A Practical Approach to Trading Psychology

The root cause of trading problems, learning from Qullamaggie, and why just discipline isn't enough

Edit: Following reader feedback, I followed up this stack with an article on more ‘traditional’ trading/performance psychology to add nuance to the below: Lessons From a Chess and Tai Chi Champion on the Art of Learning and Optimal Performance.

Are you a trader who suffers from any of the below?

Fear

Greed

Impatience

Indecision

Indiscipline

Lack of confidence

Repeatedly selling too early

Chances are that, should you share these problems with the trading community, you’ll be told that psychology constitutes 80% (or whatever) of trading, and be pointed towards a ‘classic’ trading psychology book.

I won’t name any such books, because I don’t want to badmouth any. I’m well aware of how numerous people, whom I deeply respect, found a lot of value in the very same books that I personally got nothing out of — perhaps unsurprisingly. I’m a technical writer. I’m literally paid to write in a way that is practical, unambiguous and concise. After all, no one wants to read instructions that are wishy-washy or simply not actionable.

Anyway, for better or worse, those inevitably become traits I increasingly wish to see in any non-fiction books I read, too — not just the ones I write. For me, the trouble with trading psychology books is that they tend to lack those traits — based on the ones I’ve read, anyway. If you think I’m doing them (or some of them) an injustice, please do recommend a practical book in the comments below.

But even if you’re a fan of such books, please hear me out. Allow me to suggest some practical trading psychology aids that — if nothing else — you may be able to add to your trading ‘toolbox’.

The root cause of many trading problems

The first person who really got me to think about the root cause behind such trading problems was Tom Dante. To paraphrase him (the full, proper quote is here):

Do you actually, categorically know — based on a large sample size — what the right thing is for you to do?

The point is that most losing traders haven’t done their homework. Or at the very least, that they haven’t done enough of the right kind. If you don’t know your edge, how do you expect to make money, particularly over a meaningful number of trades?

Let’s do a little test. Just for your own trading, how many of the below do you have definitive answers for? For how many of the below do you even have an inkling of what the likely answer is?

What setup makes you the most money? Do you even know what setups you have a positive expectancy on?

Within a setup, or just among your trades in general, do you do better with volatile or slower-moving names? As I’ve previously already shared, my personal sweet spot is 5–7% ADR, and I perform best in large caps. But that information is of no use to you — you need to figure out your own ideal conditions. You also need to decide for yourself what you will do with what you’ve found out — do you only trade within your sweet spot, or just trade with bigger size?

What makes you more money: selling into strength, or using a trailing stop loss? And what is your optimal selling point — at certain ATR multiples? At 5R? At a flat percentage from the correct buy point? (I appreciate that this varies depending on the market conditions, but if you’re struggling, aiming for consistency using hard, quantifiable rules that are based on your real results is a good place to start. It certainly helped me.)

Setups often have variations — a stock can break out on a gap up, for example, but also by just trading through the pivot point. Do you know if you have a better (or worse) expectancy with some variations? For example, with high tight flags, I don’t do too well where there are big unfilled gaps in the pole, so tend to pass on those. And when I do play them, I trade with smaller size.

If you are unable to respond to several of the above, I strongly suggest you start finding those answers before you reach for a generic trading psychology book. If you don’t know how to, try this. I’ll write more posts with specific Excel-based techniques and formulas for analysing your journal in future, which will all be available here.

I can’t promise that having in-depth knowledge of your own trades will resolve all your psychological problems. But I assure you that it will help you trade with much more confidence going forward. Because confidence goes hand in hand with having a clearly defined system, with clear rules that you know are right for you.

In turn, that should put you well on your way towards improving your mental game.

Take advice from the GOAT

In my view, Kristjan Kullamägi, aka Qullamaggie, is the trading GOAT. It’s certainly hard to deny that he is one of the trading greats. As such, I don’t think I’m sticking my neck out when I suggest you listen to what he’s constantly telling people to do — and actually go on and do it!

