The Routine of a Successful Part-Time Trader

A guest post by USIC competitor Clement Ang

Lately, I’ve faced more questions on my approach in stock speculation:

“Teach me bro”

“How do I get started?”

“Any stocks you recommend?”

The most constructive conversation I had — which I really appreciated — was a call to talk about my background, routine and strategy.

During this call, I was surprised to encounter difficulty articulating something I’ve spent the past couple of years building and perfecting: my routine.

Note from Kyna

Many readers have messaged me to request content on this topic. I believe Clement Ang is a better person to write about this than I am. Plus, I’m on holiday this week, so am very grateful to Clement for filling in.

When you read through Clement’s 𝕏 feed, you’ll find him transparently sharing his daily plans and other insights into trading and the markets.

Furthermore, since he’s a part-time trader — with a young family and living in an awkward time zone to trade US stocks from — many of you should find the challenges he’s had to overcome relatable. How can you keep on top of the markets while juggling the commitments of everyday life?

And to Clement, I suggested he’d personally benefit from writing out his routine. I’m a huge believer in gaining mental clarity through writing. He kindly agreed!

Back to Clement.

My motivations for writing this stack

1. Better clarity

By putting my thoughts in written form, I aim to gain more clarity on my routine.

As Kyna (correctly) pointed out to me, one probable reason I found it difficult to explain myself was that what seems obvious to me isn’t obvious to someone else. This might be, for example, due to lack of context, clarity or experience.

John Coates’s book The Hour Between Dog and Wolf: How Risk Taking Transforms Us, Body and Mind describes ‘automatic thought’ as involuntary, effortless, and largely opaque to introspection — in other words, what you might describe as ‘instinct’.

Over time, my routine has become instinctive. My thought processes while going through the routine are non-linear.

So, I hope that by breaking down my routine into conscious steps, I open the door for me to evaluate, re-iterate and refine my processes.

2. Sparking ideas

For you, the reader, I hope this stack sparks some ideas for improving your existing routine.

For newer traders, this might offer a ‘blueprint’ for your own routines and processes.

For more advanced traders, perhaps you get nuances out of this you’d like to incorporate into your existing routines.

We’re all just students of the markets

Before I go on, I’d like to humbly profess that I — like every other serious trader — am just a student of the market, and always will be.

My ideas aren’t unique.

They’re simply an amalgamation of the various books, articles and tweets by individuals I consider to have achieved excellence in the markets, including:

Mark Minervini

Gil Morales

Jeff Sun

Etc.

Think of me as a living literature review, sifting through what does and doesn’t work for me. And I encourage you to do the same for yourself!

Make a deliberate effort to study those who have achieved excellence. Discover what they have in common: these reflect trading ‘best practices’ and principles. Then, apply them to your own trading, adapting them as necessary to suit your personality.

Profitable trading isn’t merely about memorising different setups, knowing what indicators to use and risk management techniques.

Rather, profitable trading is about:

Understanding the context of why the trade was made and why it worked.

Developing judgement and intuition after long periods of deliberate practice, which goes hand in hand with understanding the finer nuances. This allows you to press on the gas when the time calls for it.

Most importantly, understanding yourself, and the interplay between your emotional state, the movements of the market and your actions. The goal is to stay in line with the market, which requires equanimity.

Once you find yourself doing all the above, you’ll reach the next level in the journey towards becoming a (more) profitable trader.

Now, let’s dive into my routine.

My routine

As a working professional in Asia, for the most part, I’m deskbound between 8:00 and 18:00 Hong Kong time. I’m also a parent to my wonderful 2-year-old.

So, as the US market opens either at 21:30 or 22:30 local time, depending on daylight savings, I’m really not left with much time between work, family duties and trading.

With that in mind, I’ve had to come up with a strong and efficient routine, so I can juggle keeping up with the state of the market with my other commitments.

