Discover more from The Trading Resource Hub

How to Cultivate Intuition

Lessons from Qullamaggie, Marios Stamatoudis, Josh Waitzkin, and others

Audio available at the end of this post.

If you want to see a trader’s intuition in action, look no further than Qullamaggie’s streams.

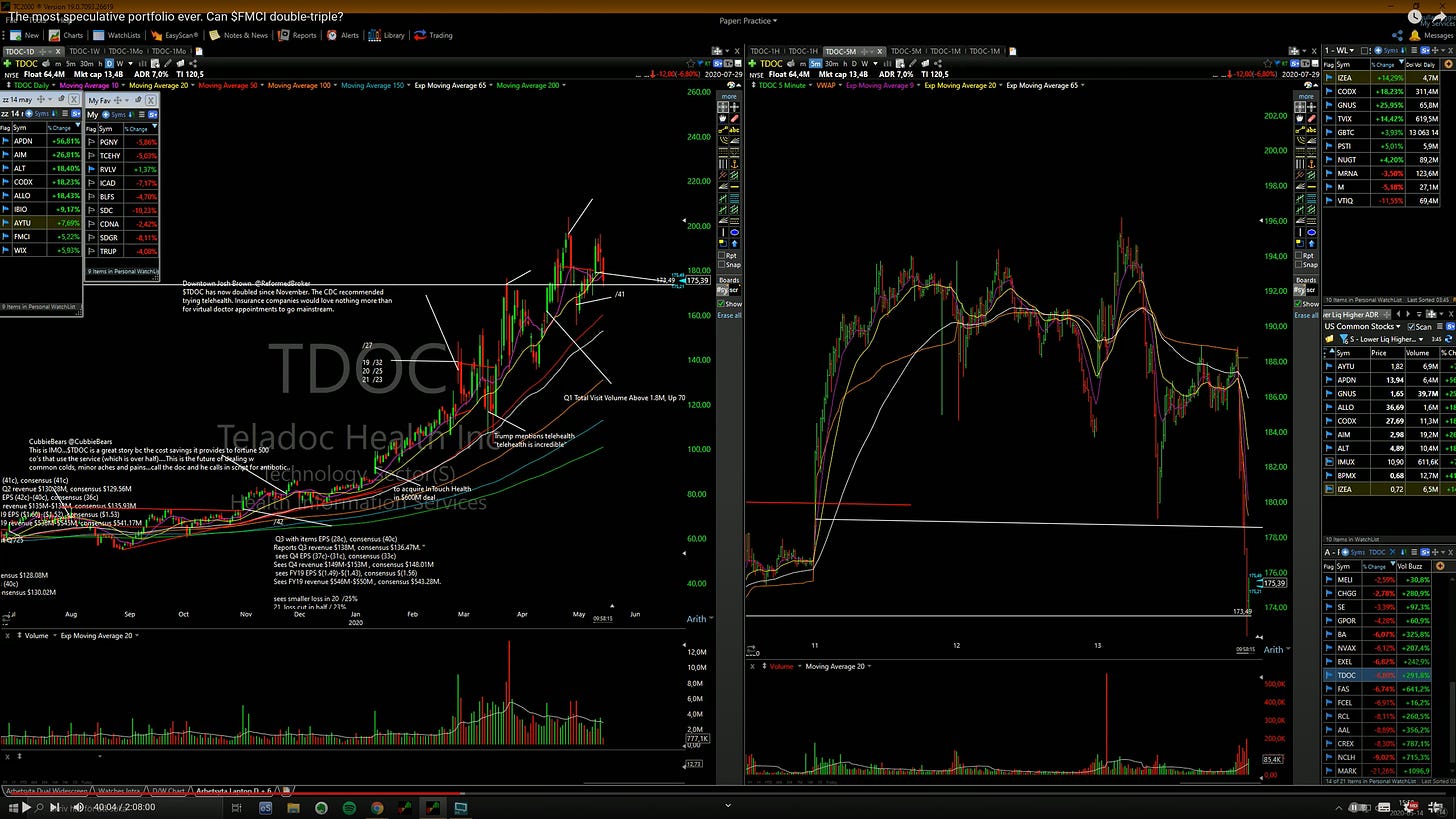

Take 14 May 2020 as an example:

