Deliberate Practice: The Shortcut No One Wants to Hear

3 ways in which manual effort beats automation

Audio available at the end of this post.

1. Journaling

I once — and only once — tried dedicated journaling software. Can’t remember which one (this was more than three years ago), and it was only a free trial.

I hated it.

How I started: pen and paper

For context, I started out journaling trades by hand. Literally just pen and paper. Nothing ‘fancy’ — I just logged ticker, number of shares, entry price and date, exit price and date, and P&L — but it made me conscious about every single trade I placed.

If I traded, I had to log the trade — by hand. And whenever I flipped through my notebook, the bad trades would always be there, staring me in the face.

I considered that a good thing. It put me off placing bad trades.

Switching to Excel

I switched to Excel around the same time I transitioned from trading UK to US stocks. I was more serious about trading by this point, and thought using Excel would help:

Speed things up; and

Up my game.

But my Excel skills were non-existent then. It was basic formulas throughout, and I was still nearly a year away from starting quantitative analysis.

Testing journaling software

So, I tried out dedicated journaling software.

Step one? Export your transactions with your broker, then import them into the journaling software. Simple!

For my liking, too simple.

Suddenly, I didn’t have to look my bad trades in the eye. They’d just blend into my other trades.

Balancing manual work against automation

Automation has its place. I like Excel formulas. I like quantitative analysis. Learning how to crunch my numbers helped me build discipline and conviction — two extremely valuable lessons.

But I must also confront the reality of my own trading. So, for me, manual entry is non-negotiable, because:

If I’m reluctant to log a trade, my brain (or subconscious) is telling me I shouldn’t have taken that trade. It suggests I broke a rule somewhere — too much open risk, bad market environment, not a playbook setup, etc.

You’re putting in more reps. You’re expanding your ‘brain-based database’. It helps you develop a ‘feel’ for what your winners or losers have in common.

Developing intuition

The above contributes to developing your trader’s intuition. You’re gaining the necessary experience in, and building up the knowledge of, individual activities and concepts.

As you grow in experience and knowledge, things start clicking for you.

You start ‘chunking’ information. In other words, you’re grouping information that belongs together, and increasingly getting to the core principles behind:

Trading and the markets in general; and

Your trading style.

You’re increasingly internalising the things that truly matter. This allows you to get to the ‘heart’ of your style.

And the better you’ve internalised those core principles, the more successfully you can apply discretion to your trading.

Connecting to your data

Dave, who guest posted on this Substack about how to analyse your mental state in a quantifiable way [1] [2], has his own perspective on this:

“I literally feel connected to my performance data — the good, the bad and the really ugly. Trading is such an integral part of me that I don’t see myself as separate from my data.

“A colleague recently told me that I am too close to the data. That I take it too seriously.

“But I view it as a mirror to my behaviour — mechanical and mental. How can I not take it seriously given that it is me?”

I personally wouldn’t describe myself as having this deep a ‘connection’ with my data, but I do understand Dave’s perspective. More to the point, I think his perspective adds another layer of importance to including a manual component when you journal.

Your numbers represent you as a trader. Spend quality time with them.

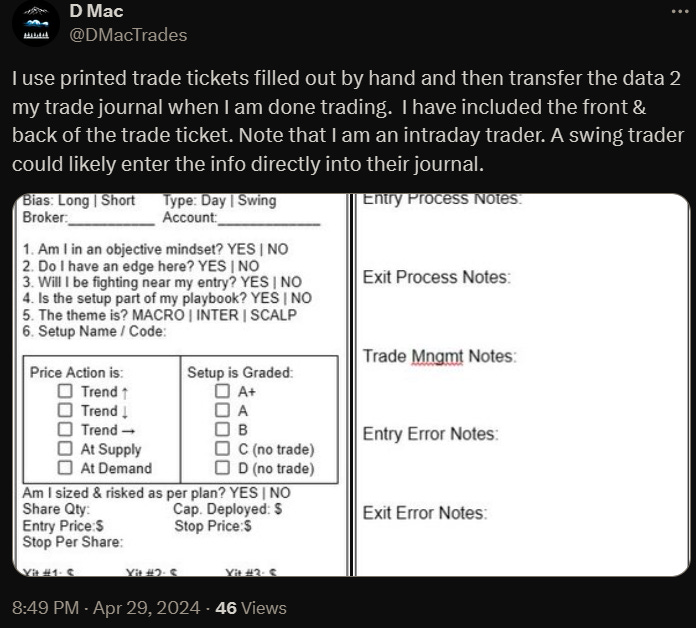

Printed trade tickets

Dave and I take similar approaches in that we automate our data analysis, but log our trades manually. More specifically, Dave uses printed trade tickets:

Dave added to me:

“The manual component of my journaling, to include the manual filling out of printed trade tickets, is hugely significant to me.

