I’m teaming up with Anthony Shi (Dolan V. Kent) again! In case you missed it, our first collaboration was on EP nuances and market cycles.

Today, we’re moving to a different setup: high tight flags (HTFs). They’re also known as ‘power plays’.

We’ll go through:

The anatomy of a HTF;

‘Messy’ flags and some HTF variations;

Nuances for gauging the odds of a HTF working;

Why you need to understand what is ‘normal’; and

Using that information to create a daily process loop.

The anatomy of a HTF

First, a friendly reminder that chart patterns simply reflect supply and demand. So, what’s the story behind the price (and volume) action of a HTF?

1. Big upward momentum: the ‘pole’

For a HTF to indeed be ‘high’, we need upward momentum in the pole. That means:

A sharp rise in price…

Relatively quickly…

On high volume.

The momentum will have a fundamental or technical driver, often starting with an EP, which in turn requires a catalyst, like an earnings surprise.

Whatever the catalyst, market participants have agreed that the price should be much higher, and buyers are much more aggressive than sellers.

2. The pole tops

As the stock gets more and more extended, it attracts increasingly fewer buyers — particularly new ones.

Furthermore, early buyers are sitting on significant unrealised profits, which they’ll be tempted to take — at least in part.

In other words, for now, the boat is fully loaded on one side. And it’ll be particularly prone to heeling to the opposite side if short sellers are getting involved (because the stock is extended).

3. The pullback finds support

As price pulls back and the flag starts to form, traders who missed the initial run-up want to get in. The earlier these buyers show up — i.e. the smaller the % pullback — the stronger the stock.

As the pullback bottom becomes apparent, many more sideline buyers recognise the support, and are willing to get in at, or slightly above, those levels. The price may be pushed up further by short sellers covering.

A good point Anthony makes is that most stocks don’t find support after a big run-up in price. So, when you find one that does, particularly when at a key moving average, that’s already a sign of strength.

4. The top of the flag (resistance) forms

As price continues to move higher, earlier buyers will — once again — want to sell at least a portion of their position near the highs, particularly if they missed their chance at point 2. You may also get new short sellers, betting that these recent highs won’t be taken out (yet).

Combined, that creates a resistance level.

5. Volume drops off as fewer new participants show up

This back and forth continues, and support and resistance levels become more evident in the flag. Plus, with fewer and fewer new participants showing up, volume drops off.

More and more traders have now placed their bets, whether that’s buying near support or selling near resistance. With the latter, it means that the weak hands — who bought the stock at an earlier stage (e.g. in the pole) and have now taken their profits — are out of the stock.

That’s what you want to see. You want as many of the weak hands as possible — who are more prone to selling into any breakout — to have offloaded before you get on board. To get the most powerful breakout possible, you’re looking for low long and high short positioning.

(As unpleasant as this is to say, you’ll get increased short positioning by ‘trapping’ the short sellers that anticipated a breakdown while the stock was still trading within a range. A stock finding support several times and persistently making higher lows is a sign of strength.)

6. The range breaks out (or down)

The range gets so tight that the decision has to be made! If a lot of participants like the direction of the range resolution, up or down, the move will attract a lot of fresh participants, so a lot of volume comes in.

In the case of a successful breakout, you get a combination of:

New buyers taking a position;

Weak hands rushing back in; and

Short sellers finding themselves underwater and covering.

This makes for a powerful cocktail of an explosive upwards move on big volume.

The messy reality

It’s important to understand the psychology behind the price and volume action of a HTF, as that helps you interpret the price action when looking at it in a non-textbook setting.

For starters, keep in mind that not every flag, textbook or not, breaks out. Some break down out of their range.