From 40:00, Kristjan expressed relief at having sold $AMD and some $TDOC a few days ago, before both suffered big price drops:

As he says: you’ve got to see these things coming. You’ve got to look at “the signs”. Here, the signs were the bear flags Kristjan was seeing 2–3 days before this stream, about to break down.

In his words: “I just felt it in my bones.” So, he (partially) sold several of his positions.

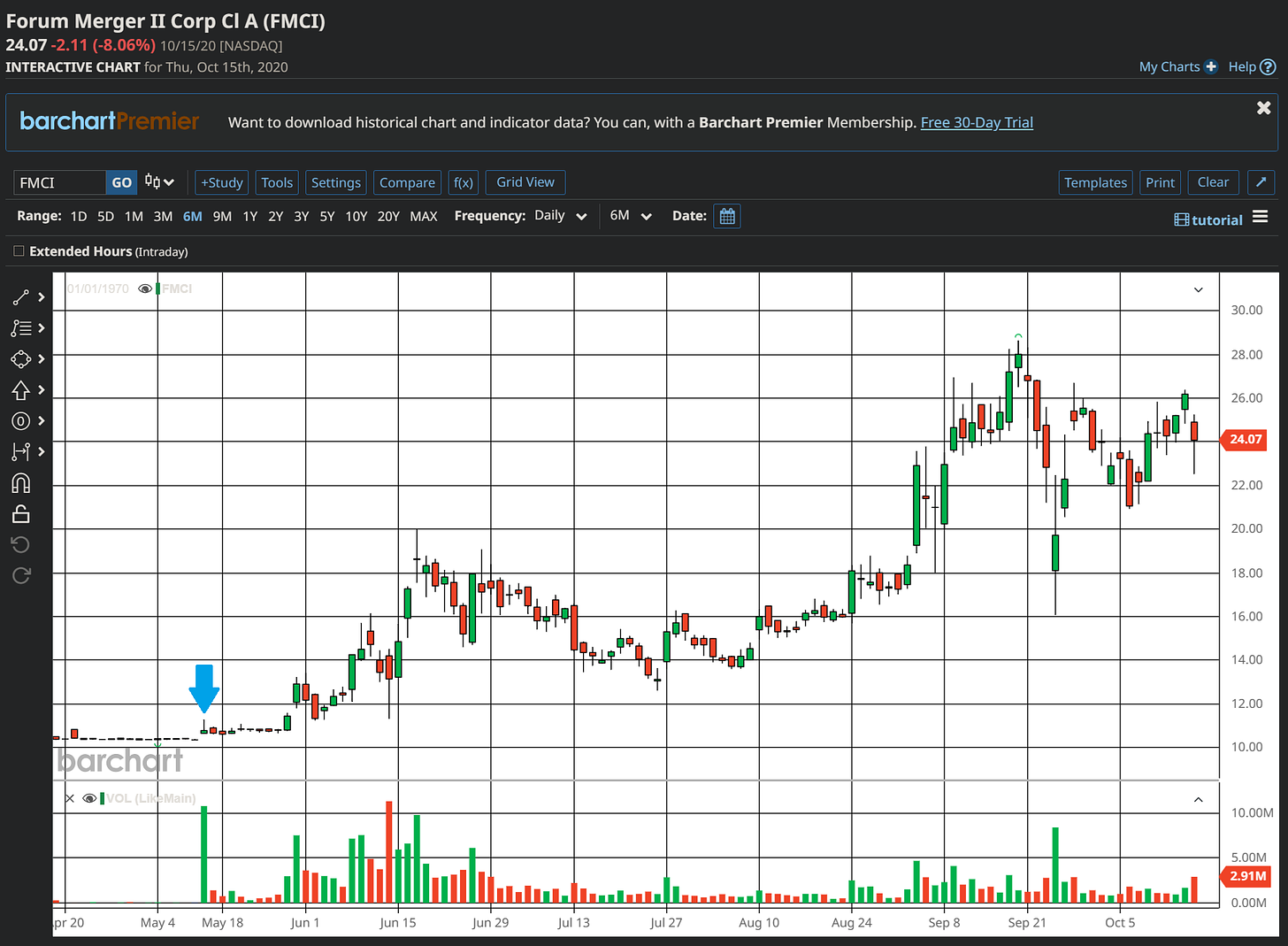

As another example, from 1:37:03, Kristjan was buying $FMCI during the stream:

And on a shorter time frame, after he’d stopped buying:

Kristjan said he felt this stock could go to $20. And having the catalyst — speculation about a merger (see the note on his screen) — probably added to that feeling.

Was he chasing? Yes, a little.

But, as he said during the stream, this type of speculative stock has the potential to make a huge move, with phenomenal risk-to-reward, particularly given the risk-on market at the time. Such markets don’t come round very often, so if you’re ever going to take risk, that’s the time to do it.

