6 Ways to Treat Trading Like a Sport

Lessons from Marios Stamatoudis and other top traders and performers

Audio available at the end of this post.

Marios Stamatoudis, a top performer in US Investing Championship (USIC) 2023, tweeted about treating trading like a high-intensity sport. Approaching it like an athlete.

He also brought the concept up during his TraderLion interview earlier this year.

It stuck with me, because the analogy felt so apt, yet I hadn’t heard it before.

The concept further embedded in my mind when I heard the athlete analogy on a recent podcast with Cal Newport and Andrew Huberman.

In short, to optimise your cognitive function, you must prioritise things like sleep and nutrition — just like an athlete.

(That’s a podcast well worth listening to if you’re interested in enhancing focus and improving productivity, by the way. As Stockbee says: “Depth creates edge.”)

Inspired by Marios’s tweet, as well as lessons I’ve picked up from other traders and top performers, this stack looks at six ways in which it’s helpful to treat trading like a sport:

Imitate before you innovate

Do most work ‘off the field’

Build procedural memory

Find/spark your passion

Build mental resilience

Be adaptable

1. Imitate before you innovate

Aspiring professional athletes study the greats in their field, current and historical. They pick apart their technique, strategy, mindset, and so on.

Then, they copy them, and see what works and doesn’t work for them. From there, they can start developing their own style.

As an analogy, I’m an amateur pianist — classically trained, musically not very creative. So, I shamelessly imitate. I listen to lots of recordings, then copy the bits I like and dismiss the bits I don’t.

You don’t need original ideas to perform well. Besides, this ‘pick and mix’ approach still allows you to develop a personal style.

Marios and reverse engineering

Imitation works perfectly well for trading too, particularly as a starting point.

As Marios says:

“There’s no need to reinvent the wheel[. By] studying successful traders of your era and those who came before, [you] accelerate the acquisition of otherwise hard-earned skills and techniques.”

As he explained in his TraderLion interview, Marios ‘reverse engineered’ the minds of other traders by going through their trades.

For example, Marios downloaded all of Mark Minervini’s tweets to study his trades — why did Minervini go long when he did?

(This is something Qullamaggie also did, by the way — he went through every single tweet by Minervini to study his setups, entries, etc.)

Another important point Marios made is that this approach helps you take pride in your work and grow your confidence — because the work is truly your own. You made your own discoveries and drew your own conclusions. You weren’t spoon-fed.

Qullamaggie’s experience

The theme of ‘imitate before you innovate’ is common among successful traders.

To come back to Qullamaggie, listen to this rant. I still remember hearing it live, and how hard it hit then. I knew Kristjan was hard-working, but having it spelled out like that was eye-opening. As far as studying went, it made me up my game.

Kristjan also says that he “picked up bits and pieces and developed my own thing that fits my own personality”. This makes me think of my musician analogy earlier — you can develop your own style by mixing and matching.

Wisdom from Minervini

Qullamaggie achieved success in a remarkably short period of time. Undoubtedly, this is a testament to his dedication and hard work.

But it’s also important to acknowledge the tools available to the 21st-century trader that older traders never had.

As Minervini said at the end of his 2021 interview with Richard Moglen:

“The good news is that it’s a great time to be a stock trader — it’s a great time to be anything. [Because] the learning curve is automatically shortened. […]

“We have YouTube, we have the internet, we have Zoom, we have […] Twitter. [We have] all this exchange of information [now].

“When I started, there was nothing. I was going to the library, and I was reading books that were old and outdated and [on] strategies and techniques that never worked in the first place.

“So, it took me years and years and years of trial and error […] to figure it all out. […]

“But now, your learning curve’s been shortened tremendously. […] All the information is there. We have information overload now. There’s too much information.

“It used to be that you couldn’t find any information — now, you’ve got to figure out what’s the good information and what’s the bulls**t. That’s the big problem now! […] Narrowing it down to the good information.

“But that’s a better problem to have, I think, than no information.”

2. Do most work ‘off the field’

To quote Marios:

“A professional athlete may engage in a 2-hour game, but over 50 hours are invested in training and preparation before stepping onto the field. This preparation refines their technique and cultivates confidence and mastery.

“In trading, these are your ‘Deep Dives’ on the past and ‘Post-Analysis’ of your trades [and] watchlists.

“To refine your methods and gain confidence, prioritize studying as much as, if not more than, executing in the present. Many people forget that!”