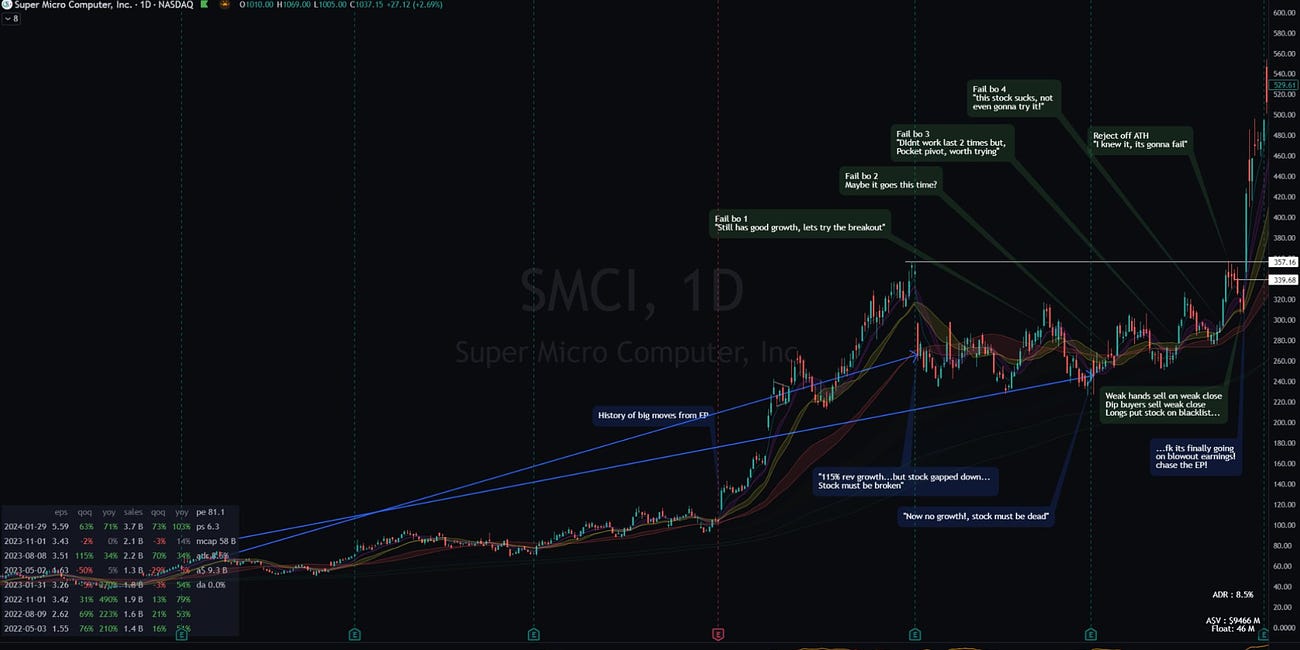

You also get ‘messy’ flags: they break out, fail, form a new base, then set up again. Here’s an example from a tweet from Anthony:

(Here’s Anthony’s full thread on HTF variations, with a bunch of chart examples.)