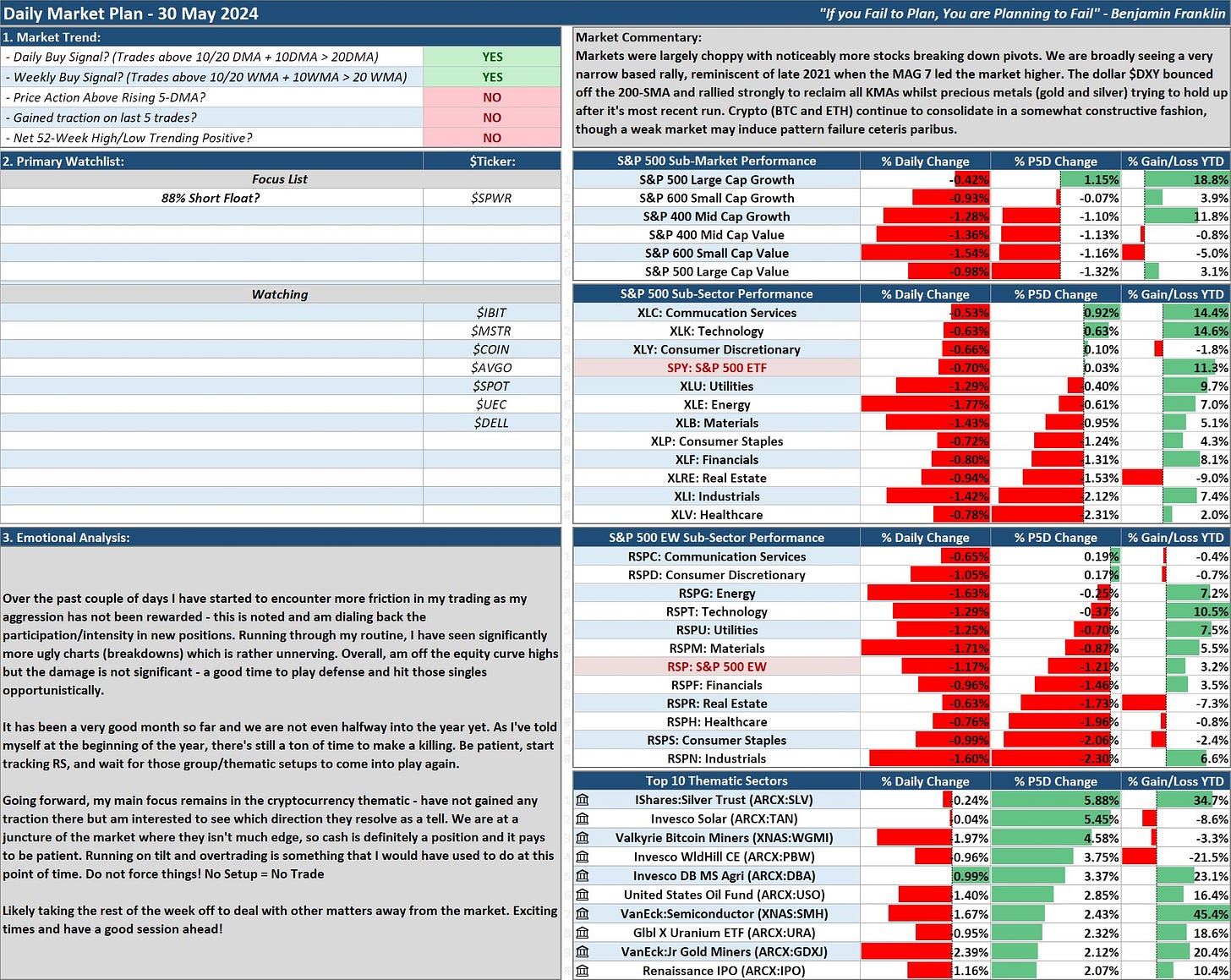

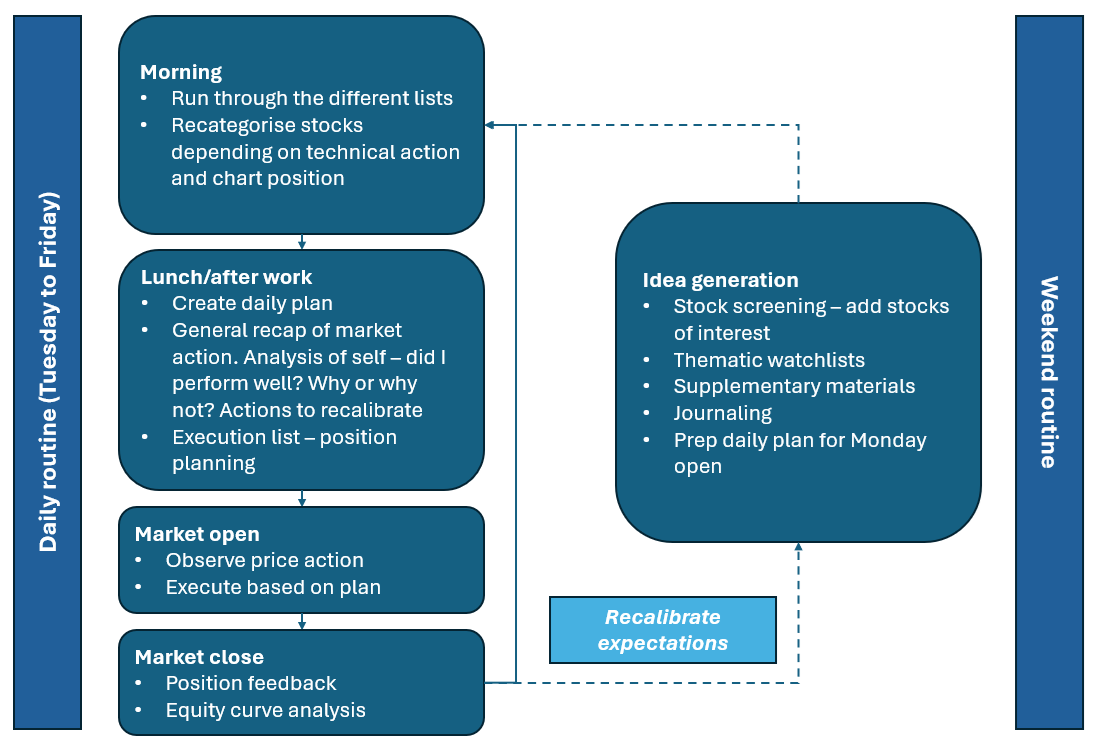

This diagram shows how I incorporate speculation as part of my everyday life:

Weekend routine: idea generation

My routine is best explained by starting with weekends. This is when I have more time, and can spend a couple of hours undisturbed with the markets.

My weekend (and weekly) routine usually starts with generating new ideas via three avenues, in the following order:

1. Bottom-up stock screening (~45 min.)

To look for stocks of interest, I typically run five different scans (using Deepvue):

A combined scan of the top price gainers on one-month, three-month and six-month time frames.

A fundamentals scan, showing me stocks with at least 30% sales growth and 30% EPS growth for the past quarter.

A technical scan, showing me stocks currently exhibiting tight ranges.

The three-month Minervini trend template, which returns stocks in an uptrend of at least three months.

The Deepvue leaders scan.

The main idea behind all these scans is to identify uptrending stocks, with the potential for a continuation move to the upside, after they’ve consolidated their prior move and formed a new base.

I add charts that fit these criteria and have a certain ‘look’ to my watchlists (more on those later).

Incidentally, many great traders — including Mark Minervini, Qullamaggie and Marios Stamatoudis — have the continuation breakout as part of their playbook. This price action simply represents demand outstripping supply, which a skilled trader can capitalise on.