Kristjan also said “I’ve seen it before” and “I just have a feeling”.

The stock has since been delisted, but when you look at the historical chart, you can see Kristjan was right. The stock did go to $20 and beyond, but Kristjan was two weeks early with his buy during this stream (see the blue arrow):

I urge you to watch this stream — if not all of it, then at least from 40:00 and 1:37:03. Watching Kristjan in action like that provides an education hard to get elsewhere.

These segments also offer a good introduction to the main topics of today’s stack: the layers within trading and a trader’s intuition.

How important is a trader’s intuition?

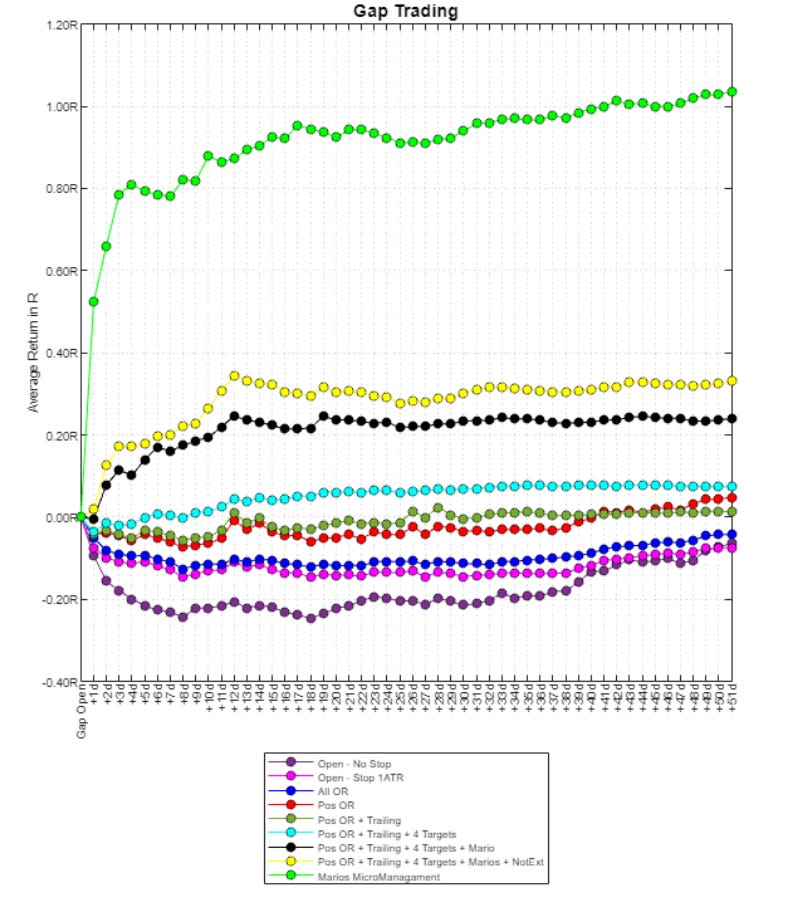

I normally pin down my stack topics about a week ahead of publication. But this week, I was halfway through an unrelated stack when Marios Stamatoudis shared this image:

Marios’s full tweet explains the details of the study he took part in. The above is a preview to the paper he’s writing with Concretum Research.*

Anyway, intuition is a topic that’s been lingering on my mind for weeks now. This is reflected by how I’ve touched on it in the odd paragraph in recent stacks, including last week.

But Marios’s tweet triggered so many fresh ideas I wanted to explore, I decided to start this week’s stack from scratch two days before publication.

*I haven’t read the full paper yet, as it hasn’t been published at the time of writing, so the above is solely based on what Marios and Concretum Research shared in their tweets [1] [2] [3], and on what Marios shared in private messages to me. Note that the study accounts for only one trader (Marios); however, Marios went through around 10,000 gap ups — every gap up that occurred between 2016–2023, with a price above $2 and some volume parameters.

What makes this study interesting?

First, it offers concrete, tangible evidence that an experienced, human trader can significantly outperform mechanical strategies around the same setup: trading gap ups.

Second, and more importantly, Marios was able to outperform without the information we all know to be essential pieces of the trading ‘puzzle’:

Market environment

Theme or sector

Fundamentals

Volume

News

And this was while trading gap-up events! In case you needed a reminder: these are driven by the very catalysts Marios had no access to during this study.

The relationship between setup and edge

To my mind, being able to outperform based on price alone adds an important nuance when it comes to the role of a setup in a trader’s edge.

No, setup ≠ edge.

But how well you read price action — even without access to other information — is a perceptible determinant in your strategy’s profitability.

Which is, of course, part of the reason Stockbee keeps hammering on about doing a deep dive. Study thousands of examples of your chosen setup.

Depth creates edge.

How and why does technical analysis work?

Well, as they say: only price pays.

Price reflects the laws of supply and demand. Price is, as Marios points out, the “unfiltered raw data” that reflects the market’s “true mechanics”.

The question of whether chart patterns actually matter also cropped up in a recent interview I wrote up for base.report. Shan, the interviewee, talked me through a study he’d conducted that provided supporting evidence.

(As I often say, to build conviction, you must do your own research. Don’t just take someone else’s word for it.)

But price isn’t an absolute. If you look at price or setups as a means of predicting the future, you misunderstand the purpose of technical analysis.

As Marios says:

“Prediction is not our true edge. […] Forget about prediction and start thinking in terms of dynamics, inner mechanisms, odds, and timing.”

Marios outlines two layers in trading:

First layer

Setups

Basic execution

Basic risk management

Second layer

Finding and fixing the inefficiencies in how you implemented the same ideas from the first layer.

The information itself isn’t different. The difference lies in how you interpret and process it.

Which leads to different conclusions based on the same information.

How come?

To quote Marios:

“[The more profitable] trader has a better, more cleanly structured database of events stored in their brain.

“A superior database enables better application of selectivity, [which leads] to better results. Studying only a strategy and its parameters isn’t enough [for outperformance].

“To truly excel, you must study stock market history through the lens of your strategy, seeking out commonalities among the best-performing setups.

“That is how you build your own superior database.”

Jeff Sun seconds this:

“Achieving proficiency in retaining that database of information in your mind requires adherence to your daily routine and rituals. Engage in reviewing daily scan charts for new watchlists or charts post-scans to track their progression.

“This skill isn’t something that can be taught, nor does it demand a degree in rocket science. It demands diligence and consistent daily effort.