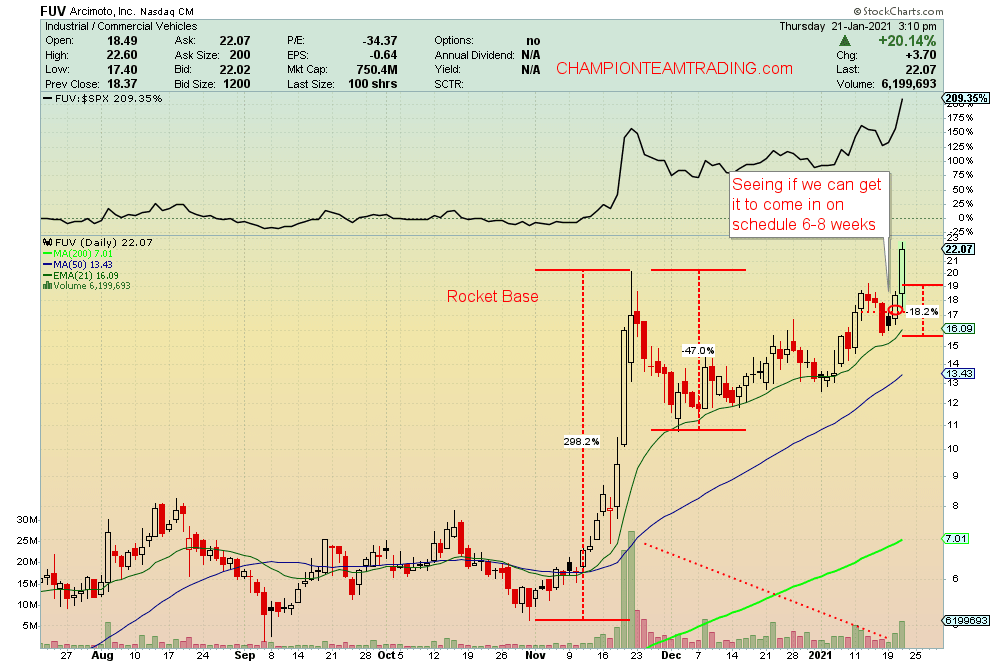

Leif Soreide’s ‘rocket base’

Alternatively, a HTF might just fail without a fakeout, then form a new base again and break out for real — this is basically Leif Soreide’s ‘rocket’ or ‘rocket base’ setup. Here’s an example:

The initial HTF it was forming failed, but the stock then developed a ‘rocket base’, with volatility contraction pattern (VCP) characteristics.

Shakeouts

You can also get a HTF that works perfectly well first time round — but there’s at least one shakeout in the flag itself.

Qullamaggie really likes shakeouts because they look like a breakdown, so weak hands quickly sell, while strong hands step in to support the stock. You also get shorts stepping in, who then need to cover when the stock reclaims thanks to those strong hands.

All this magnifies the buying pressure alignment.

(This relates to a discussion in the previous stack with Anthony, about neglect and long bases.)

Or, the breakdown is just that: a breakdown

Sadly, many flags just break down to never come back. The HTF is a great setup because it offers great risk-to-reward, but if you’re trading it, be prepared for low strike rates. In other words, be prepared to be wrong a lot. Losing streaks are a mathematical certainty.

You need the wind in your back (i.e. a market conducive to breakouts) for a HTF to be successful — by which I mean a sustained move post-breakout. Without the right market environment, breakouts more often than not fail.

And don’t forget: you only get 2–3 periods a year when you can get aggressive as a swing trader.

Plus, even in the right environment, HTFs can still fail. There are no certainties in trading. You can only stack the odds in your favour.

Adding nuance

Market environment aside, what characteristics or factors improve — or decrease — the odds of a HTF working?

Theme

Stating the obvious, I know. But a strong theme (or industry) boosts your odds of your setup working, HTF and otherwise, even if the setup itself isn’t five-star.

A textbook HTF can be beautifully symmetrical, with a flag that looks like a sideways isosceles triangle. But it might be in a lagging industry. In which case, you’re better off taking the three-star setup that’s in a hot theme.

Magnitude, catalysts and EPs

The bigger the pole (% move) of the HTF, the more powerful the stock. This is particularly promising where there’s a fundamental driver for that move, like strong earnings.

Which brings us to the interplay of EPs and HTFs.

Momentum stocks start with an EP, followed by post-earnings-announcement drift (PEAD), generally between earnings seasons, which lead to flag setups.

Or, to put it differently, EPs and breakouts are inherently linked: breakouts are an extension of their initial EP and PEAD.

The above phrasing is mostly from Anthony (with some copy-editing from me), but is something I’d already learnt myself, by publishing the Qullamaggie stream notes.

Last week, I mentioned how I’d hardly traded EPs before I started publishing stream notes. Put differently, I hadn’t really studied this setup until last year.

It was only then that I realised how many successful breakouts are preceded by a good EP. That was amplified when I took notes on Dr. Mansi’s videos. Last June, I wrote:

“even if you’re mainly a breakout trader, it’s worthwhile to spend time learning the EP setup — at least so you can recognise them in hindsight, if you don’t actually want to trade them — because the stocks that had one recently, thus recently had a positive catalyst, make for considerably higher-probability breakouts.”

When you think about it more, it makes a lot of sense.