“My personal opinion is that the best way to be deeply connected with our trade data, both mechanical and mental, is via manual journaling.

“I’ve used both automated journaling platforms (where your data is uploaded directly) and manual journaling in Excel, and the manual approach wins every time.

“If trading less, being more patient, having a more macro viewpoint of your playbook, being more self-aware and having a strong basis in data analysis are an edge, then Excel improves my edge because it facilitates all those things.”

2. Building watchlists

Following his recent TraderLion interview, Anthony Shi did an AMA — ‘ask me anything’ — in the Qullamaggie Discord.

One of the things Anthony advised, if you’re trying to get to grips with sectors and themes, was to manually create watchlists for different sectors or themes. And to sort them by relative strength.

Emphasis on ‘manually’, so you’re getting the reps you need at that stage. To quote Anthony:

“This is the exercise that will turn you into a stock picking expert.”

And the better you pick stocks, the better your performance.

(Where needed, stugots’s watchlists can offer a cheat sheet. But it’s important you do your own work. There’s no shortcut to experience.)

Effective use of automation when manually building watchlists

Clement Ang, another competitor in this year’s US Investing Championship (USIC), shared a similar view with me:

“I feel that manual chart screening and manually building/maintaining watchlists are much more efficient than automation.

“I think many misunderstand the value of an automated dashboard with a lot of market information. For me, an automated dashboard just gives me a quick top-down overview of the state of the market.

“Occasionally, it also helps me identify a strong-performing sector I’ve missed — but this is rare.

“Most importantly, my dashboard gives me confirmation that I’m in touch with the market. For example, I saw silver ETFs being the top performer on a past-5-day basis, and I was already positioned in those.

“This is feedback to myself: it tells me that the bottom-up stock screening/chart flipping I’ve done is working.”

I really like this approach.

Clement uses automation as a way of doing independent analysis of his manual work.

More specifically, he’s using automation to collect feedback about his manual analysis that’s independent from just his P&L. Smart!

The problem of using P&L alone to read market health

Naturally, P&L is a useful gauge of how well you’re reading the market.

There’s a reason why traders like Mark Minervini and David Ryan say that whether or not their most recent trades have been working provide them with vital information on overall market health. If your trades stop working, this may suggest a change in the market, going from conducive to hindering for your strategy.

But this assumes you’re not missing things. Which, of course, many traders do, at all levels of the game. As Anthony said in his TraderLion interview (38:57):

“If you only look at your trades, you don’t know what you’re not seeing.”

It’s akin to the error made during World War II, when the Allies examined returning aircraft damaged by enemy fire. They wanted to identify which parts of aircraft suffered the most damage, on the assumption that these were the areas most requiring additional armour, so fewer planes would be lost.

The problem? Survivorship bias. The Allies weren’t looking at aircraft that didn’t return at all.

In fact, if a plane took a lot of damage to certain areas and nonetheless returned from its mission, that suggests these areas are least in need of reinforcement, if the goal is to have more aircraft return from missions.

3 benefits of manual charting and watchlist creation

Coming back to Clement, he explained that, to him, there are three benefits to manual chart-flipping and categorising them based on perceived market opportunity:

Situational awareness. You “frame the opportunity” (Clement’s words) as to whether the market environment is favourable to get aggressive.

You get a better ‘feel’ (i.e. you develop your intuition) for the character of individual stocks or groups of stocks.

You get more reps in for identifying proper setups, and train yourself to pick up on nuances — a core principle behind an edge.

Clement also suggested maintaining a watchlist of index ETFs as a way to start, if jumping straight into manually creating watchlists for different sectors and themes feels too overwhelming at first.

It’s always better to do something, anything, than not get started at all — I’ve written about that before.

But the sooner you do the ‘dirty work’, the better! You have to put in the reps if you’re serious about becoming a good trader.

What if I tried to do this and I got overwhelmed?

This question came up in Anthony’s AMA. Specifically, someone asked (I copy-edited):

“When you have those watchlists in place, what does your daily workload look like? Do you go through all those hundreds of tickers daily? Or do you just look at the top 10 (or 20, or 30) gainers of each watchlist to get an idea of what’s moving?

“A problem I personally have is that I get overwhelmed by all the charts out there. It’s hard for me to put it all together.