“You can’t rush proficiency in trading.”

I’d like to add that while this isn’t a skill that can be taught, it most certainly can be learnt. Through consistent, manual effort, concentrating on the hard stuff.

In other words, through deliberate practice.

Four keys to ‘unlocking’ the second layer

1. Find inefficiencies in common risk management tactics

Then, adapt them to your system.

When I asked Marios if he could elaborate with an example, he offered the following:

“Classic breakouts on momentum stocks have a slight edge erosion, thus a lower win rate, as so many people now trade them.

“The only way to hedge against edge erosion (low win rate) is improving your risk-to-reward ratio.

“For example, you could use tight stops — after all, fail rates don’t have a linear relationship with the tightness of a stop.

“This sounds simple. In fact, it can be simple. Tighter stops, allowing for larger position sizes, are a good example of a potential inefficiency you can quickly take advantage of.”

Speaking for myself, tightening up my stops massively improved my own results. What gave me the confidence to do so was calculating my maximum adverse excursion (MAE).

2. Improve your situational awareness

You can then use it to control risk and determine how aggressively you should be trading.

3. Improve how you implement your ideas

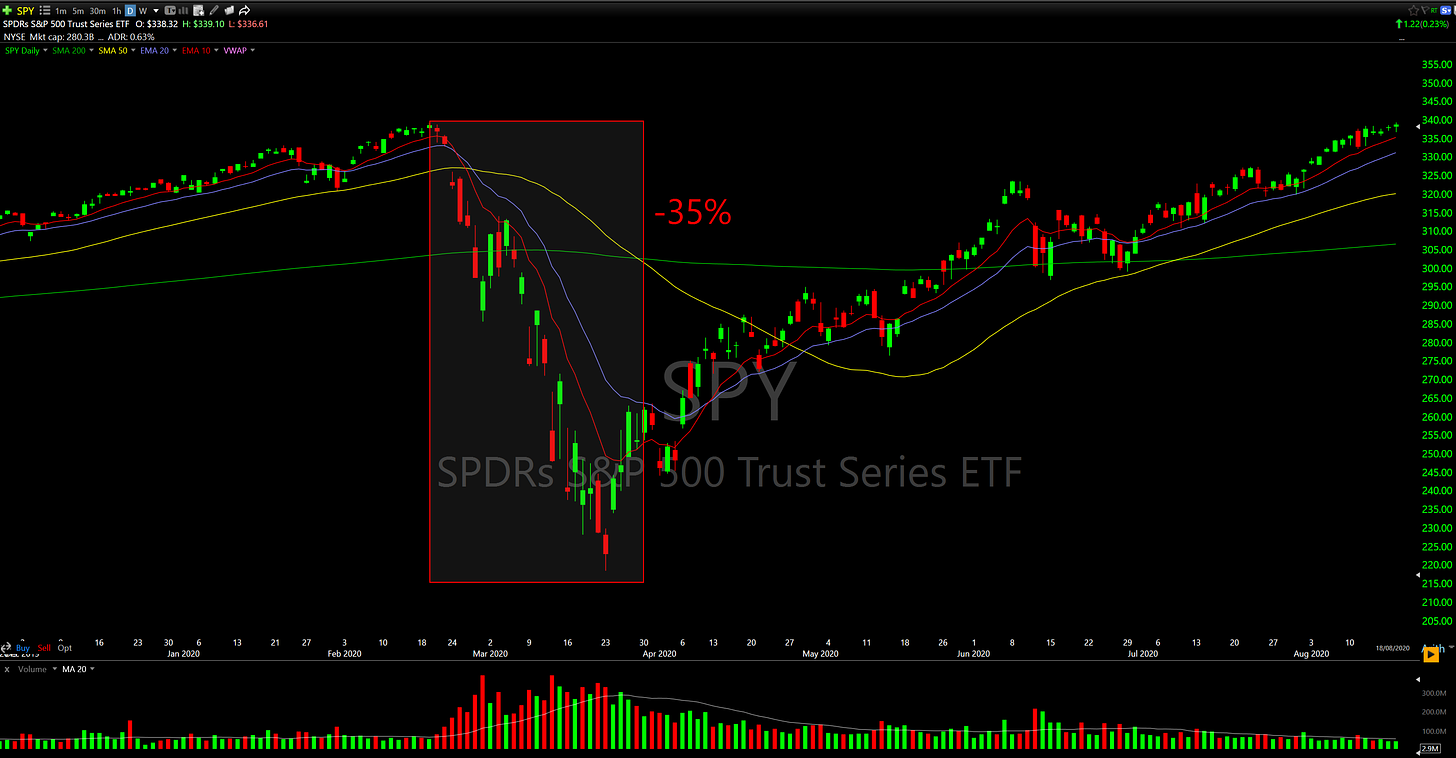

For instance, if you’d anticipated a correction in early 2020, you had various options, including:

I. Shorting $SPY

II. Shorting $TQQQ

III. Going long $UVXY

This is Marios’s wider point:

“Different implementations can significantly change your results, even if you have the same profound idea about a probable event, emerging theme, etc.

“Choosing the right vehicle at the right time is truly important in trading, which goes way beyond setups.

“You’re connecting the dots through time to supercharge your ideas with a bit of luck in efficient ways.”

You can’t always execute your ideas, and you’ll usually not be in the most efficient ‘vehicle’, but even just thinking about these questions puts you ahead of those who don’t consider them.

4. Deep studies of the market

This one is particularly important for enhancing your intuition, and reaching a much higher level as a trader. Studying deeply and consistently are key to improving the mental “database” of events/information Marios and Jeff refer to.

But what are other ways of building or improving this database?

‘Chunk’ the information

