We all have to fight our demons.

So, when they appear, which side of the trading coin do you turn to? Mechanical or mental?

Unquestionably, both play important roles. But what is the ideal balance?

There is no one-size-fits-all answer. There are, however, certain universal guidelines.

Note: This is a guest post by a reader and full-time trader, Dave (@DMacTrades on 𝕏). He wrote the bulk of this stack; I edited and added a few notes of my own, particularly towards the end.

Mechanics come first

A focus on the mechanical side of trading is what keeps us in the game. Without a working strategy, and executing it with discipline, there’s nothing to talk about.

So, first and foremost, traders of all experience levels must practise extreme ownership* around their ‘playbook’.

And if they don’t yet have one, they should be trading one-share lots until they do.

But once you have that playbook, and are disciplined about executing it while managing risk, you get some leeway. You get to work on the psychology/mindset side of things, to try to take things to the next level.

*The term ‘extreme ownership’ was coined by Jocko Willink in the book “Extreme Ownership: How U.S. Navy Seals Lead and Win”.

What does taking extreme ownership mean?

Extreme ownership starts with taking full responsibility for your actions.

You, and only you, are responsible for every decision you make.

The harsh reality of trading is that there isn’t anywhere to hide from your results — the only person you hurt by shunning responsibility is yourself.

How often do we see a post on social media like the following?

The price action today was crap and I erased my entire month.

This is a perfect example of a trader shifting responsibility for their own actions to an external source.

Instead, take extreme ownership.

Be the trader who understands that by taking full responsibility, you place the power to bring about change squarely in your own hands. You can only improve as a trader if you admit that your results are the direct outcome of your actions.

Note from Kyna

This is very closely related to what I wrote in this stack:

“I’m not saying psychology is a non-factor in trading. Of course I’m not. In any competitive endeavour, mindset and the ability to perform under pressure are often precisely the things that distinguish the champions from the rest.

“But I do believe — as, evidently, does Tom [Dante] — that people are prone to making excuses, rather than taking responsibility, and psychology is often a very convenient candidate to blame.

“The corollary is that having the opposite mindset — being prone to blaming yourself, even when it’s unjustified — is precisely what can improve your trading and trading psychology. Because that mindset often goes hand in hand with trying to find solutions. To need to be doing something so that you can get better, resolve the issue and move forward.”

Back to Dave.

Tracking mental states in a journal

A trading journal is one of the most important tools in practising ownership. This is the ‘mirror’ forcing you to look at your own actions on a daily or weekly basis.

This needn’t be limited to mechanics.

If you also record your mental/emotional state each time you take a trade, you can start to determine where you might be going wrong.

After all, the best way to bring about change is to know what you’re dealing with first.

Suppose that 95 out of 100 trades are tagged as one of the following:

‘Early exit’

‘Trading scared’

‘Moved my stop’

This tells us fear is playing an integral role in the trader’s decision-making, subconscious or otherwise.

With that information, we can dig into the root of the problem:

Are you under severe financial pressure and having difficulty making objective decisions?

Do you lack confidence in your playbook?

Is the problem something else?

All traders experience mindset challenges. But the more aware we are of the root causes of those challenges, the better we can address them.

That starts with identifying the problems.

How I journal

Data input

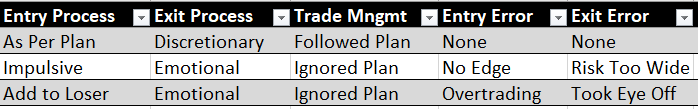

Specific to mindset, I track the following data points:

As shown above, I log my mental/emotional state in five different categories:

Entry process

Exit process

Trade management

Entry error

Exit error

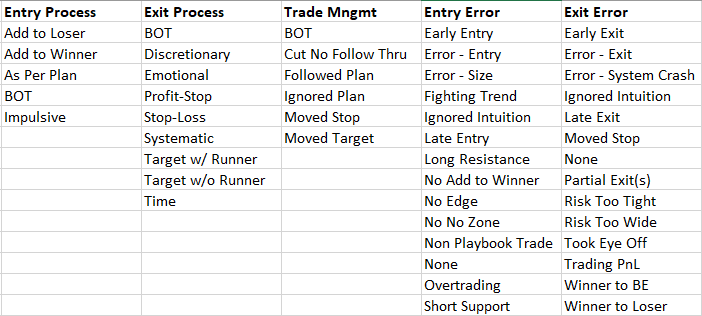

These are my drop-down items for each category:

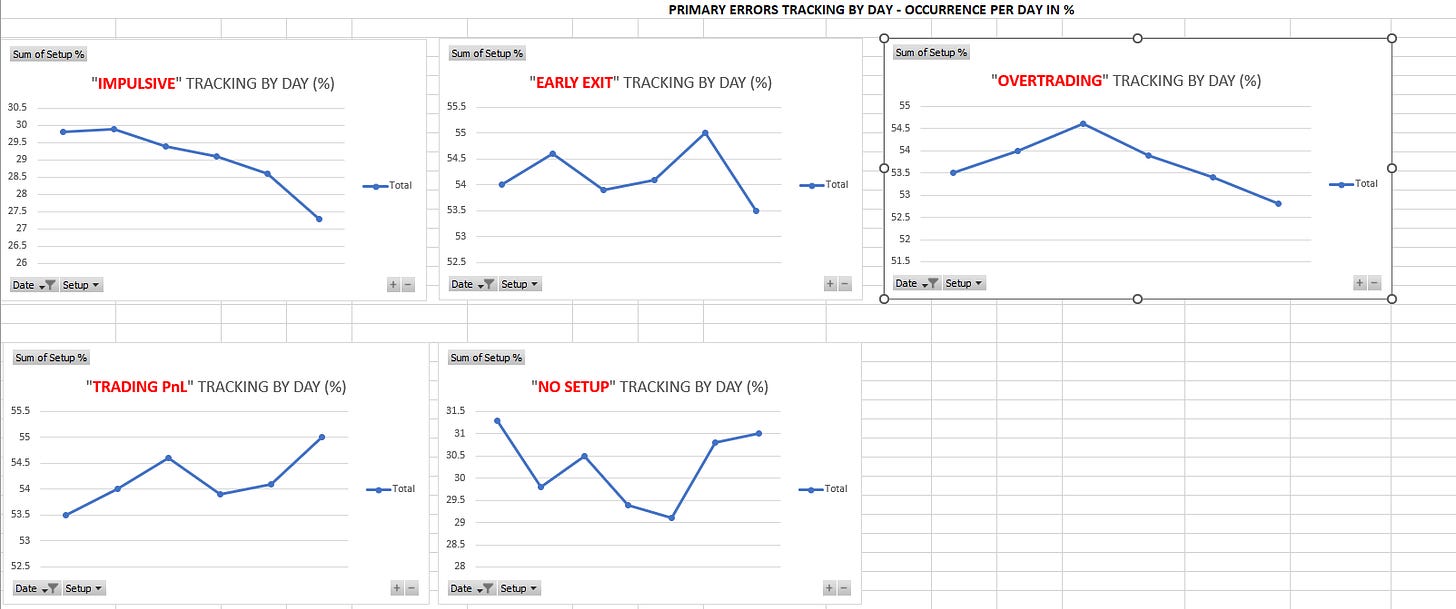

Analysing the data

On a separate tab, I have graphical representations of my top behavioural/tactical errors:

By plotting mindset results in the same way we plot P&L, we get a stark visual overview of our progress towards reducing negative behaviours.

For example, an uptrending curve on ‘early exit’ is a clear indication you’re trading your P&L. That’s usually a sign of fear, lacking confidence in your playbook, or both.

Getting even one of these graphs to trend down is an edge in itself:

A trader who tracks mindset data can earn more money, even if they only reduce the number of early exits. Or make one other, simple change.

More broadly, it shows they’re capable of solving problems, with an immediate, positive impact on their P&L.

Final thoughts from Dave

There’s power in taking responsibility for our actions. It’s the foundation of learning and improvement.

Clearly, our actions are affected by our various mental states.

The key is to identify them. Then, we can work on modifying them to help us meet our trading goals.