You might refer to such setups or patterns as a ‘high tight flag’, a ‘cup and handle’ or a ‘flat base’. I simply like to adhere to first principles by looking for:

From left to right within a base, a contraction in the volatility of the price action — i.e. Mark Minervini’s volatility contraction pattern (VCP).

Ideally, this volatility contraction in price is accompanied by a reduction in volume, as this signifies supply is drying up. In other words, people aren’t selling, suggesting that demand is — or will be — outstripping supply.

A short ‘pivot’ to form within or near the highs of the base. This is visually represented by a tight trading range, making it easy to define your trade’s risk-to-reward:

If price breaks out, through the high of the range, you expect it to continue.

On the flip side, if the low of the pivot is violated, you expect sellers to push the stock lower.

If you know what you’re expecting, you’ll also know when the proverbial train isn’t on schedule.

2. Top-down ETF screening (~15 min.)

Next, I flip through my watchlist of ETFs, looking for the same criteria as with my bottom-up stock screening process.

This approach is more ‘forest to the trees’, with the following benefits:

Occasionally, I notice a group potentially setting up for a decent move, which I may trade via a leveraged ETF (where possible).

It gives me extra information — in addition to the bottom-up process — on the overall health of the market.

Think of it as first using a magnifying glass to examine the details, before zooming out to look at the bigger picture to confirm your findings.

3. Curated thematic watchlists (~15 min.)

Lastly, for the purpose of completeness, I have — over time — compiled various thematic watchlists that I flip through as part of my weekly routine.

These lists are mostly fixed now. That said, I may occasionally add a new thematic watchlist if I find I’m missing one. For instance, following the recent moves in $GME and other highly shorted meme stocks, I created a new watchlist for them.

As to why I go through these watchlists — I’ve adopted this practice by studying Gil Morales and the way he operates in the markets.

Flipping charts in this manner is another way of trying to identify strong groups, but on an individual stock basis. This can catch things that stock screens and group ETFs sometimes miss.

Plus, by looking at charts that may not qualify for my watchlists, I get more reps in. I develop a better understanding of how stocks trade, identifying what stage (as per Stan Weinstein) the stock is in, and how price interacts with the moving averages.

All in all, my weekly routine takes me anywhere from 1–1½ hours to complete, going through about 800–1,000 charts in total.