Jeff Sun’s take

Jeff Sun, another USIC top performer (from the 2021 and 2022 competitions), made a similar remark only yesterday:

“Committing to a daily exercise routine to push yourself physically can help maintain your overall well-being and mental clarity. What you do after hours has a severe impact on your live market action. [Emphasis added.]

“I feel sweating out is the only way to enhance focus, reduce stress, and improve decision-making skills, all of which are essential attributes for optimal discretionary decision making in the stock market.”

And in a follow-up:

“Consistency doesn’t guarantee that you will be successful. But not being consistent will guarantee that you won’t reach success.

“Instead of spending time getting into the mood to start, just start working. There’s no better condition to start than starting itself.”

The main point

Though Marios and Jeff approach this from different angles, the main point stands:

Most of the work is done ‘off the field’.

That’s how you get consistent and build confidence.

And that’s how you optimise your performance.

To be at your best, physically and mentally, you have to be in a good place. Good nutrition, regular exercise and enough sleep are essential for that, along with a solid study routine.

Marios’s study routine

Once Marios had ‘woken up the researcher’ in him, which ignited his passion for trading — more on that later — studying became a “tradition” for him.

As he explained, studying has to become part of your daily routine, because trading is like a sport. You only ‘perform’ (trade) for an hour or two. The real work lies in your ‘training’ and preparation.

So, do those deep dives. Marios studied:

Other traders;

Big winners; and

Past trades (post-analysis).

3. Build procedural memory

As Marios explains:

“Professional athletes don’t rely on spontaneous decisions; they anchor their actions in technique.

“By outlining various scenarios, what may appear as an ‘on-the-spot’ decision is often a result of muscle or mental memory.

“In trading, your technique and decisions are embodied in your ‘Setups’. Operating without setups inevitably leads to randomness, causing both capital and mental exhaustion, as well as fear.”

This links well to a point Dave made in last week’s guest post: mechanics come first. That’s what keeps us in the game.

Or, as Stockbee puts it, you need a profitable setup before you look at anything else.

This is why you need a ‘playbook’ — a setup, with a statistical edge, you know inside out. A setup you’ve defined in a lot of detail, so you know exactly what you’re looking for in real time, and aren’t prone to random trading.

Mastery experiences

As I wrote in this Stockbee stack, you must spend significant time and effort to master a particular skill or field. In other words, you must gain ‘mastery experiences’.

For example, if you want to learn to trade bottom bounces, you need to study at least 500 bottom bounces.

The more you study what you want to learn, the better your understanding, and the easier you can identify it in real time.

Building procedural memory

Another concept brought to the trading table by Stockbee is building ‘procedural memory’.

That means getting to the point where you can correctly execute your trading processes without needing to think about them.

As Stockbee says:

“Procedural memories are implicit memories. They allow us to lower cognitive load. They are learned intuitions. […]

“If you read about trading or buy trading manual, you will not develop procedural memory. You develop trading-related procedural memory by doing actual trading. If you do a process thousands of times, you develop procedural memory.”

Stockbee is, of course, a huge advocate on doing deep dives — studying hundreds, if not thousands, of examples of your chosen setup.

But you must also recognise that gaining actual trading experience is another essential part of becoming a trader.

Some of it, you may be able to gain through a platform like TradingSim (which Marios used), but you’ll ultimately need to practise with real money to learn the psychological side of trading.

Just make sure you don’t risk more than you can afford to lose.

Minervini: you can’t force experience

Coming back to Minervini’s answer to Moglen, he made a similar point while talking about the modern-day shortened learning curve (58:13):

“It can be shortened only so much. You can’t force experience. […]

“Michael Jordan can tell you how to dribble and toss a basketball. But you’re not going to be able to be a professional basketball player without playing. And being in those situations, and having a certain amount of experience on the court and in big games.

“So, it’s the same thing. You still have to have a certain amount of experience, so […] make sure you understand that it’s going to take time. […]

“Make a commitment to it, and do what you love. That’s the main thing. If you enjoy it, then stick with it, and you’ll get great at it.”

Which leads nicely to my next point.

4. Find/spark your passion

In his TraderLion interview, Marios pointed out that we all start trading to:

Achieve financial freedom; and/or

Work without a boss.

However, at some point, you must find passion.

In Marios’s case, his passion was ignited through studying, and learning new things every day. As he calls it, through ‘reverse engineering’ the minds of other traders. That ‘puzzle-solving process’ sparked his passion.

