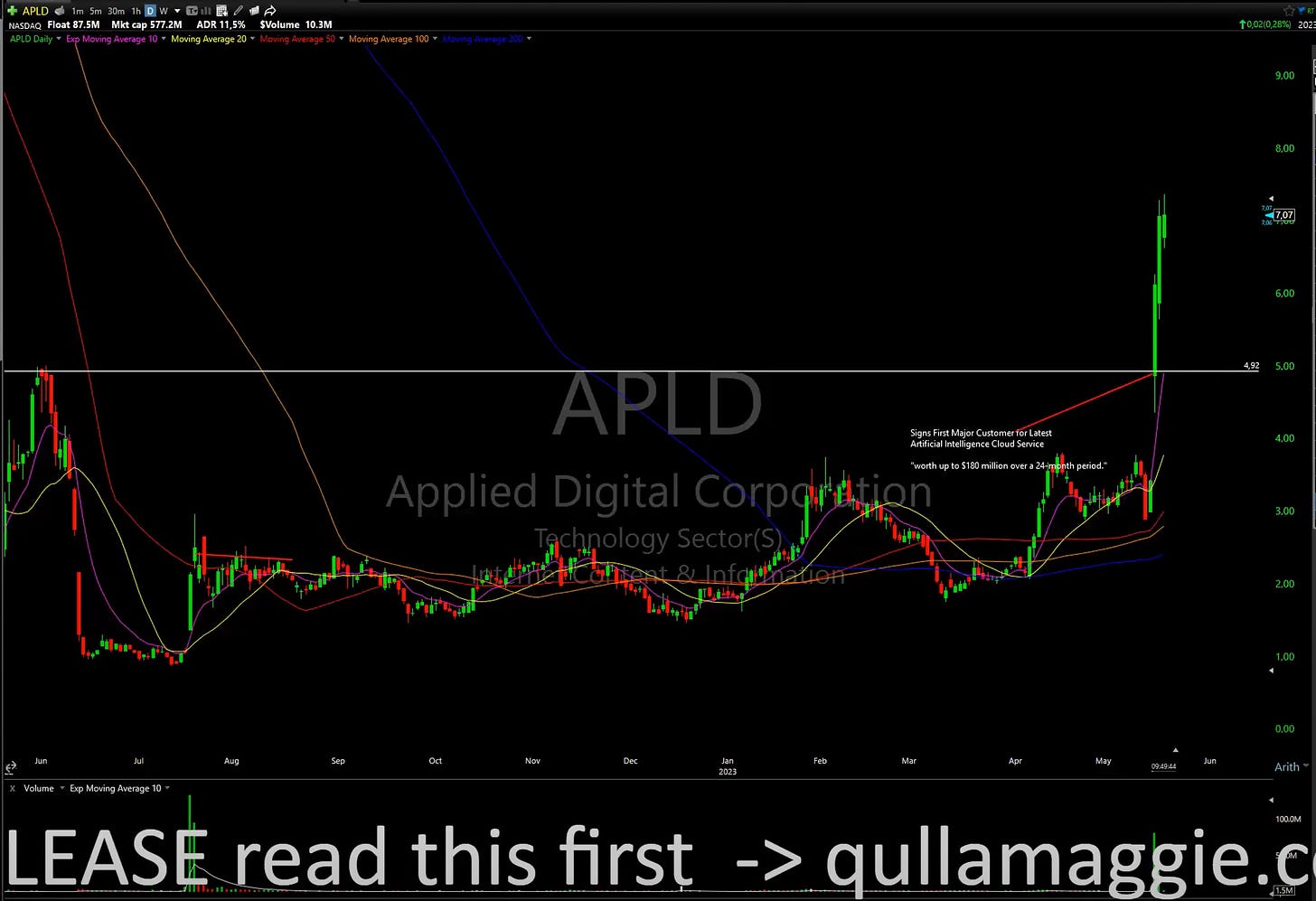

Kristjan provided this example of $APLD (the below is the 5-minute chart; I discuss the daily chart later in this post):

As you can see:

The stock initially took out the opening range low (this is before taking out the ORH).

Then, the stock came back, taking out the ORH (where I added the blue line and arrow). That’s your buy point.