I think the best way for you to get the idea is if I quote Kristjan himself from a couple of his recent streams.

“Don’t take my word for [it that] EPs are good trade[s]. No, what you need to do is to study it for yourself. Is this guy bulls**tting, or is he actually telling the truth? Is this really […] something you can trade?”

“I think this is the best strategy for most people, but you need to […] gain some experience first. You need to study hundreds of these, or even thousands.”

“If you can go back five years [to look at charts from all different market conditions to] just study EPs, look at […] what type of news and what type of volume is needed to get these big moves, […] stocks that go up 50 or 100 per cent in a few days or a few weeks.”

“You need to do the work yourselves, guys. Look at […] what kind of entry method would’ve been the best, what kind of exit method would’ve been the best. Is it best to sell into strength after 3–5 days? Or is it best to sell some into strength, and then trail the rest with the 10 or the 20 moving average?

“You need to do it yourself. You’ll never have conviction if you just take someone’s word for it. It’s not about being perfect, it’s about building conviction in your […] own skills, right?

“Because people are always saying: ‘Oh, […] can you help [prevent me from] selling too early?’ […] Well, actually, I can’t. You can — by studying stocks! By studying these setups! And if you’ve gone through, say, 500 setups, and you’ve convinced yourself [about] the best method, then you won’t have a problem anymore [with] selling too early.

“You need to build the skills yourself. I’m just here to give you some ideas with […] what type of things work in the market, but you need to put your own personal flavour on it.”

This is the bottom line: Kristjan — or any other proven trader — can tell you how they trade. Sometimes, they even share their system in minute detail. Yet this won’t make you profitable, because as Kristjan says, you won’t trade with conviction, especially when the inevitable losing streaks occur.

Describing these as ‘inevitable’ isn’t a judgement of your trading skill — it’s a mathematical certainty.