This means you’re grouping information that belongs together — because they share certain patterns or principles.

Chunking allows an expert to take in and process more information than an average practitioner. Both might have the same number of ‘mental files’ stored in their brain, but the expert has stored more pieces of information within each ‘file’.

The edge lies in being able to access each ‘file’ as though it were a single piece of information — because, to the expert’s brain, that information belongs together.

Examples in trading

One obvious example in trading is how an experienced trader will never look at tickers in isolation.

So, if they see $NVDA set up, they’ll automatically check other AI/semiconductor names too. Think about Anthony Shi’s suggestion from last week: build watchlists limited to ~5 tickers, and get in the habit of checking what the other 4 stocks are doing when a name on that list is doing something interesting — e.g. breaking out.

Plus, when you think ‘$NVDA’, you should immediately also be thinking about its theme, approximately what the chart looks like, the fact it’s a liquid mega cap, etc.

But you don’t store the above as isolated pieces of information — you put them all together in the same file.

Studying Qullamaggie

As another example, think about the Qullamaggie streams. As I’ve said before, I think the biggest value comes from watching them — not just listening to what Kristjan says.

Specifically, I find it fascinating to watch him look at one chart, rapidly check a bunch of other names from memory, then make the decision whether to pull the trigger — usually within the space of a few seconds.

It’s an astounding display of the volume of information he can correctly process in a very short amount of time. This is obviously the result of:

Extensive, hard studying;

Lots of practice; and

Intuition.

Delving into the mechanics of intuition

My belief is that intuition plays a role in every field at the highest levels.

Marios likened intuition to “a kind of brain-based machine learning”. It involves subconscious processing.

But why? Why subconscious?

I believe this is the inevitable result of the sheer volume of information you have to be able to usefully process if you want to reach the top of your field.

Josh Waitzkin described the conundrum eloquently in The Art of Learning:

“Once we reach a certain level of expertise at a given discipline and our knowledge is expansive, the critical issue becomes: how is all this stuff navigated and put to use?”