Set your stop loss at the low of the day (LOD), where I drew the red line. And always set a stop! Kristjan actually quoted Dan Zanger during the stream:

“Love your stops, not your stocks.”

But where EPs are concerned, that’s it! No need for fancy indicators or dozens of screens. You can literally be anywhere with an internet connection with just a laptop.

How to study recent EPs

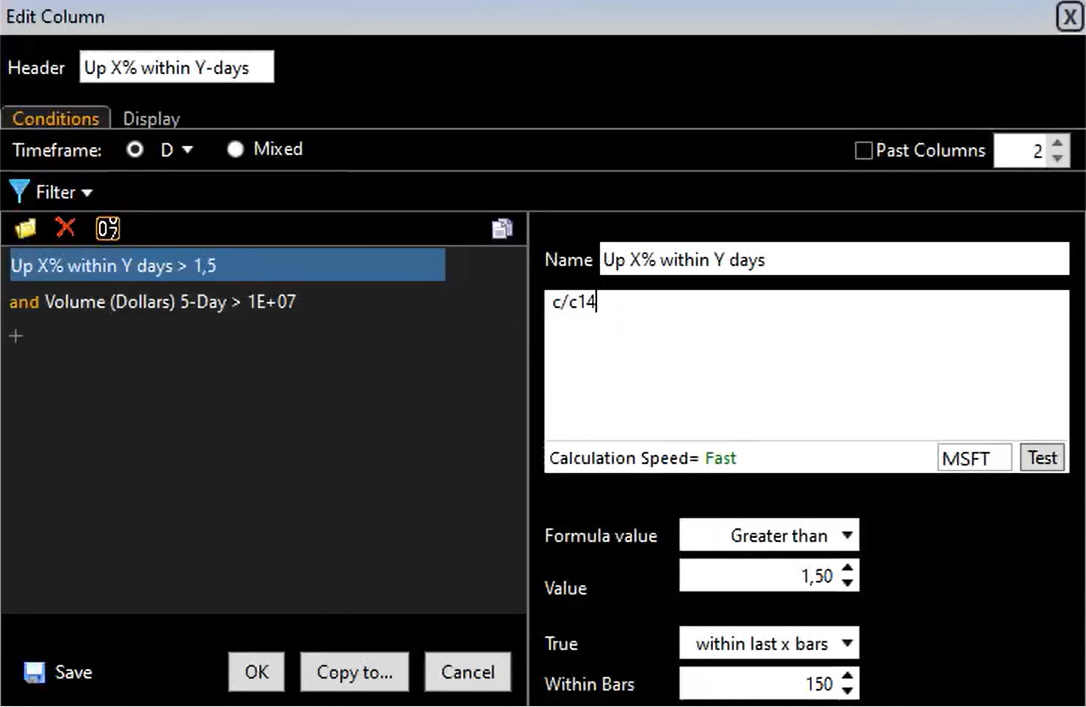

This scan shows liquid stocks that moved up at least 50% in 14 days over the past 6 months (but you can change these parameters as you see fit, particularly volume — make sure you’re not more than 1% of the average daily volume, or you’ll suffer bad slippage):

When Kristjan applied this scan during the stream, he got 444 hits — see the screenshot below. And again, this is just from the past six months. As Kristjan says: “If you’re a struggling trader, this is where you need to look if you want a simple method. […] These are the ones you need to study. And many of these were EPs.”

Some of the charts to study

Let’s look at some examples Kris went over during the stream.

If you want me to go through more of the list in a separate post, let me know in the comments below.

Alternatively, you can always send me a message on X/Twitter.