“How do I take the information hundreds of stocks are providing, and come up with a clear and easy way to interpret it all?”

Anthony suggests you just keep at it. Be persistent — not just for chart review, but also when reviewing trades, doing deep dives, and so on.

He also gave some concrete tips:

Focus on one thing per week — for instance, concentrate on relative strength only. In Anthony’s own words: “Slowly things will unblur.”

Limit each sector watchlist to just five tickers (or so). This also makes it easy to compare different groups against each other.

As another benefit to these sector watchlists, if you see a stock break out (or down) during market hours, get in the habit of checking the other four names on that watchlist — are they moving too? This way, you might look at:

50 charts a day;

250 charts a week; and

Over 1,000 charts a month.

Just run one scan, looking at the biggest movers of the day, then look at other stocks in the same sector or theme and start building watchlists that way. This might take just 15 minutes a day, but after 2 weeks, you’ll have watchlists for all the major/strongest sectors!

These are just examples of breaking up the process into more manageable-feeling steps. You’re still getting the reps in, but aren’t feeling too overwhelmed.

You may be able to think of different ways to achieve the same thing, or break things up even further.

Just make sure you pivot to doing that grind as quick as you can. The quicker you do the hard stuff, the faster you’ll reap the rewards.

Introducing automation

Again, automation is something you should only look to do further down the line. I think this true for both watchlists and journaling. For the latter, this happened by accident for me, for which — in hindsight — I’m very grateful.