Why passion is so important

As Marios said (9:48):

“[Passion] is important because there are going to be many times […] you’re going to feel disgusted with yourself. […] The market is going to hit you like a train and you’re going to feel lost.

“You really need to have […] that flame going.”

When you have the passion, you can get through the inevitable rough patches.

As Marios puts it, if you have that flame, you’re able to get through ‘moments of crisis’. It allows you to focus on your routine and long-term goals, and keep your mind on the positives to balance out the negatives.

Dan Zanger takes a similar attitude: you need passion. With Qullamaggie, we see the same thing: incredible dedication and passion.

It takes many, many hours to achieve mastery — at anything.

Trading is no exception, but it is different in that you can only make it by truly mastering your setup. (The good news is that you need to master only one to be profitable.)

That aside, we all have limited time on this earth. We may as well enjoy it while we’re here.

(My full ikigai thread, inspired by Jeff Sun, is here.)

Marios’s test

Marios’s test to check whether you have the passion is to ask yourself: if I made $20 million tomorrow, would I carry on trading or retire?

Of course, his answer — and that of any successful trader — is that he’d carry on regardless.

Marios loves the fact that he can learn something new every day.

Every day, he has an opportunity to improve. He considers this so “self-rewarding” that it makes him want to trade for life.

For more on this topic, see this stack.

5. Build mental resilience

Marios tweeted:

“Athletes have to operate under a set of boundaries and rules even after the most extreme occasions.

“Athletes need to bounce back and remain focused even after a set of in-game failures. Athletes fully accept that [doing] their profession requires them to operate in a constant failure and be okay with it.

“In trading, that is your ‘Mental Toughness’. If you do not develop mental toughness and you remain light-hearted [and/or] stubborn, you are set to fail.

“Trading is a constant failure environment. People who accept it early can remain focused; people who don’t are organically dropped out of the game.”

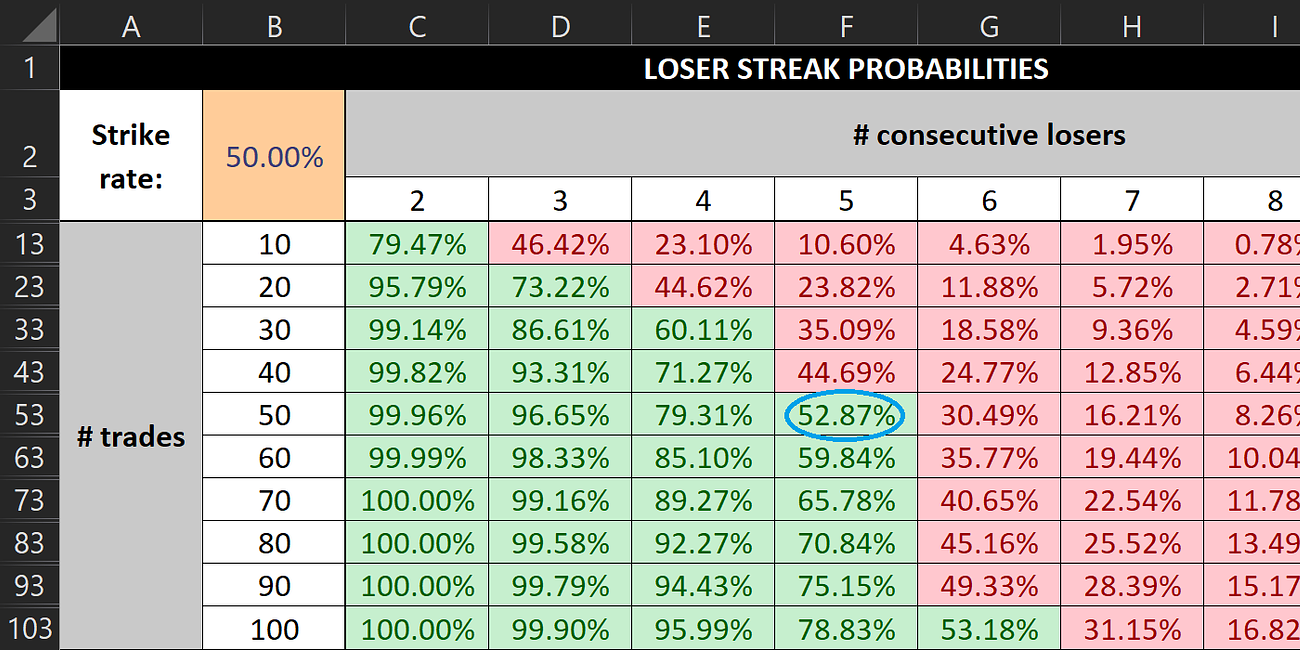

This aligns well to one of Marios’s Medium articles, in which he explains that many traders achieve great success with strike rates as low as 20–30%. That is, so long as they win big when they’re right, and lose small when they’re wrong.