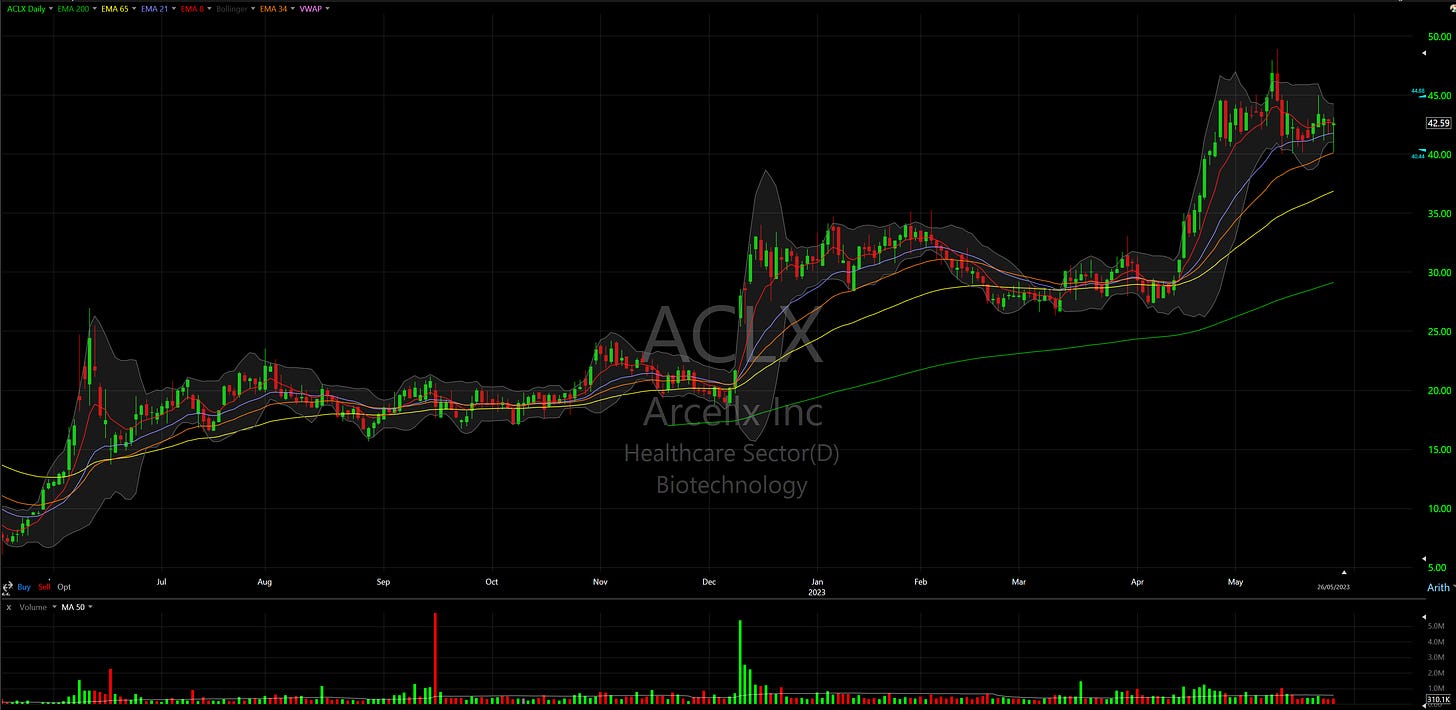

$ACLX

Biotech $ACLX (ADR 6.5%, mid cap) had an EP on 9 December 2022, on positive clinical trial results. That day $ACLX also announced a strategic collaboration with $GILD to co-develop and co-commercialise the same product candidate from the clinical trial that had the positive results.

I added blue rectangles around the price action and volume in question. Notice the decent follow-through and big volume:

Also notice how well the stock acted afterwards: it never closed the gap; rather, it consolidated for several months, then broke out to new highs in April. At the time of writing, $ACLX is building another base:

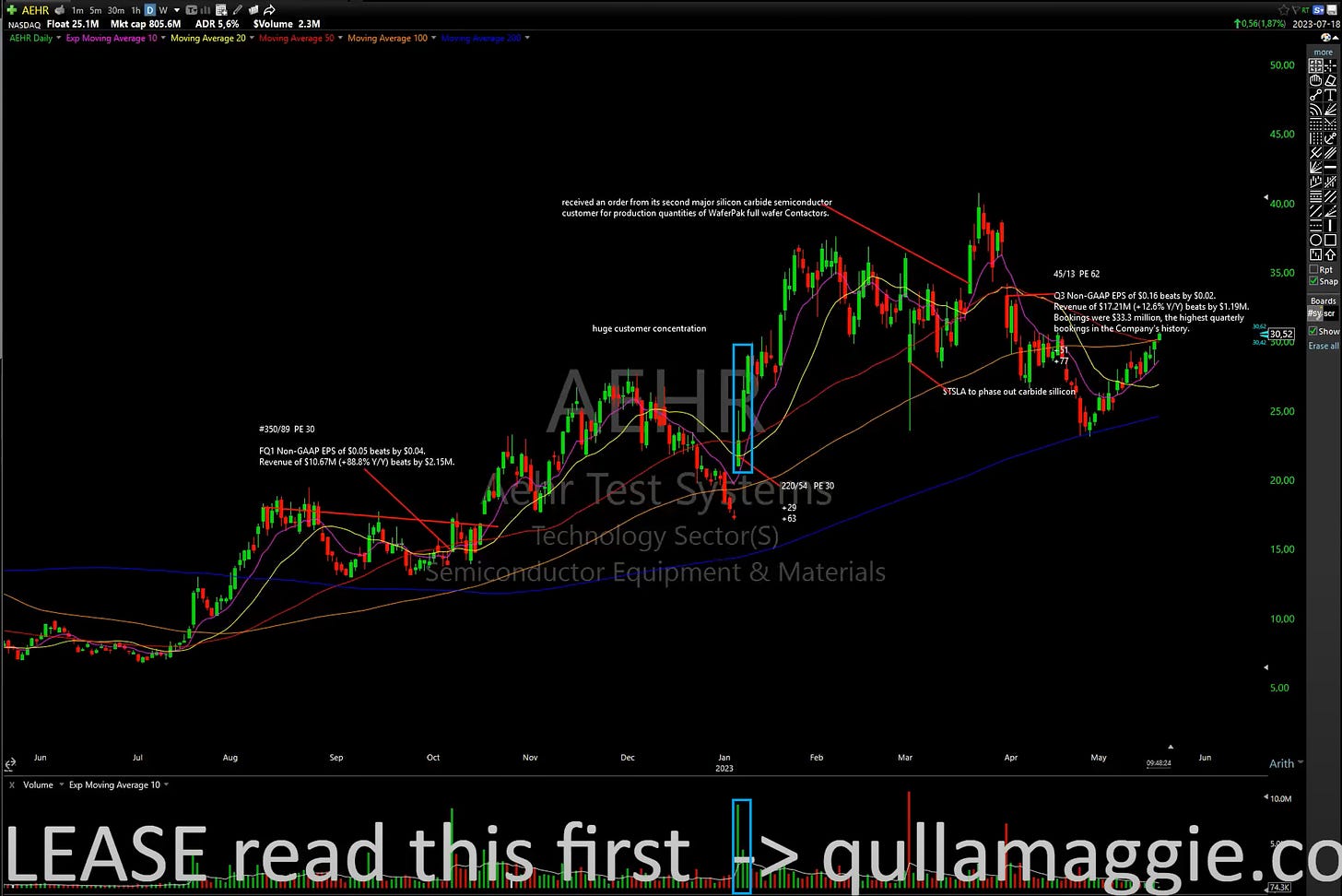

$AEHR

Semiconductor name $AEHR (5.6% ADR, small cap) had an EP on 6 January 2023 on earnings, reporting 54% year-on-year revenue growth. Again, look at the huge volume (highlighted in blue):

Not mentioned by Kristjan on this stream, but notice that this stock traded more sloppily after the initial explosive move — a common trait in smaller names with a higher ADR, and something to bear in mind if you trade them. That doesn’t mean that you should avoid such stocks, for they present great opportunities, but trimming positions as the stock explodes is important. Kristjan talked about that on the 19 May 2023 stream.

$AIRS

A more recent EP was $AIRS (7.4% ADR, micro cap) on 12 May 2023, on an earnings beat and 15.3% case growth compared to the same period last year. $AIRS also announced the opening of its first overseas location (in the UK, where I’m based). That same news story also indicates what the company does — providing a medical procedure to “permanently remove stubborn body fat” that is “performed while patients are fully awake with no needles, scalpels or stitches”.