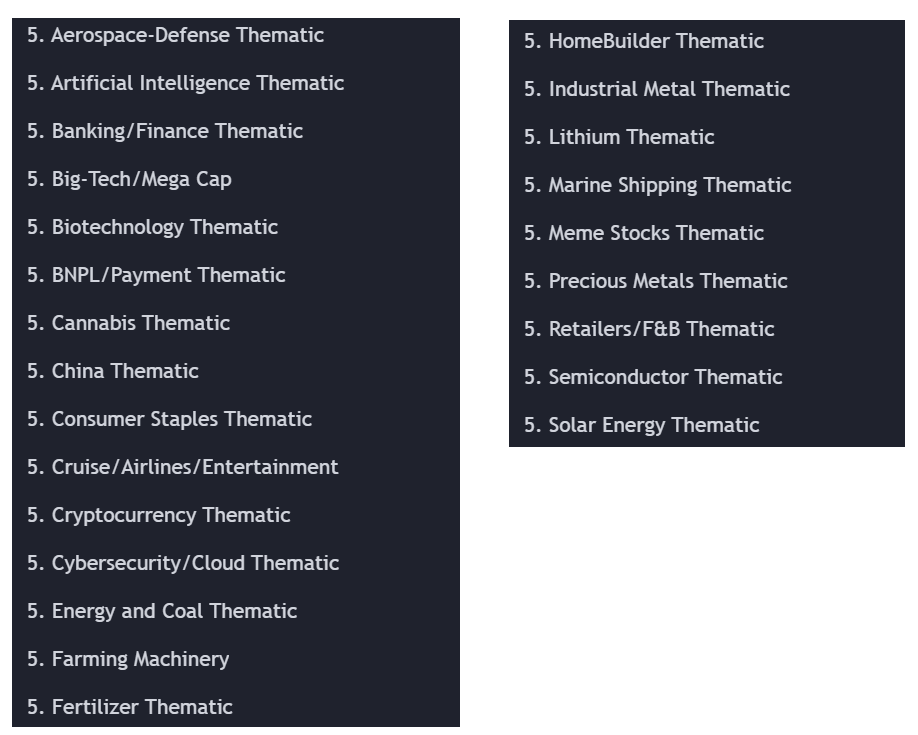

Maintaining watchlists

I maintain the following five watchlists:

1. Execution list

Stocks I want to watch intently in anticipation of a range expansion — again, I mainly look to trade VCPs.

That said, depending on the market environment and where we are within the price cycle, I may look for other tactical trading opportunities — price and moving average undercuts and rallies, for example.

In a good market, I may have up to 20 ideas in my execution list, but I’ll narrow my focus during the active trading session to just the top 5. In a poor market, this list can shrink all the way down to 0.

2. Almost ready list

Stocks that look just about ready, but ideally need more time to properly set up a good risk-to-reward entry (pivot) point. As Qullamaggie famously says: “few more days”.

The stocks on this list trade above the 10 and 20 exponential moving averages (EMAs), and the 50 simple moving average (SMA).

In a good market, I typically have up to 60 names in this list. In a poor market, this list can also go to 0.

3. Secondary watchlist (strong stocks)

These are stocks of interest trading above the 10/20 EMAs and 50 SMA. However, they lack an obvious entry point — perhaps because they’ve already started their run and are extended.

I keep an eye on these for future potential entry points.

4. Wide list (long)

These are stocks that may present long opportunities in future, but are currently trading below the 10/20 EMAs and above the 50 SMA.

5. Wide list (short)

Stocks that trade below the 50 SMA. For my style of trading, nothing good ever happens below the 50 SMA.

I predominantly trade the long side, but this list is useful in conjunction with the four lists above to give me a balanced view of the market.

I move leading stocks that were in the long watchlists above to this list as momentum wanes and stocks break down from their late-stage bases.

Why organise watchlists in this way?

The act of flipping through the charts, and (re)categorising them every day (see below), gives you an objective feel for the market environment.

It’s what I told Kyna a couple of weeks ago:

“I feel that manual chart screening and manually building/maintaining watchlists are much more efficient than automation.”

This allows you to develop situational awareness on when it’s appropriate to trade aggressively.

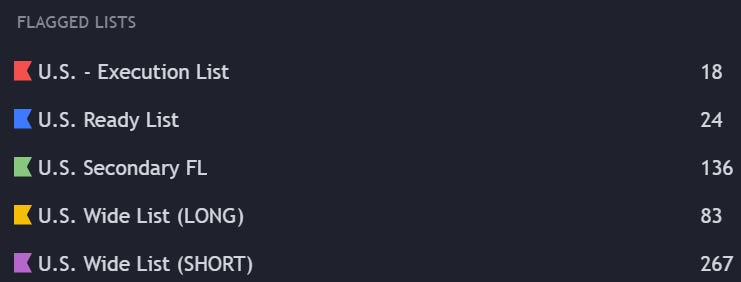

For example, over the past week (I’m writing this on 31 May 2024), we’ve started seeing a lot more pivot failures as stocks break down and the market rally narrows. Just a select few stocks (mainly $NVDA) are leading the market higher.

So, I’ve since moved a lot of stocks from my ‘almost ready list’ and ‘secondary watchlist’ to both ‘wide lists’ (long and short).

Flipping through my lists every day after the market close, I could see a negative divergence between the market index, and the breadth of the market (number of stocks participating in the rally), without referring to any market breadth indicators.