As I continue on the road towards mastery of my chosen field, I appreciate Josh’s book more and more.

It clearly helps that the author is a multi-disciplinary champion, where the disciplines appear unrelated: chess and tai chi. This alone suggests that Josh has figured things out about the process of learning that others have not.

Generalising his process, you start with the fundamentals so that you gain a deep understanding of the principles of your chosen discipline.

Then “you expand and refine your repertoire, guided by your individual predispositions, while keeping in touch, however abstractly, with what you feel to be the essential core of the art”. Avoid internal conflicts.

The result: a neural network

To quote The Art of Learning again:

“What results is a network of deeply internalized, interconnected knowledge that expands from a central, personal locus point.

“The question of intuition relates to how that network is navigated and used as fuel for creative insight.”

This image illustrates such a network:

Marios suggested that I add the above image to this stack. He also said:

“The more experience you gain, the more data you store, the more multi-level connections your brain makes, and the bigger the chance you can quickly find multi-chain events and actions going forward.

“Intuition has a lot to do with quick and efficient actions, or having some profound idea without a clue as to where it came from.

“You see it in top athletes [and other performers], where they do remarkable things without thinking about them. You also see it in trading.”

The mechanics of creativity

Marios’s point about doing “remarkable things without thinking about them” links to creativity. And actually, the mechanics of creativity — outlined in the list below — aren’t that different to the mechanics of intuition:

Acquire the knowledge.

Internalise this knowledge so deeply that you can access it without thinking about it.

You then make a discovery — a leap that takes what you know one or two steps further.

Find the connection between that discovery and what you know. It must exist.

Figure out the technical components of your creation.

Use those components to add your discovery to your existing knowledge, and trigger your creation at will.

(I learnt these principles from The Art of Learning, but adapted them to create my own step by step. May as well put my technical writing experience to good use.)

Thank you for reading! Before we get into the final section for today, a quick request.

Since you’ve made it this far, chances are you find my writing valuable.

This Substack will never be paywalled. I made that decision from day one. But I’d love it if you bought me a coffee.

Many small fixes lead to potent improvements

Money isn’t the only thing that compounds. Skills, habits and little improvements do, too — by working on all four keys outlined earlier, for example.

As Marios says:

“Great performance lies in small tweaks to commonly available knowledge, rather than trying to find ‘new rare’ knowledge in setups and strategies.”

This applies outside of trading, too. Nicolas Cole (the writer) tweeted:

“Being creative is all about pulling from people who came before you, learning from their strides (and stumbles), and then evolving.

“Too often, people ‘try’ to be creative and make something in a vacuum — a dark room with zero inspiration and no outside influences.

“While that can be an effective exercise from time to time, what’s much more effective is to study and pull from others’ work. Chances are, someone has already tried what you’re creating, and you can save yourself a lot of unnecessary time by studying their process as you continue to explore your own.

“As the cliché goes: ‘Good artists copy. Great artists steal.’”

This all ties into things I’ve said before:

Imitate before you innovate.

Edge lies in noticing things other people miss. Everyone can see/do the surface stuff, so this doesn’t give you a competitive advantage. Edge lies in doing the hard stuff. In going deep.

Free, useful information is abundant. Question is: how are you getting more out of it than 95% of traders?

The path to success is no secret. But it’s also difficult, narrow and long. So, make sure you enjoy the process — not just the prize. Finding fulfilment in the process is the mindset of a professional; only seeking the reward is that of an amateur. Choose which you want to be.

Listen to this stack

More content like this

Support my work

Enjoyed this stack? If you’d like to contribute financially to say thank you, please buy me a coffee.

You can also help out by liking, commenting on and/or sharing this stack. They all help spread the word!

Amazing article! Thank you so much for writing this

Thank you so much for sharing your articles publicly for free. They are incredibly helpful, and I feel lucky to have come across your Substack. You may not realize it, but your work is truly appreciated. 🙏