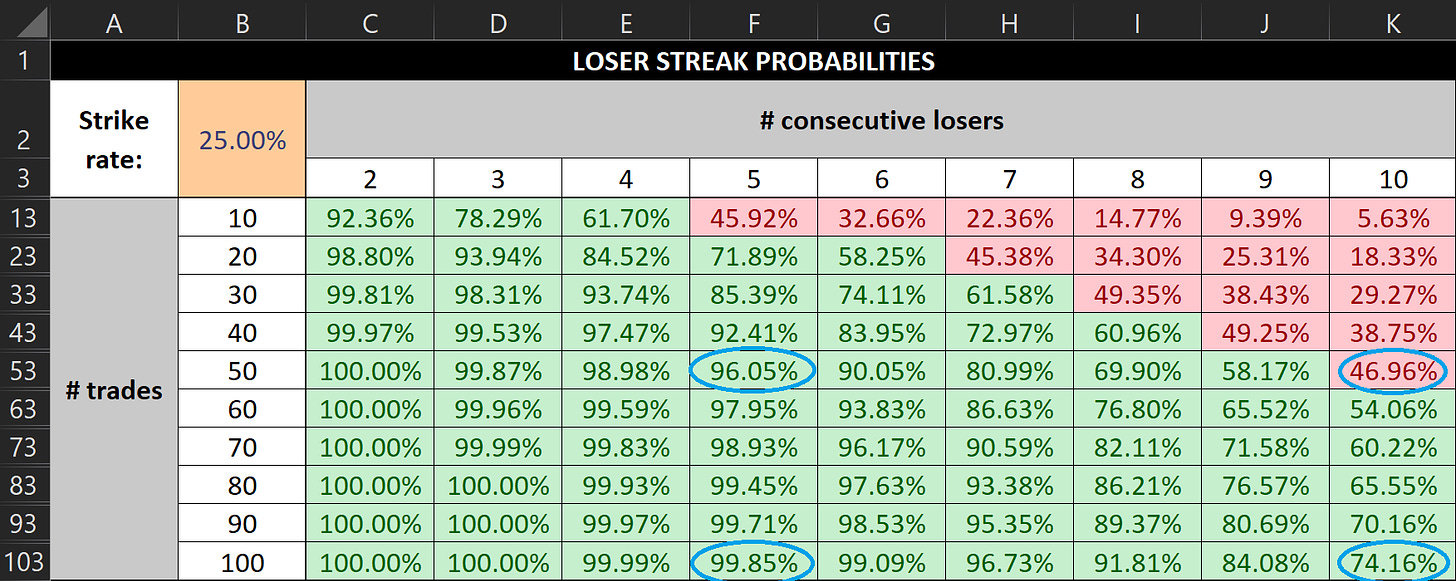

Kristjan has around a 25% strike rate — in other words, on average, it takes four trades to get one winner. With that in mind, would you start to panic if you had a five losers in a row? But, as you can see in the image above, the odds of that happening every 100 trades is 99.9%. Even the odds of that happening every 50 trades are 96%.

What if you only started to get worried if you had ten losers in a row? Well, every 100 trades, your odds of that happening are 74%. Every 50 trades, the odds are 47% — still more than high enough for this to be a regular occurrence.

Ask yourself this: could you mentally cope with ten consecutive losers on a regular basis? Can you even cope with five consecutive losers — repeatedly? And make no mistake: this will happen. You’ve seen the statistics (discussed in more detail here).

If the answer is no, you’re going to have to do some serious studying. Take the time to do as the GOAT says: study hundreds, if not thousands, of charts of the setup you want to master. Because that’s what it will take if mastery is your goal. And mastery is what needs to be your goal if you’re to repeatedly tolerate those types of losing streaks.

If you have put in this sort of work, and still can’t cope with a 25% strike rate, I suggest you go back to your journal and/or backtest to find a way of profitably trading Kristjan’s setups. It can be done, just be aware that the price of a higher strike rate is a lower risk-to-reward ratio (at least for individual trades).

Just discipline won’t cut it

Most of you don’t know this, but when I was younger — especially in my high school and university days — I was really into language learning. (Well, I still am, but in those days I was almost obsessive about it.) At one point, I was even thinking about pursuing a career as an interpreter and/or translator. As it turned out, I did become one — a translator of technical lingo into plain English, that is. Not quite what teenage Kay had in mind, but I think it turned out for the best!

What does this have to do with trading and discipline?

When people found out about my interest, they’d often tell me about their plans to learn Spanish, or Mandarin, or whatever. Some people were even already taking a beginner class, or were working their way through a Teach Yourself course, or had taken another kind of ‘first step’.

But when I enquired about their motivation, I rarely got a response that got my hopes up on their behalf:

‘For better career opportunities.’

‘Because a lot of people speak it.’

‘I just wanted to.’

These ‘motivations’ are akin to getting into trading simply because you want to be rich or because you want ‘freedom’. The vague goal of a possible new career opportunity won’t get you to keep going when things get tough, when you become too busy or distracted or, in all likelihood, even to be consistent until one of those other situations crop up.

Compare that to a goal like preparing to move to another country (maybe for work reasons, maybe not) and wanting to be able to have conversations with the locals. Or wanting to learn your partner’s mother tongue, so you can converse with their family directly. Or even just because you want to complete that wonderful book series of which only the first two books had been translated into English!

These types of motivations will actually push you through the hard times and even minimise ‘away’ periods, because they are concrete goals. If you really have a reason for wanting to learn something, however long it takes, you will get there.

Back to trading

I rather hope that I’ve already made my point with respect to trading, but will spell it out anyway: a skill such as this, which takes thousands of hours of hard work to master, will never be acquired unless you really want it. It doesn’t need to be your number one passion, but you do need to genuinely enjoy some aspect of the actual trading activities and process themselves — not just the money at the end. If you’re just after the money, I politely suggest you find another endeavour — one that you are genuinely passionate about, and are (or can become) good at — to seek your fortune.