I think all traders would be well served if they:

First and foremost, strictly adhere to the mechanics of their playbook;

Track behavioural data the same way as numerical data — with a daily plan and a journal, in which they log the attributes of each trade;

Through journal analysis, determine what aspects of their mental state aren’t serving them well, so they can subsequently work towards changing them;

Seek guidance specific to their needs, as determined above; and

Understand that behavioural change is a gradual process that can only come from intentional action. Which is why adhering to your playbook is so important.

I’ll leave you with this video of Dan Shapiro on taking responsibility for our actions. Along with Tom Dante’s “Stop Moaning and Start Improving”, this is one of the better ‘rants’ (in my opinion).

Thoughts and tips from Kyna

Dave’s approach to journaling was new to me. I also believe it can genuinely help some traders who are struggling, which is why I asked if he’d like to write a stack with me.

This is, of course, the nice thing about guest posts. They bring something different to the table. Let me know if you’d like more!

I wanted to finish this stack with a few tips of my own, which I believe complement Dave’s points well — particularly around taking full ownership.

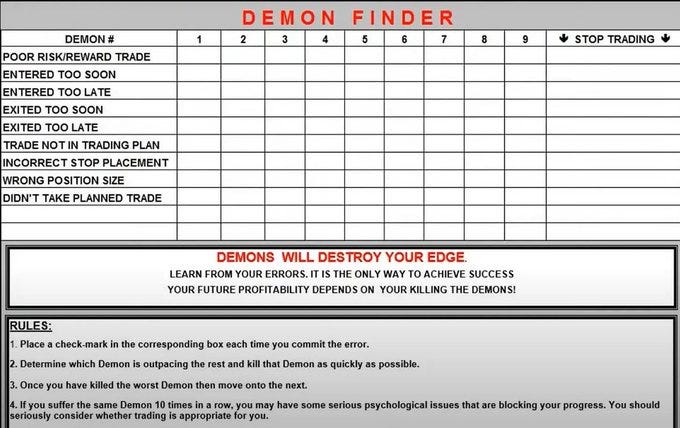

1. Use Tom Dante’s demon finder

Tom’s demon finder is a powerful visual aid for identifying your worst demons:

Hang it above your monitor, or somewhere else easy to see when trading, and check the boxes accordingly. This tells you which demons you must address first.

Perhaps more importantly, it should also get you to pause before you commit the error for the umpteenth time.

2. Manually journal

The value of manual journaling, e.g. in Excel, is underrated. It’s a great test for trade quality. (Even if you only log numerical data, and not your state of mind.)

I believe that if you’re reluctant to log a trade, deep down, you probably know that you’re breaking your rules — either through overtrading or by trading outside your strategy.

So, before you pull the trigger, ask yourself whether you’re happy to log this trade in your journal.

3. Look after your physical health

An astonishing amount of mental problems can be fixed, or at least reduced, through some basic self-care:

Eat well

Exercise

Have a hobby

Get enough sleep

Psychology books may or may not improve your performance. Whereas all the above definitely will, on top of all the other health benefits.

If you’re looking for a good return on investment, your physical health is a good place to start.

4. Have a full schedule

My day job, family and hobbies help ensure I’m not watching every tick in the market.

In fact, I think my current job, which is more demanding than my previous role, is improving my trading performance because it keeps me too busy to do anything other than basic strategy execution.

Different things work for different people, but I think every trader needs options they can distract themselves with when they can’t trade. That might be for certain hours of the day, or for weeks/months at a time.

Again, this is also a healthier way of living, which in itself will help your mental state and performance.

More stacks like this

If you found this stack helpful, you may also enjoy part 2 to this stack:

All my stacks on psychology and/or mindset are here.

The Trading Resource Hub’s full archive is here.

The idea of plotting the % of occurrence of a certain error or mental status is quite interesting, never though about that. Does it plot the % of trades with that certain flaw over the whole list of trades since inception, among the N x trades, or does it plot the % of days when that flaw appeared (even if only once among several trades in the same day)? I guess all of them would work, but still intrigued

Hi Roman. Thanks for commenting and sharing your question. The use of PivotTables in Excel allows you to easily do both which is how I have it set up. I want to see the occurrence of the behavior on a per setup basis and also on a daily basis regardless of setup. This is easily accomplished by adding “setup” as a filter in the PivotTables field. If you would like more insight into this feel free to shoot me an email (I use gmail and my username is dmactrades).