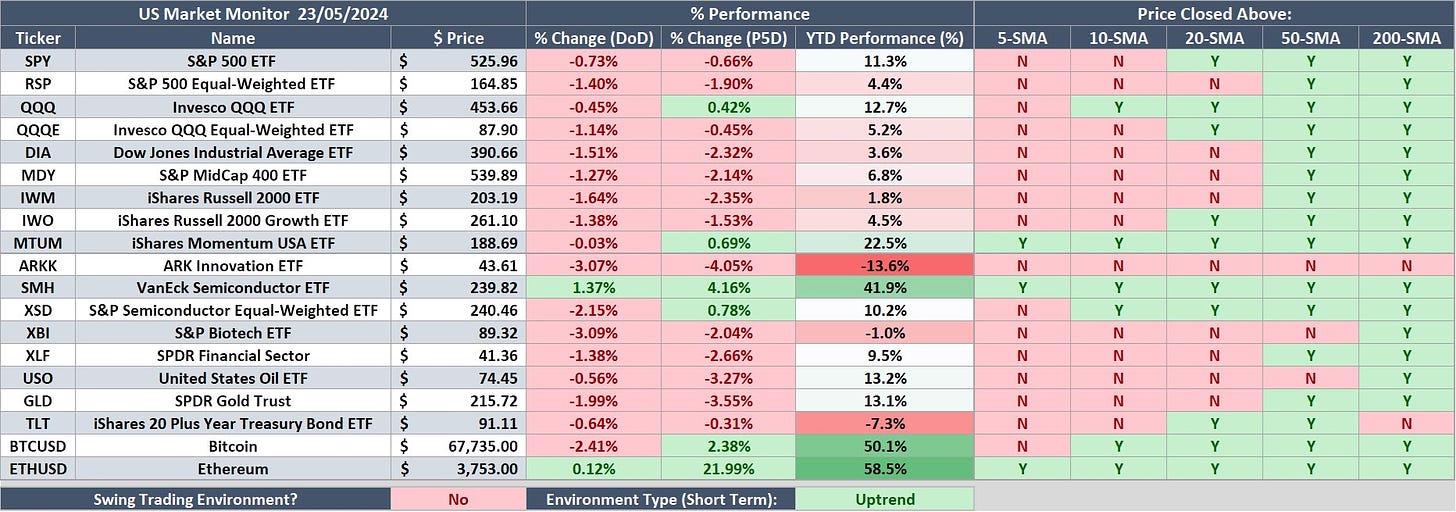

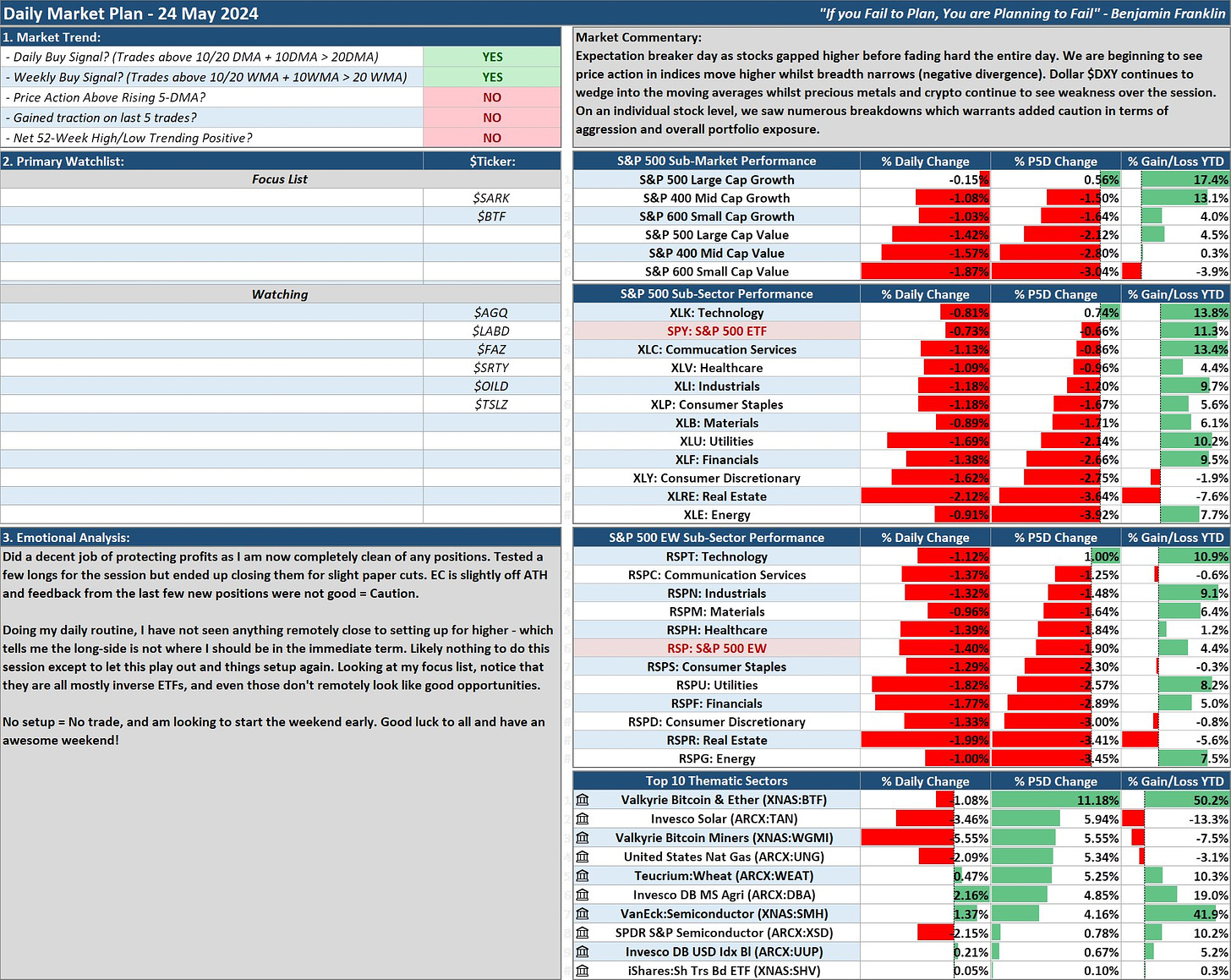

Anyway, market overview dashboards. Here are some examples from Clement, for 24 May 2024:

If you’re looking to build something similar for yourself, in Excel, this tweet from Jeff Sun may help.

Combining manual charting, automated dashboards and P&L

Manual charting (and watchlist-building) can combine well with automated dashboards for the purposes of obtaining feedback.

But what if you also added P&L into the mix? Specifically, the Minervini approach of analysing your equity curve and/or past few trades?

As Clement pointed out to me, when you add this on top of manual charting and checking your dashboards, you end up with a very solid routine that:

Identifies and executes opportunities when available;

Gets feedback on those opportunities/trades; and

Moderates your aggression in the markets.

Points 1 and 2 are your offence. Point 3 is your defence.

3. Deep dives

Every serious trader has done a deep dive of their setup.

After all, as I’ve said before, edge lies in the details. In the things other people miss. Otherwise, how can it be a competitive advantage?

What is a deep dive?

If you’re unfamiliar with the term, here’s a 2½-minute explanation by Stockbee:

As Pradeep says: if you’re a beginner wanting to shorten your learning curve, the “first thing” you should do is a deep dive.

Want to trade stocks that can move at least 20% within a week? Go back five years and study every stock that made such a move, in such a time frame.