Breakouts are a continuation setup. If successful, the stock continues to move in the direction of its existing uptrend.

But what caused that initial uptrend? A catalyst! A surprise to the market. Something that completely changes the prospects or potential of that company. Something that leads to aggressive buying, to such a significant extent that the stock gets extended and needs time to rest (consolidate/base), only to then shoot off again.

In other words, that stock has to be so appealing that it keeps attracting new buyers. Or new buying from existing buyers. That ties in with what Dan Zanger says:

“When these things get up and run, you can just plough your money into them.”

The key is the ‘new’ part. You need new buying and, preferably, new buyers. Demand has to outstrip supply. The big players that want to own this company can’t all be holding shares in it already.

I also want to remind you of something Anthony and I pointed out last time:

“Every bubble starts from a grain of truth.

“Overpriced stocks repeatedly pop up in the market. And they can stay overpriced for a long time. In fact, just because something is already overpriced doesn’t mean it can’t still go up. A stock only tops after the last holdout becomes a buyer.”

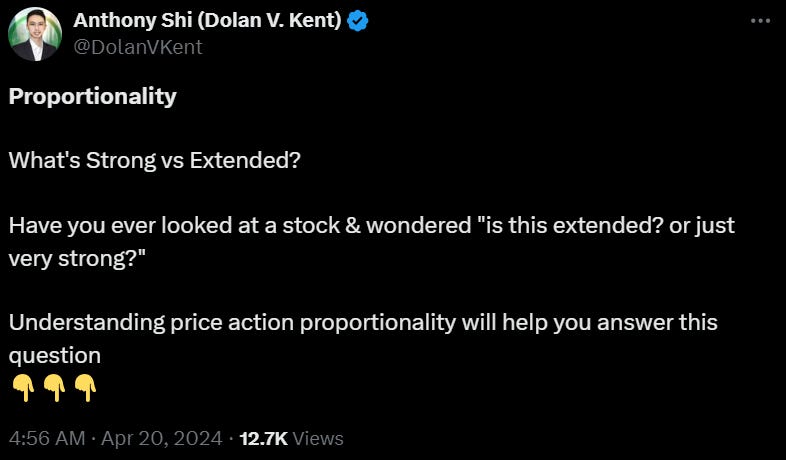

Proportionality and symmetry

Let’s come back to magnitude. Again, the bigger the pole of the HTF, the more powerful the stock. Also, the less time it took to build that pole, the more powerful the stock.

But the faster and bigger the move, the faster and bigger (i.e. deeper) the pullback.

Furthermore, the more parabolic the initial move, the lower the odds of getting a secondary move. And if you do get continuation, it’ll likely be after a longer base, as the stock will probably need more time to digest the huge move. (Something like a rocket base.)

However, not everything in the market moves symmetrically. The road up is often not symmetrical to the road down. This is why we have the saying that ‘stocks take the escalator up, and the lift/elevator down’.

That said, there are certain predictable characteristics:

Mid and large caps tend to have less steep slopes. Why? Because institutions tend to focus on them, and they can’t buy their full position at once.

Small caps move more explosively — they go up and come back down quickly. Why? Again, institutions. They’re less likely to buy small caps.

Parabolic movers (often growth stocks) both go up and come down fast.

As there wasn’t enough room in this stack to go into much more detail on this, Anthony created this thread:

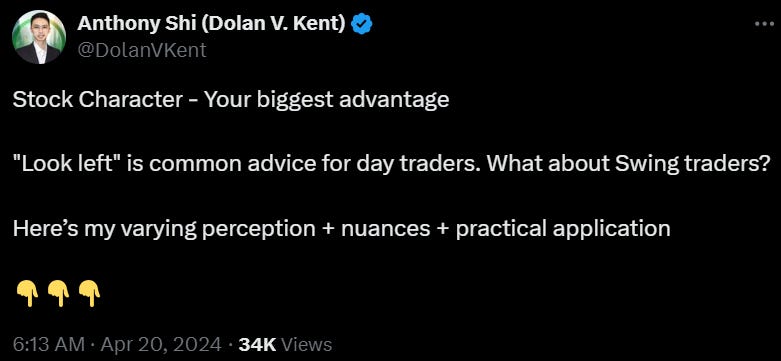

Individual stock character

This is another thing addressed in the EP stack with Anthony: chart history. In other words, stock character or personality (also addressed by Qullamaggie).