I’ve again indicated the relevant chart area in blue below, as well as the big volume:

At the time of writing, the stock seems to have found support on the 8-day EMA (that’s the red line, which I personally prefer over the 10-day EMA or SMA. You should use what works best for you — it doesn’t really matter which, as long as you are tracking a short-term moving average):

$AKBA

This EP — in biotech $AKBA (11.0% ADR, micro cap) — had big volume on a big gap up on news on 2 February 2023: FDA approval for a $GSK kidney disease therapy.

$AKBA made a 60% move in just a few sessions:

This is also another smaller cap where, in hindsight, taking some profits off the table after the initial explosive move would have served you well.

$ARCT

Here’s another small-cap biotech example, $ARCT (6.2% ADR), which had an EP on 29 March 2023 following a PR on a 2022 Q4 financial and trial update.

$WW

Another small-cap EP, $WW (10.7% ADR), on 11 April 2023, which gapped up, then rose 55% from the entry point in 1.5 weeks. There is a medical/biotech link, as we are talking about WeightWatchers and its associated programme here. This EP happened on news, announcing the completion of a company acquisition.

$APLD

This one Kristjan traded himself recently: $APLD (11.5% ADR, small cap) had AI-related news — as we already know, a hot theme (Kristjan put together a list of AI- and quantum-computing-related stocks, available here) — on 16 May 2023, and gapped up on huge volume:

This stock is not very liquid, so Kristjan has it as a very small position, in his small tax-free account that he wants to grow. But as he says: “The best way to grow a small account is to buy small caps.” A stock like $SHOP is simply not going to go up 100% in a few days, whereas $APLD was, at the time of the stream, already up 46% from Kristjan’s entry two days ago.

To quote Kristjan again: “Small account edge!” And as you can see from the above, small caps have a provided a ton of EP opportunities lately.

Do your homework

Kristjan concluded as follows:

“Don’t take my word for [it that] EPs are good trade[s]. No, what you need to do is to study it for yourself. Is this guy bulls**tting, or is he actually telling the truth? Is this really […] something you can trade?”

This is a question you have to answer for yourself. It doesn’t matter whether you’re following advice from a proven trader or not; if you want to trade with confidence and conviction — both of which are essential to be consistently profitable — you have to put in the work:

“I think this is the best strategy for most people, but you need to […] gain some experience first. You need to study hundreds of these, or even thousands.

“If you can go back five years [to look at charts from all different market conditions to] just study EPs, look at […] what type of news and what type of volume is needed to get these big moves, […] stocks that go up 50 or 100 per cent in a few days or a few weeks.

“The point is, you want a method that’s easy, easy to manage [and] doesn’t take […] 10 hours per day.”

My tips

(These are in line with the above, and what Kristjan generally says.)

Do as Kristjan says: study hundreds, if not thousands, of charts of stocks that recently made big moves. Figure out what they have in common and how you can trade/build an edge around them.

Journal your trades, and go back and analyse them. This one helped me a lot, and famously also many other big, well-known traders, including David Ryan. I have developed some quantitative analysis techniques for Excel that, if you’re interested, I can share with you — let me know in the comments below or via X/Twitter.

Spend many, many hours reading books and going through other quality materials — there’s an amazing amount out there available for free. For starters, there’s Kristjan’s YouTube channel, which hosts all past streams, but also a lot of other resources based on or inspired by those videos. This Substack is only one of them: other great places to look are the Trading Archive, who posts Qullamaggie stream highlights and compilations, and Dr. Mansi, who has a playlist setting out in an amazing amount of detail exactly how she trades, inspired by traders like Kristjan. In the near future I intend to publish notes on her videos too, as well as notes on many other great resources out there.

More stream notes

All my Qullamaggie notes are available here.

If you want to support my work, please like and share it!

More about Qullamaggie

To learn more about Kristjan Kullamägi, aka Qullamaggie, and the way he trades, visit qullamaggie.com.

All past streams are available on Kristjan’s YouTube channel.

Great summary.

I am wondering if I can search "Up X-% in Y days for last 6 months" on tradingview. I would like do deep dive on EP.

This is so easy to read! You do an amazing job breaking it all down and presenting it clearly. Thank you so much :)