However…

“Does being wrong 70% of the time feel good? Definitely no. Does it truly matter in making money? Again, definitely no. […]

“I can’t think of a single day in my trading career that I haven’t felt even a little bit frustrated. Because every day, the market has its ways of making you feel stupid. Because there [was] always a better, wiser choice or series of actions. […]

“Not getting it right does not feel good. And that is a reason why many traders quit. Because they can’t handle the unsettling feeling of not being optimal, the unsettling feeling of not being right.”

An athlete’s take

This reminds me of something Josh Waitzkin — a chess and tai chi champion — explains in The Art of Learning.

If you’re resilient, you can invest in your loss — be that a lost game or a losing trade.

Take it as a learning opportunity. Ask yourself:

What did I do wrong?

What can I do better next time?

How do I avoid repeating this mistake?

David Ryan’s and Mark Minervini’s perspectives

As David Ryan likes to say: investing in the stock market is like going to the ‘university of Wall Street’.

See that loss as a tuition fee you paid the market. And make sure you get a valuable lesson out of it — get your money’s worth!

Or as Minervini says:

“Persistence is more important than knowledge because skill can be developed, but nothing great comes to those who quit.

“Make an unconditional commitment to learning from the best and learning from your mistakes and you will not fail.”

6. Be adaptable

Just like an athlete adapts their approach to their opponent — without changing their core technique — traders must adapt to the market environment.

In other words, they must practise situational awareness.

As Marios says:

“Adaptability is key, as not every market battle is fought on equal grounds.

“Striking a balance between a concise technique and adaptability to your environment is indispensable.”

Frankly, I think that first line — “not every market battle is fought on equal grounds” — should be framed above every trader’s desk.

Take a key lesson from Dan Zanger:

Concluding thoughts

To recap, six ways in which you can treat trading like a sport are:

Imitate before you innovate

Do most work ‘off the field’

Build procedural memory

Find/spark your passion

Build mental resilience

Be adaptable

This list is by no means exhaustive, but it’s a good place to start.

While Marios was the main inspiration behind this stack, many others contributed too, including Dan Zanger, David Ryan, Jeff Sun, Mark Minervini, Qullamaggie, Stockbee, and others — including some non-traders.

In fact, this is probably my most ‘collated’ stack to date. The largest number of people whose ideas I’ve gathered in one place.

I think that reflects my own growth.

As time passes, and I become more experienced as a writer and trader, I’ve come to realise two key things:

1. You add more value by connecting ideas than by regurgitating them

This may be selfish of me, but I now prefer to write stacks that connect different ideas, as opposed to present ‘straight’ notes.

(I also suspect that AI can soon do that faster than, and as well as, a human can.)

So, that’s what I’m moving towards. Connecting ideas from different people and resources. Joining the dots. And doing it in public.

Perhaps Kieran Drew has influenced me on this too:

“When you write to teach others, you lose the personal touch. But when you write to teach yourself, you understand precisely what needs to be said and how to say it.

“Selfishly write, selflessly share.”

I think he’s right. I very much believe in not paywalling my Substack (selflessly share), but am arguably not thinking enough about what I want to learn. That may be to the detriment of both my writing and myself.

2. Different disciplines overlap more than you think

Another huge thing I’ve realised is that you can learn valuable trading lessons from non-traders, and vice versa.

(Which is arguably just an extension to point 1.)

Maybe that’s because the top 5% in any field largely have the same mindset, and share a handful of core principles.

Or maybe I’ve completely got the wrong end of the stick here.

Either way, expect to see more of that, too. If I come across ideas from non-traders that I believe can help me as a trader, they’ll make an appearance here, on my X/Twitter feed, or both.

And if it simultaneously helps me grow as a writer, all the better.

I hope you’ll join me on my journey.

Listen to this stack

More content like this

All my stacks relating to mindset are here.

The Trading Resource Hub’s full archive is available here.

This is awesome. Thanks Kyna

Thanks a lot Kay awesome content!