As Anthony puts it, you can further set your expectation for a given stock by looking at its individual character. Does it trade cleanly or choppily? Or, to break it down into five more nuanced options:

Random chop

Choppy strength

Linear strength

Extended

Parabolic

The other thing to pay attention to is when the stock tends to make a significant move:

On earnings?

Between earnings?

Put differently, what sort of history does the stock have? Odds are, history will rhyme. Use that information to inform your entry tactics.

Anthony published this thread to explain these characteristics in more detail, including a bunch of examples.

Why it’s important to understand what’s ‘normal’

If something happens against the odds, that’s a sign of strength or weakness, depending on the context. Here are a couple of examples:

A parabolic mover doesn’t make a normal 50% pullback, but only corrects 20% — a huge indication of strength.

Good breakouts in hot themes are failing. A clue that it’s time to reduce exposure.

But to know those odds, you have to know what ‘normal’ looks like. And knowing (or sensing) what is and isn’t normal will become a lot easier to internalise if you understand the logic behind these moves.

Last week, inspired by another conversation with Anthony, I highlighted the importance of intuition if you want to excel in your field.

I’m definitely nowhere near that stage as a trader. I’m not even convinced I’m at that level as a writer.

But my best guess is that if you want to have reliable intuition as a trader, trading must feel intuitive to you.

The only way that can happen is if you have in-depth understanding of the laws of supply and demand. So much so that you can apply them to quickly and accurately interpret live price action, while you have skin in the game.

Part of the reason I write stacks such as this is to deepen my own understanding. Like the last time I collaborated with Anthony, this felt like quite the mental workout. Plus, the version that you’re reading is leagues ahead of the first draft I shared with Anthony, which — to my mind — is evidence of improvement in just the past week.

Creating a process loop

The other big reason it’s important to understand the psychology behind the price action is to be able to use that information to create a process loop.

Again, if you can calibrate what constitutes ‘normal’ behaviour, you can build a daily process loop — even if only a rudimentary one.

1. Run daily scans for the biggest movers

If you’ve watched Qullamaggie’s streams, I hope you’ve noticed that Kristjan always adds the day’s most notable movers to a watchlist called ‘zz [date]’, which he then tracks for about a month. Here’s an example from 1 December 2023.