I chose this analogy not just to share something about myself (I believe a few of you were curious), but also because I think it very relatable. A lot of people have some vague ambition of learning a foreign language. Many will not succeed. Those that do all have discipline.

But discipline isn’t enough. You need genuine motivation for wanting to learn the language, no matter whether your goal is to achieve native-like fluency or merely be able to sustain a basic conversation in your target language.

Of course, you also need a method that actually works, just like you need an edge in trading. Without it, all the discipline in the world won’t get you consistently profitable (or fluent in a foreign tongue).

Conclusion

My honest opinion is that most psychological problems in trading stem from laziness. The beauty — some would even describe it as the ‘appeal’ — of trading is that you are in control. You don’t need to get frustrated over inefficient or incompetent colleagues. There’s no endless bureaucracy, or pointless meetings to attend. And so on.

But this also means that the responsibility to perform is yours, and yours alone. Most traders will fail — but that is because most traders are looking for easy money. Consistency requires more than luck. It requires hard work. It requires sacrifice. It requires mastery.

The good news is that you don’t have to master anything and everything trading-related. All you need is one setup. One edge. One winning system. That’s all it takes.

Study the charts of at least hundreds of winning stocks to build conviction. Figure out where you should be entering and exiting them, in a way that enables you to define clear rules. When under pressure — because you’re already in the trade, for example — you can’t think as clearly as when you’re outside the trade, so decide ahead of time what action you will take. The more mechanical, quantifiable and simple your rules, the easier it’ll be to stick to them.

Journal your trades to identify your edge and analyse your performance. What do your winners have in common? What patterns do your losers have? Where are you most profitable? Where do you need to improve? Studying historical winners is great, but ultimately, you need to be you. We all have different personalities and strengths — use that to your advantage!

Enjoy the process, and remember your overarching goal(s)/reason(s) for trading. You won’t maintain discipline if you don’t.

I hope you found this post useful, even if you don’t agree on everything. If you want me to elaborate or want to start a discussion, please do leave a comment below, message me on Twitter or send me an email at kayklingson@yahoo.com!

More content like this

If you want to read more of my stacks on trading psychology, take a look here. My posts about journaling are here. The full archive for The Trading Resource Hub is here.

And if you want to get future articles like this straight to your inbox, feel free to subscribe :)

I'm new to trading, but not to personal development and psychological self help books (and I've written a book as well) and Kay is spot on. Lots of inspiration, little on actionable steps and systematic habits that can be adopted to solve the psychological issues. My bet is that I'll go through the trading psychology books and come back to books like Systems Mindset and Thick Face Black Heart and realize that I got further by applying the actionable principles in those books to trading

Hi Kay. First and foremost, I want to highlight the fact that I have a great deal of respect and appreciation for the work that you do for the trading community. Both new and aspiring traders alike are well-served by your writings.

I am a full-time trader in my fifties and I found myself thinking about your post for quite some. While I fully agree with much of what you shared, I feel that mindset / psychology play a much bigger role for most than you are aware. Again, I share this from a place of respectful discussion as we all formulate thoughts and opinions based on experience and who we are as individuals.

This topic is at the root of frequent discussions with both my 17-year old son who started his trading journey at the age of 15 as well as my trading partner who is in his late forties. What is the key to successful trading?

Part of the answer is certainly to be found in the objective mechanics of trading. No question. However, in my experience, the biggest gains in performance progression have come as a result of my working on mindset. Interestingly, the same has also held true throughout my life as a long-distance runner. The technical side of trading, or running, can only take us so far in the face of a limiting mindset. It is the improvements in mindset that hold the key to ever-improving execution performance.

I highly recommend listening to the interview with Richard Bargh chronicled in the book “New Market Wizards”. From both a knowledge and practical application point of view I very highly recommend Jared Tendler’s book “The Mental Game of Trading”.