As Mark Minervini often says: it’s not a ‘stock market’, but a ‘market of stocks’. This is why the bottom-up approach is non-negotiable to any stock routine.

Situational awareness aside, you’ll get a better ‘feel’ for the character of individual stocks or groups of stocks. You’ll also get more reps in for identifying proper setups, and train yourself to pick up on nuances.

Preparing my daily plan

After rearranging my lists, I look at the stocks on my execution list and begin preparing my daily plan for Monday.

As part of that process, I ask myself:

Where are we in the market cycle with reference to the index? Is $QQQ trading above the 10 and 20 EMAs?

Are we in a period of positive net new highs/lows?

Are stocks on my execution list of good quality? Is a thematic group in play?

Have my past few trades been working? Have I been stopped out more frequently than not? Or has everything I touched turned to ‘gold’?

Do the trades I’ve taken belong to a leading sector/theme on my dashboard? In other words, to quote Jesse Livermore, am I trading “the leading issues of the day”? This tells me whether or not I have my pulse on the markets.

All these questions set the stage for my expectations of the trading session ahead.

Progressive exposure

The concept of progressive exposure — the importance of which many of the market greats have underlined — is worth bringing up here.

To create a smoother, nicely uptrending equity curve, you want to be out of the market when times are bad — based on the feedback from recent trades as well as your read on the market based on what the charts are telling you — and get aggressive on the heels of success.

By ‘aggressive’, I mean this in terms of:

Total exposure; and

Individual position size.

I don’t mean you can get reckless. You must only take trades that fit your playbook — and if you can’t find setups, the market is trying to tell you something.

To quote Ameet Rai:

“No setup, no trade.”

Taking random actions will only yield random results.

Market open

When the market opens (21:30 or 22:30 local time), I intently watch my execution list to see if it’s worth putting on positions.

For me, speculation goes on until about midnight (either 11:00 or 12:00 EST), when I’ll usually put in stop orders for my positions (if not already in place) and call it a day.

Weekday pre-market routine: daily plan and deliberate practice

From Tuesday to Friday, my alarm goes off at 6:30. I run through my daily routine during my morning commute to work. This typically takes me around 30 minutes — I’ve usually completed it by the time I reach the office.

Depending on how busy I am at work, I’ll then either spend lunchtime preparing my daily plan while having a takeaway, or prepare it after my workday ends (it’s a grind — I know).

When creating my daily plan, I take note of:

How the market indices performed compared to the positions I’ve taken (if any);

Whether the trades I took in the previous session gained traction; and

How I performed (i.e. how well I executed) in the previous session.

This all sets my expectations for where the market may go in the coming few sessions, as I try to align myself to it.

For my daily routine, I’ve made a deliberate decision not to scan for new stocks during the weekdays, as time doesn’t permit me to do so.

However, (re)categorising stocks within my watchlists in the morning is my deliberate practice that allows me to get my reps in, while simultaneously create my daily plan for the next trading session.

Perhaps one day, when I’m able to make the bold decision to trade full time, daily scans will become part of my routine.

Building blocks for success

A routine doesn’t, unfortunately, guarantee success in the markets.

But not having one virtually guarantees failure. Which makes a routine a non-negotiable for me.

Discipline

Having the discipline to commit to a routine is the first building block to success. As Bruce Lee points out:

“I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick 10,000 times.”

Note from Kyna: Josh Waitzkin, a chess and tai chi champion, provides additional insight.Emotional equanimity and introspection

The next building block, in my opinion, is being in touch with yourself.

In the five years of my trading journey, the thing I’ve gained the biggest appreciation for wasn’t the technical aspects of trading, but how trading has made me more introspective.

Outside my daily plans, I now regularly journal my thoughts (and emotions) on things happening in my life, and how they may affect my trading. This has allowed me to identify when I’m likely entering — or have already entered — a period of poor trading.