(To do this study for current movers, use these scans. Pradeep recommends performing this exercise daily. It tells you what’s actually happening in the real, dirty market. Textbook setups only get you so far.)

Collect as many examples as you can

Look at thousands of examples of your chosen setup. The more examples you look at, the deeper your understanding, the faster you’ll learn, and the quicker you’ll start making serious money.

This type of exercise — particularly when done for historical examples too — teaches you:

Variations of your setup;

How the setup acts under different market conditions; and

How you can capitalise on your setup in different market conditions.

Oh, and collect your examples in a pattern book. As Marios Stamatoudis says, the books you write yourself — intended to teach yourself — are the ones that “truly save you”.

That sounds like a lot of work!

Yes, that’s the point. If everyone was prepared to do this, everyone would be banking.

Oh, and by the way, the work doesn’t end with your pattern book. To quote Pradeep:

“Once you[‘ve done] a deep dive and you master a pattern[, the] next challenge is to execute it in [the] real market environment.

“This requires innovation and process flows.

“You try one way of doing it[, and] if that does not work, you try another way [— until] you find [a] way to do it.

“Process hacking is how humans develop ways to make things work.”

And yes, along with the deep dive itself, this takes time and effort.

Which makes it vital you don’t just enjoy the money at the end.

You have to enjoy the journey, too.

If you don’t, you’ll never stick it out. Trading is a tough business, with a lot of ups and even more downs. Most people just aren’t cut out for it.

Furthermore, goalposts move. To my mind, your ‘big goal’ only serves one purpose: giving you a direction.

A Substack analogy

Yesterday, this Substack had its first anniversary. I also passed 2,500 subscribers earlier this week. It got me to reflect on a massive lesson I learnt over the course of this past year:

If you genuinely keep pushing, you’ll never stop re-evaluating your understanding of ‘good’.

For me, this has meant that the better I got, the wider the gap became between where I was at that moment and my understanding of what constitutes ‘good’.

In other words, I kept moving the goalposts for myself. (In terms of the quality of my work — I don’t have a target number for subscribers.)

And that’s okay.

Because I’m enjoying the journey and, to my mind, moving in the right direction.

Looking for a shortcut anyway?

First, I want to reiterate that for the three areas I’ve discussed today, doing the manual work is the shortcut. This is your ‘hack’ to learning as fast as possible.

But you can further speed up the learning process. By working on your self-efficacy.

This term was coined by Albert Bandura, and is defined as:

“People’s judgments of their capabilities to organize and execute courses of action required to attain designated types of performances.”

You’ve got five sources for building self-efficacy:

Mastery experiences

Vicarious experiences

Social persuasion

Visualisation

Psychosomatic state

I’ve discussed all five in more detail in this stack.

The core principle: deliberate practice

Putting in the reps isn’t just about putting in the time.

It’s doing the right type of work: deliberate practice.

You’ll learn more from doing one deep dive than from reading hundreds of trading books, even though both take a similar amount of time. It’s not hard to be busy, particularly in a world of social media.

But one is much harder than the other.

Reading hundreds of books is an example of what Cal Newport describes as “challenging but tractable”.

Giving a little more context, people like to write stories about the things they want to be true, which are usually challenging but tractable. It’s not easy, but it’s doable.

The hard stuff is deliberate practice. You have to put yourself through the discomfort of stretching your capabilities. Of agitating your brain.

Otherwise, how could you possibly be growing?

You have to get uncomfortable to improve.

For an aspiring trader, there’s no need to ‘write your own stories’. The path to success is very clearly defined, starting with a deep dive of your setup. You really don’t have to listen to many Qullamaggie streams — the most transparent successful trader around — to figure that one out.

Yet people still look for a shortcut — not realising that the deep dive is the shortcut. Qullamaggie became profitable much more quickly than is considered ‘the norm’, because he did the hard and, crucially, right work.

As another example, of late, Richard Moglen seems to have interviewed a lot of successful traders who are remarkably young, including Marios. They’ve all done the hard, manual work for at least thousands of hours.

The path to success is no secret.

But it’s also difficult and narrow.

So, if you’re going to stick it out for the 10,000 hours, including thousands of hours of deliberate practice, I once again offer this advice:

Learn to alchemise the intense discomfort of certain training into fulfilment.

Support my work

If you find my writing valuable, and would like to support future work, please buy me a coffee:

Or if you’re new here, you can explore my archive first.

Thank you so much

Where can I store trades I've made, with pictures, comments and tags? Tried using excel but files get too big with the pictures.