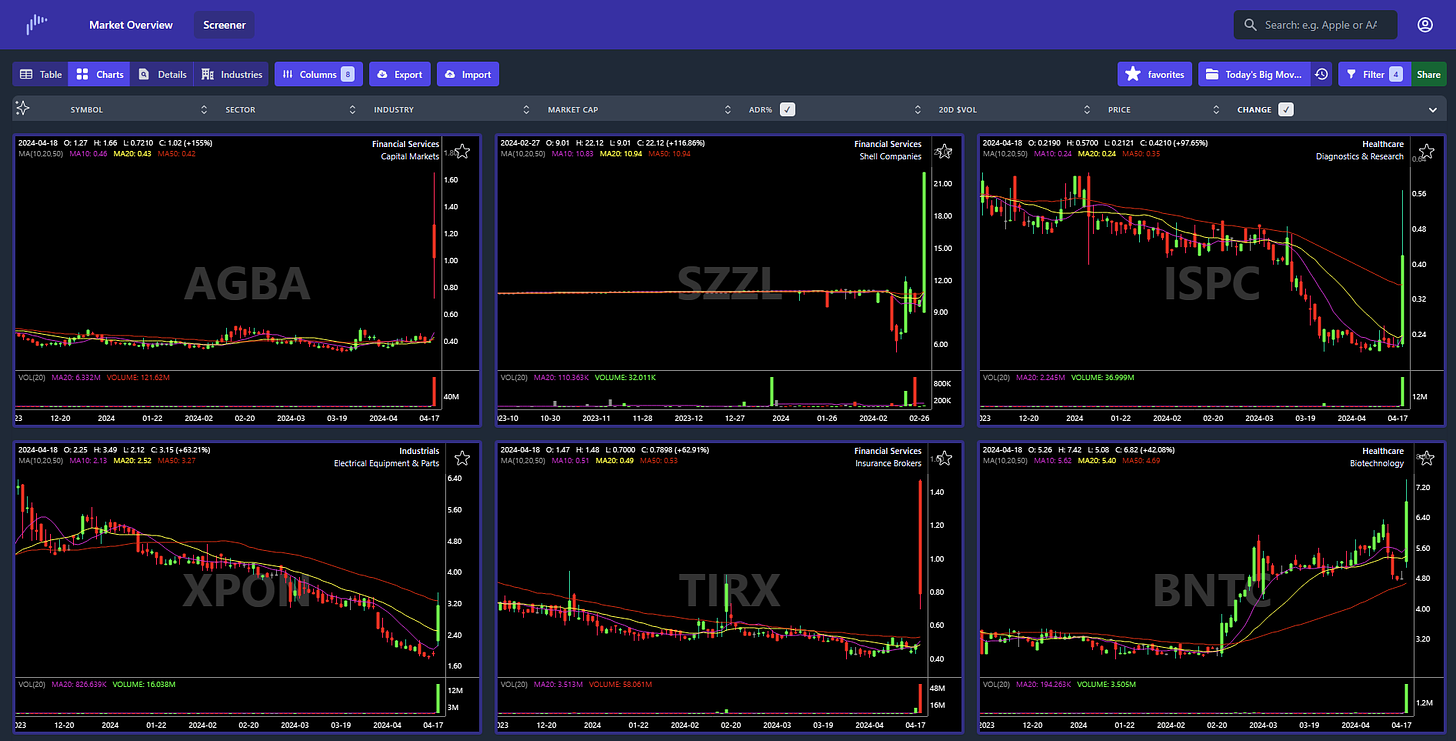

Recently, I’ve been using base.report to identify the day’s biggest movers, because I like how I can view multiple charts at once in this software. Here’s an example from the day I’m writing this (18 April 2024, after the market close):