The mental game is an aspect of trading often underestimated, but really shouldn’t be. Professional athletes regularly consult mental game coaches and sports psychologists to help them stay on their A-game.

In similar vein, as a trader, knowing yourself before knowing the market is the least we can do towards the path of consistent profitability and in pursuit of superior returns.

Final thoughts from Kyna

When Clement sent me the first draft, I asked him to clarify or elaborate on certain aspects of his routine. (As we’ve already established, when you’re describing something as natural to you as your own routine, it can be hard to identify what is and isn’t obvious to a reader.)

But, as we went through that process, we both realised there’s only so much room within a stack.

So, what’s the key question we wanted to answer today?

We settled on providing insight into how you can trade part time in an effective way, while juggling work, family, and other commitments.

Is Clement’s routine perfect? No. Mine isn’t either, and this will always be a price to pay when you do anything part time.

But that doesn’t mean you can’t be a serious part-time trader

You can make productive use of ‘dead time’, such as commutes.

Make good use of lunch breaks. A break doesn’t have to mean doing nothing; it can simply mean doing something different.

Know during what market hours you need to be at your desk, and when it’s okay to simply rely on stop/limit orders.

Understand the importance of deliberate practice: it’s how you move the needle in a short space of time.

As Clement said to me:

“At the end of the day, I don’t think there’s a ‘true’ effective way to trade part time.

“The reality is that it’s not easy, and juggling many commitments at once — on top of trading — truly is a grind. [Particularly if you want to do them all well.]

“What I think makes my routine truly ‘effective’ to me is the passion for trading, and desire for excellence in the markets. This leads to the discipline to commit to this routine!”

Key take-aways

Routine helps with consistency and getting yourself into the right cognitive context quicker.

Do the majority of the work — particularly scanning for new stocks/ideas — on weekends.

Do both top-down and bottom-up scanning. Also look at charts outside your criteria to get a better feel for the overall market and get more reps in — do that deliberate practice.

Different watchlist types are very helpful to stay organised. Plus, seeing the distribution of names across your lists in itself tells you something about the overall market.

A detailed daily plan helps with getting a feel for the overall market and to execute well — but limit it to names already on your watchlists. This is how you maximise results when time is limited.

Journaling — and not just in a quantitative way — can be life-changing. For traders and non-traders alike.

Still have questions?

Leave them in the comments below! You can also reach us on 𝕏 (@Clement_Ang17 and @KayKlingson), though bear in mind I’m on holiday, so won’t catch up on messages until next week.

Who knows — maybe the questions will inspire a new stack :)

Thanks very much for reading. We hope you found it helpful. If you did, please like and share this stack to help spread the word!

More content like this

The Trading Resource Hub’s full archive is here.

Hey Roman! Thanks for reading!

On this, for me it ultimately depends on a few factors:

1. Which are the higher ADR% stocks? Ceteris paribus if all show volatility contraction on volume dry up, a higher ADR% stock will give me better risk reward from the get-go when it moves in the direction of my favor. A lower ADR% stock will naturally take more time - for a smaller account size (<1mm), I want to make sure that the ‘small account edge’ is being exploited as much as possible!

2. I would prefer a stock whose group look to be setup together. Whilst you want a stock to move in the direction of the market, explosive moves also come when the group is moving together.

3. Closely linking to point 2. - is there a thematic driver/story behind the move? If the stock belongs to that, it gives me more conviction to choose that over another.

Inevitably there will be situations where the market heats up and you’ll have many stocks to choose from, that’s a good thing (because it also probably means you can throw a dart, and make money in that environment). It will then come down to experience, intuition, and discretion to narrow the list down to at the very maximum 20 names. Then set alerts and take the setups in the order of the alerts going off.

Lastly, you will inevitably miss stocks that make big moves, sometimes just got to learn to let it go and make sure you follow up by studying why that particular stock made a big move. Over time you’ll get better at it and nail the leading issues of the day!

Absolutedly great stack