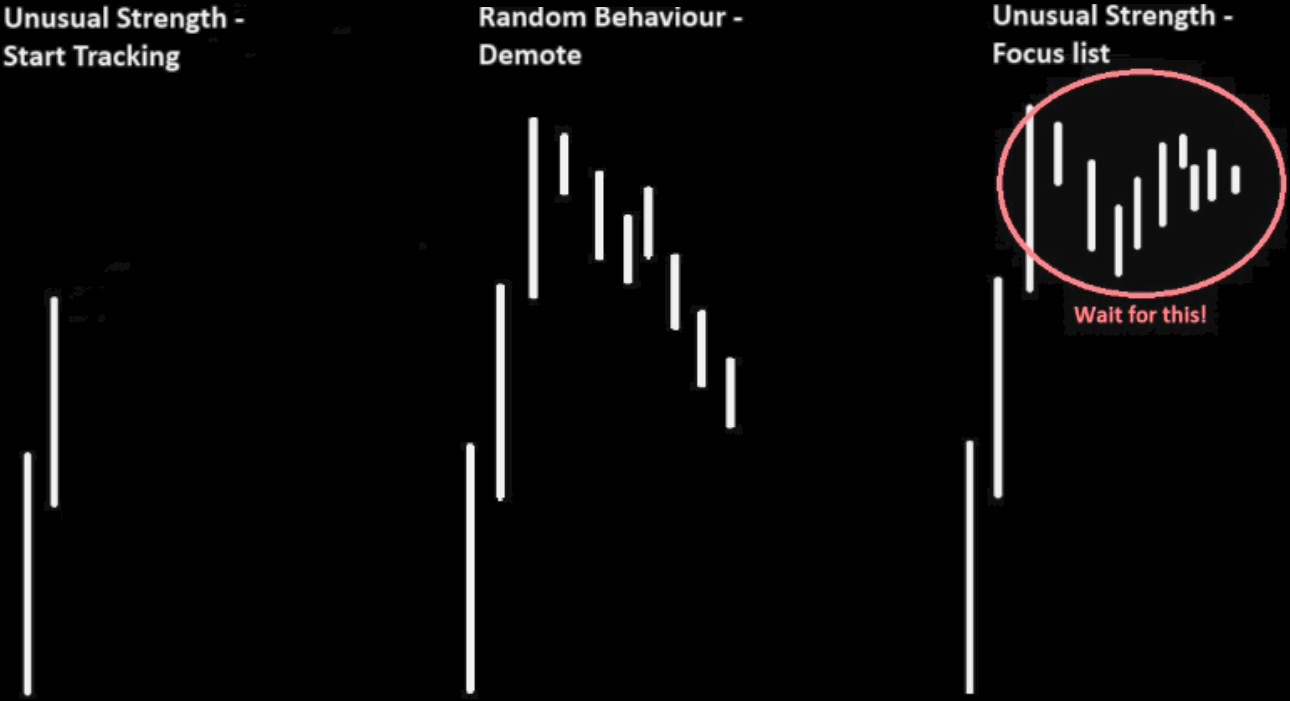

Where the big moves look interesting — akin to the chart on the left in the image below (provided by Anthony) — you add them to a separate watchlist.

2. Monitor your watchlist

What happens to the big movers on your watchlist after their pole tops?

Retrace the move (middle chart above)? Kick it off your list. This is what you’ll end up doing with most names.

Form a flag (right-hand chart above)? Keep watching! That’s the unusual activity you want to lock in on.

By tracking the biggest movers throughout their flag development, you also get clues as to which themes are the strongest. Combined with situational awareness, and keeping track of the swing cycles, this process alone could yield good results for a trader.

Closing wisdom from Anthony

Broadly speaking, you get two opportunities to go long on a strong stock:

The EP: you spot a gap up on huge volume following a catalyst and, preferably, a period of neglect.

The breakout: after the EP and PEAD, a flag forms, which becomes increasingly tighter until the range resolves itself, breaking either out or down.

Here are some final pearls of wisdom from Anthony:

Each step of the way, you should have the archetype in your head:

If it follows the archetype, you know to keep it on watch.

If it exceeds your expectations, you keep it on high watch.

And if it fails to meet expectations, you can stop watching it.

Where you have multiple trade ideas, always pick the strongest stocks available at the time.

The pattern itself (i.e. how textbook it looks) doesn’t tell you which sectors or themes are strongest.

Don’t forget to use a risk management tool.

Note from Kyna

Although I did most of the writing, the vast majority of information was inspired by Anthony. He was also a huge help in structuring it all.

Earlier in the stack, I wasn’t exaggerating when I said that the final version of this stack is streaks ahead of the first draft, which existed mere days ago. This studying and writing process truly has been a mental workout for me, and one I badly needed as a trader.

Not going to lie: feeling pretty drained right now, but also incredibly content at having learnt so much this week — hopefully while also helping a few of you along the way.

Anthony, getting to collaborate with you like this truly is a privilege. I’m learning so much from you, along with (probably) many others. Thank you!

More content like this

All Anthony Shi stacks are here.

The Trading Resource Hub’s full archive is here.

Supporting my work

To get future posts like this straight to your inbox, why not subscribe? It’s free!

If you were already on my mailing list, you’ll have noticed that I’ve now officially turned off pledges (having never accepted any of the money already pledged).

This Substack will never be paywalled. I don’t even want to accept voluntary payments for future unknown work.

But if you find value in my writing, you can now buy me a coffee for work you’ve already enjoyed:

The clearest and most accessible explanation I've read. Thank you very much

Great article Kay! Appreciate reading your thoughts about your trading journey and all the hard work your putting in. Thanks again.